Radio Shack 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

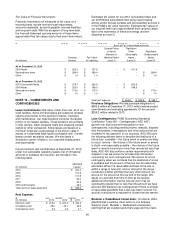

Our evaluation of our loss contingencies involves subjective

assessments, assumptions, and judgments, and actual

losses incurred in future periods may differ significantly

from our estimates. Accordingly, although occasional

adverse resolutions may occur and negatively affect our

consolidated financial statements in the period of the

resolution, we believe that the ultimate resolution of our

loss contingencies for which we have not accrued losses

will not materially adversely affect our financial condition.

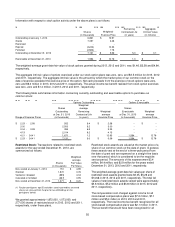

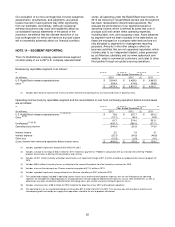

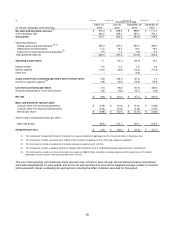

NOTE 14 – SEGMENT REPORTING

The U.S. RadioShack company-operated stores segment

consists solely of our 4,297 U.S. company-operated retail

stores, all operating under the RadioShack brand name. In

2013 we closed out Target Mobile centers and the segment

has been reclassified to discontinued operations. We

evaluate the performance of our segments based on

operating income, which is defined as sales less cost of

products sold and certain direct operating expenses,

including labor, rent, and occupancy costs. Asset balances

by segment have not been included in the table below, as

these are managed on a company-wide level and are not

fully allocated to segments for management reporting

purposes. Amounts in the other category reflect our

business activities that are not separately reportable, which

include sales to our independent dealers, sales generated

by our Mexican subsidiary and our www.radioshack.com

website, sales to commercial customers, and sales to other

third parties through our global sourcing operations.

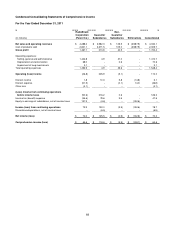

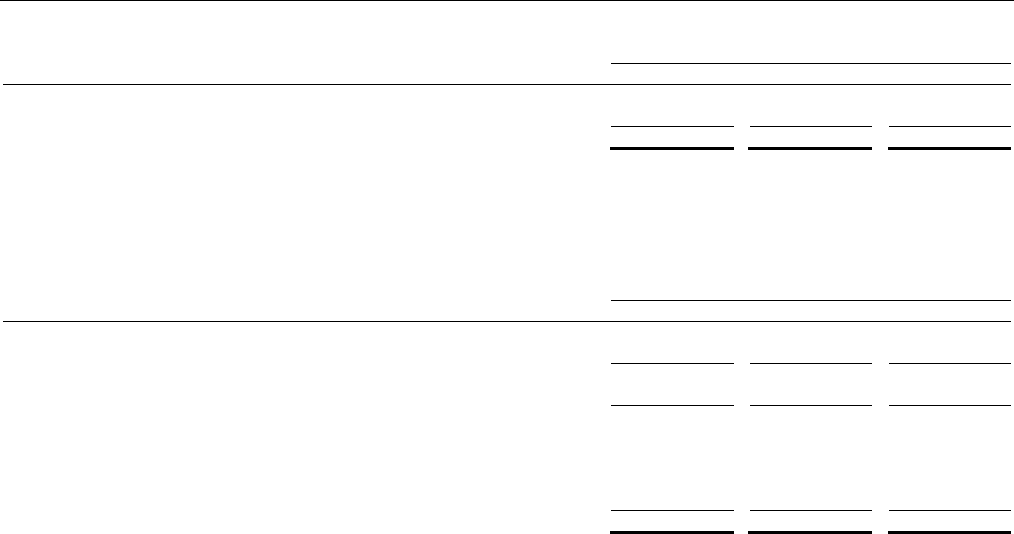

Revenue by reportable segment is as follows:

Year Ended December 31,

(In millions) 2013 2012

2011

U.S. RadioShack company-operated stores $ 3,094.9 $ 3,456.5 $ 3,663.3

Other

(1)

339.4 374.8 368.8

$ 3,434.3 $ 3,831.3 $ 4,032.1

(1) Includes $3.0 million of franchise fee revenue for 2012 related to the opening of our first franchised stores in Southeast Asia.

Operating income (loss) by reportable segment and the reconciliation to loss from continuing operations before income taxes

are as follows:

Year Ended December 31,

(In millions) 2013 2012

2011

U.S. RadioShack company

-

operated stores

(1) (2)

(3) (4)

$ 73.8 $ 337.7 $ 530.2

Other

(5) (6)

(12.1) 36.3 20.9

61.7 374.0 551.1

Unallocated

(7) (8) (9)

(405.7) (399.0) (377.1)

Operating (loss) income (344.0) (25.0) 174.0

Interest income 2.2 1.9 3.1

Interest expense (52.3) (54.5) (46.8)

Other loss (10.9) (0.6) (4.1)

(Loss) income from continuing operations before income taxes $ (405.0) $ (78.2) $ 126.2

(1) Includes a goodwill impairment charge of $3.0 million for 2012.

(2) Includes a charge to earnings of $23.4 million for 2011 related to a payment to T-Mobile in conjunction with our transition from offering T-Mobile

products and services to offering Verizon products and services.

(3) Includes a $10.1 million inventory write down and a fixed asset impairment charge of $11.2 million related to our proposed store closure program for

2013.

(4) Includes $46.6 million of inventory losses resulting from the removal of products from the inventory assortment for 2013.

(5) Includes a loss on the closing of our Chinese manufacturing plant of $11.4 million in 2011.

(6) Includes a goodwill impairment charge related to our Mexican subsidiary of $23.7 million for 2013.

(7) The unallocated category included in operating income relates to our overhead and corporate expenses that are not allocated to our operating

segments for management reporting purposes. Unallocated costs include corporate departmental expenses such as labor and benefits, as well as

advertising, insurance, distribution and information technology costs, plus certain unusual or infrequent gains or losses.

(8) Includes severance costs of $8.5 million for 2012 related to the departure of our CEO and headcount reductions.

(9) The operating loss for our unallocated category increased by $21.9 million from 2011 to 2012. This increase was primarily due to a decrease in

intercompany profits earned by our supply chain operations related to the mix of products distributed.