Radio Shack 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

under this plan. At December 31, 2013, approximately

11,000 stock options were outstanding under this plan.

2001 Incentive Stock Plan (“2001 ISP”): The 2001

ISP permitted the grant of up to 9.2 million shares in

the form of ISOs and NQs. The 2001 ISP also

permitted directors to elect to receive shares in lieu of

cash payments for their annual retainer fees and board

and committee meeting fees. The 2001 ISP was

terminated in 2009 upon the shareholder approval of

the 2009 ISP and no further grants may be made

under this plan. At December 31, 2013, approximately

0.7 million stock options were outstanding under this

plan.

2009 Incentive Stock Plan (“2009 ISP”): The 2009

ISP permitted the grant of up to 11.0 million shares in

the form of ISOs, NQs, restricted stock, restricted stock

units, stock appreciation rights, or other stock-based

awards. The 2009 ISP also permitted directors to elect

to receive shares in lieu of cash payments for their

annual retainer fees and board and committee meeting

fees. Full-value awards granted under the 2009 ISP,

such as restricted stock and restricted stock units,

reduced the number of shares available for grant by

1.68 shares for each share or unit granted. Stock

options and stock appreciation rights reduced the

number of shares available for grant by one share for

each stock option or stock appreciation right granted.

This plan was terminated in 2013 upon the shareholder

approval of the 2013 Omnibus Incentive Plan and no

further grants may be made under this plan. As of

December 31, 2013, approximately 1.4 million stock

options and 1.4 million shares of unvested restricted

stock were outstanding under this plan.

2013 Omnibus Incentive Plan (“2013 Omnibus

Plan”): The 2013 Omnibus Plan permits the grant of

up to 16.7 million shares in the form of ISOs, NQs,

restricted stock, restricted stock units, stock

appreciation rights, or other stock-based awards. The

2013 Omnibus Plan also permits directors to elect to

receive shares in lieu of cash payments for their annual

retainer fees and board and committee meeting fees.

Full-value awards granted under the 2013 Omnibus

Plan, such as restricted stock and restricted stock

units, will reduce the number of shares available for

grant by 1.96 shares for each share or unit granted.

Stock options and stock appreciation rights will reduce

the number of shares available for grant by one share

for each stock option or stock appreciation right

granted. This plan expires on March 24, 2023. At

December 31, 2013, approximately 2.6 million stock

options and zero shares of unvested restricted stock

were outstanding under this plan, and up to 13.8

million shares were available for grants in the form of

stock options under this plan.

In 2013, we granted 2.5 million non-plan options to our

Chief Executive Officer as part of an inducement grant

related to the terms of his employment. These options vest

over 7 years from the date of grant and expire in 2020. An

additional market condition was attached to these non-plan

options that restrict exercise until a stock price hurdle has

been achieved. The market condition was not met in 2013.

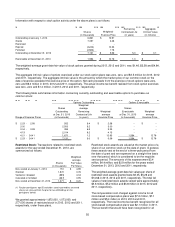

Stock Options: The respective fair values of the stock

options granted during the years ended December 31,

2013, 2012 and 2011, were estimated using either the

Black-Scholes-Merton option-pricing model or a lattice

model. These option-pricing models require the use of

certain subjective assumptions. The following table lists the

assumptions used in calculating the fair value of stock

options granted during each year:

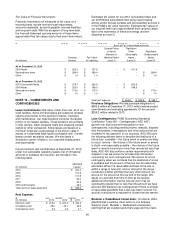

Valuation Assumptions

(1)

2013 2012

2011

Risk free interest rate

(2)

1.6 % 1.0 % 1.6 %

Expected dividend yield 0.0 % 4.9 % 2.0 %

Expected stock price volatility

(3)

57.1 % 55.4 % 43.0 %

Expected life of stock options

(in years)

(4)

6.5 5.5 5.4

(1) Forfeitures are estimated using historical experience and projected

employee turnover. Forfeitures were estimated to be zero for all periods

because of the low number of grant recipients.

(2) Based on the U.S. Treasury constant maturity interest rate whose term

is consistent with the expected life of our stock options.

(3) We consider both the historical volatility of our stock price, as well as

implied volatilities from exchange-traded options on our stock.

(4) We estimate the expected life of stock options based upon historical

experience.