Pizza Hut 2003 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2003 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

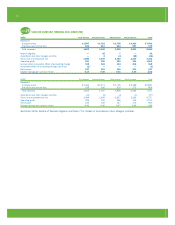

Yum! Brands Inc. 71.

Operating Profit;

Interest Expense, Net; and

Income Before Income Taxes 2003 2002 2001

United States $ 812 $ 802 $ 695

International(a) 441 361 305

Unallocated and corporate expenses (179) (178) (148)

Unallocated other income (expense) (3) (1) (3)

Unallocated facility actions(b) 4 19 39

Wrench litigation(c) (42) — —

AmeriServe and other

(charges) credits(c) 26 27 3

Total operating profit 1,059 1,030 891

Interest expense, net (173) (172) (158)

Income before income taxes and

cumulative effect of

accounting change $ 886 $ 858 $ 733

Depreciation and Amortization 2003 2002 2001

United States $ 240 $ 228 $ 224

International 146 122 117

Corporate 15 20 13

$ 401 $ 370 $ 354

Capital Spending 2003 2002 2001

United States $ 395 $ 453 $ 392

International 246 295 232

Corporate 22 12 12

$ 663 $ 760 $ 636

Identifiable Assets 2003 2002 2001

United States $ 3,279 $ 3,285 $ 2,521

International(d) 1,880 1,732 1,598

Corporate(e) 461 383 306

$ 5,620 $ 5,400 $ 4,425

Long-Lived Assets(f) 2003 2002 2001

United States $ 2,880 $ 2,805 $ 2,195

International 1,206 1,021 955

Corporate 72 60 45

$ 4,158 $ 3,886 $ 3,195

(a) Includes equity income of unconsolidated affiliates of $44 million, $31 million

and $26 million in 2003, 2002 and 2001, respectively.

(b) Unallocated facility actions comprises refranchising gains (losses) which are

not allocated to the U.S. or International segments for performance reporting

purposes.

(c) See Note 7 for a discussion of AmeriServe and other (charges) credits and

Note 24 for a discussion of Wrench litigation.

(d) Includes investment in unconsolidated affiliates of $182 million, $225 million

and $213 million for 2003, 2002 and 2001, respectively. On November 10,

2003 we dissolved our unconsolidated affiliate in Canada. See Note 8 for further

discussion.

(e) Primarily includes deferred tax assets, cash and cash equivalents, property, plant

and equipment, net, related to our office facilities and fair value of derivative

instruments.

(f) Includes property, plant and equipment, net; goodwill; and intangible assets, net.

See Note 7 for additional operating segment disclosures

related to impairment, store closure costs and the carrying

amount of assets held for sale.

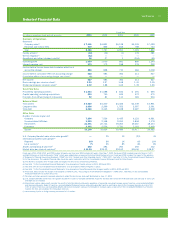

GUARANTEES, COMMITMENTS AND CONTINGENCIES

note

24

Lease Guarantees and Contingencies

As a result of (a) assigning our interest in obligations under

real estate leases as a condition to the refranchising of

certain Company restaurants; (b) contributing certain

Company restaurants to unconsolidated affiliates; and

(c) guaranteeing certain other leases, we are frequently

contingently liable on lease agreements. These leases have

varying terms, the latest of which expires in 2030. As of

December 27, 2003 and December 28, 2002, the potential

amount of undiscounted payments we could be required to

make in the event of non-payment by the primary lessee was

$411 million and $426 million, respectively. The present

values of these potential payments discounted at our pre-

tax cost of debt at December 27, 2003 and December 28,

2002, were $326 million and $310 million, respectively. Our

franchisees are the primary lessees under the vast majority

of these leases. We generally have cross-default provisions

with these franchisees that would put them in default of their

franchise agreement in the event of non-payment under the

lease. We believe these cross-default provisions significantly

reduce the risk that we will be required to make payments

under these leases. Accordingly, the liability recorded for

our exposure under such leases at December 27, 2003 and

December 28, 2002, was not material.

Guarantees Supporting Financial Arrangements of

Certain Franchisees, Unconsolidated Affiliates and Other

Third Parties

At December 27, 2003 and December 28, 2002, we had

provided approximately $32 million of partial guarantees of

two loan pools related primarily to the Company’s historical

refranchising programs and, to a lesser extent, franchisee

development of new restaurants. In support of one of these

guarantees, we have posted $32 million of letters of credit.

We also provide a standby letter of credit of $23 million under

which we could potentially be required to fund a portion of

one of the franchisee loan pools. The total loans outstanding

under these loan pools were approximately $123 million at

December 27, 2003. Any funding under the guarantees or

letters of credit would be secured by the franchisee loans and

any related collateral. We believe that we have appropriately

provided for our estimated probable exposures under these

contingent liabilities. These provisions were primarily charged

to refranchising (gains) losses. New loans are not currently

being added to either loan pool.

We have guaranteed certain lines of credit and loans

of unconsolidated affiliates totaling $28 million and

$26 million at December 27, 2003 and December 28,

2002, respectively. Our unconsolidated affiliates had

total revenues of over $1.5 billion for the year ended

December 27, 2003 and assets and debt of approxi-

mately $858 million and $41 million, respectively, at

December 27, 2003.