Radio Shack 2013 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2013 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

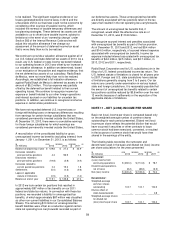

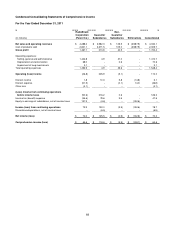

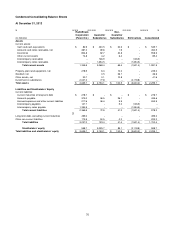

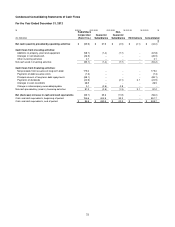

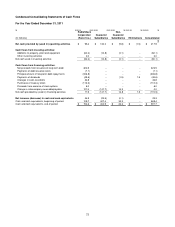

Condensed Consolidating Statements of Comprehensive Income

For the Year Ended December 31, 2012

RadioShack

Non-

Corporation

Guarantor

Guarantor

(In millions) (Parent Co.)

Subsidiaries

Subsidiaries

Eliminations

Consolidated

Net sales and operating revenues $ 4,103.1

$

3,499.5 $ 145.0

$

(3,916.3) $ 3,831.3

Cost of products sold 2,773.2 3,409.6 94.4

(3,916.3) 2,360.9

Gross profit 1,329.9 89.9 50.6

-- 1,470.4

Operating expenses:

Selling, general and administrative 1,364.1 9.5 46.2

-- 1,419.8

Depreciation and amortization 63.6 -- 2.3

-- 65.9

Impairment of long-lived assets and goodwill 9.7 --

--

-- 9.7

Total operating expenses 1,437.4 9.5 48.5

-- 1,495.4

Operating (loss) income (107.5) 80.4 2.1

--

(25.0)

Interest income 0.7 11.2 5.9

(15.9) 1.9

Interest expense (70.0) --

(0.4)

15.9

(54.5)

Other loss (0.6) --

--

--

(0.6)

(Loss) income from continuing operations

before income taxes (177.4) 91.6 7.6

--

(78.2)

Income tax (benefit) expense (31.6) 61.9 2.3

-- 32.6

Equity in earnings of subsidiaries, net of income taxes 6.4 3.7

--

(10.1)

--

(Loss) income from continuing operations (139.4) 33.4 5.3

(10.1)

(110.8)

Discontinued operations, net of income taxes -- (28.6)

--

--

(28.6)

Net (loss) income $ (139.4)

$

4.8 $ 5.3

$

(10.1) $

(139.4)

Comprehensive (loss) income $ (135.0)

$

8.5 $ 9.2

$

(17.7) $

(135.0)