Radio Shack 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

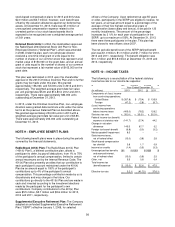

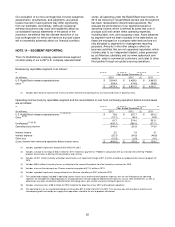

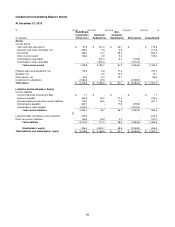

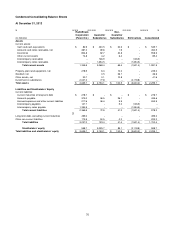

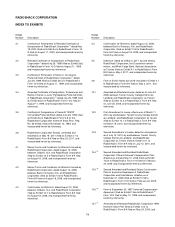

NOTE 16 – SUPPLEMENTAL GUARANTOR FINANCIAL INFORMATION

The obligation to pay principal and interest on the 2019 Notes is jointly and severally guaranteed on a full and unconditional

basis, subject to customary release provisions, by all of the guarantors under the 2018 Credit Facility. The 2019 Notes are

guaranteed by all of our 100%-owned domestic subsidiaries except Tandy Life Insurance Company. Refer to Note 5 –

“Indebtedness and Borrowing Facilities” for additional information on the 2019 Notes and the related exchange offer.

The following condensed consolidating financial information represents the financial information of RadioShack Corporation,

its guarantor subsidiaries, and its non-guarantor subsidiaries prepared on the equity basis of accounting. Earnings of

subsidiaries are, therefore, reflected in the parent company's investment accounts and earnings. The elimination entries

primarily eliminate investments in subsidiaries and intercompany balances and transactions. The non-guarantor subsidiaries

are comprised of the foreign subsidiaries of the Company and Tandy Life Insurance Company. The financial information may

not necessarily be indicative of results of operations, cash flows or financial position had the guarantor or non-guarantor

subsidiaries operated as independent entities.

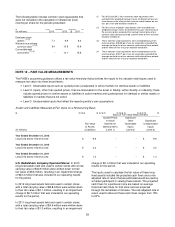

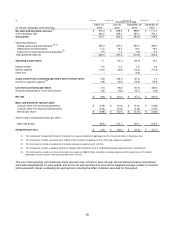

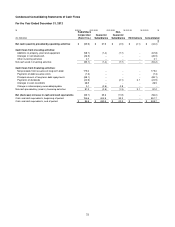

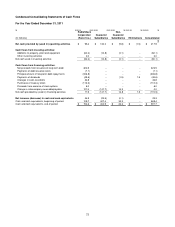

We determined that we should revise the classification of intercompany dividend cash inflows paid to RadioShack Corporation

(Parent Co.) by Non-Guarantor Subsidiaries from an investing inflow to an operating inflow on the accompanying Condensed

Consolidating Statements of Cash Flows. This was based upon an evaluation that concluded these dividend inflows were a

return on capital instead of a return of capital. This reclassification increased the cash flows from operations and decreased

the cash flows from investing activities for RadioShack Corporation (Parent Co.). The reclassification did not affect

consolidated cash flows from operations or cash flows from investing activities.

We have concluded that the effect of this revision did not materially impact any previously issued financial statements,

however we have revised the comparative information presented herein for the years ended December 31, 2012 and 2011 in

order to present such information on a consistent basis.

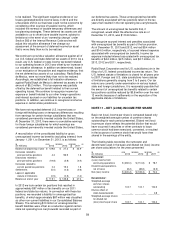

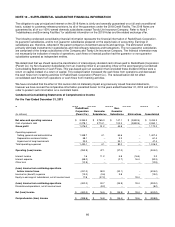

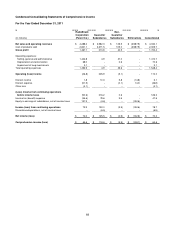

Condensed Consolidating Statements of Comprehensive Income

For the Year Ended December 31, 2013

RadioShack

Non-

Corporation

Guarantor

Guarantor

(In millions) (Parent Co.)

Subsidiaries

Subsidiaries

Eliminations

Consolidated

Net sales and operating revenues $ 3,354.3

$

2,765.3 $ 147.1

$

(2,832.4) $ 3,434.3

Cost of products sold 2,278.1 2,714.1 102.3

(2,832.4) 2,262.1

Gross profit 1,076.2 51.2 44.8

-- 1,172.2

Operating expenses:

Selling, general and administrative 1,348.7 4.1 54.6

-- 1,407.4

Depreciation and amortization 58.1 -- 3.3

-- 61.4

Impairment of long-lived assets 23.3 -- 24.1

-- 47.4

Total operating expenses 1,430.1 4.1 82.0

-- 1,516.2

Operating (loss) income (353.9) 47.1

(37.2)

--

(344.0)

Interest income 1.6 11.2 5.8

(16.4) 2.2

Interest expense (68.0) --

(0.7)

16.4

(52.3)

Other loss (10.9) --

--

--

(10.9)

(Loss) income from continuing operations

before income taxes (431.2) 58.3

(32.1)

--

(405.0)

Income tax (benefit) expense (13.2) (3.6) 3.8

--

(13.0)

Equity in earnings of subsidiaries, net of income taxes 17.8 (37.2)

--

19.4

--

(Loss) income from continuing operations (400.2) 24.7

(35.9)

19.4

(392.0)

Discontinued operations, net of income taxes -- (8.2)

--

--

(8.2)

Net (loss) income $ (400.2)

$

16.5 $

(35.9)

$

19.4 $

(400.2)

Comprehensive (loss) income $ (398.8)

$

16.8 $

(35.4)

$

18.6 $

(398.8)