Pizza Hut 2003 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2003 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

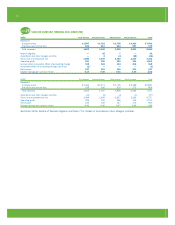

70.

U.S. and foreign income before income taxes are set

forth below:

2003 2002 2001

U.S. $ 669 $ 665 $ 599

Foreign 217 193 134

$ 886 $ 858 $ 733

The reconciliation of income taxes calculated at the U.S.

federal tax statutory rate to our effective tax rate is set

forth below:

2003 2002 2001

U.S. federal statutory rate 35.0% 35.0% 35.0%

State income tax, net of federal

tax benefit 1.8 2.0 2.1

Foreign and U.S. tax effects

attributable to foreign operations (3.6) (2.8) (0.7)

Adjustments to reserves and

prior years (1.7) (1.8) (1.8)

Foreign tax credit amended

return benefit (4.1) — —

Valuation allowance additions

(reversals) 2.8 — (1.7)

Other, net — (0.3) (0.1)

Effective income tax rate 30.2% 32.1% 32.8%

We amended certain prior year returns in 2003 upon our

determination that it was more beneficial to claim credit on

our U.S. tax returns for foreign taxes paid than to deduct

such taxes, as had been done when the returns were origi-

nally filed. The benefit for amending such returns will be

non-recurring.

The details of 2003 and 2002 deferred tax liabilities

(assets) are set forth below:

2003 2002

Intangible assets and property,

plant and equipment $ 232 $ 229

Other 101 76

Gross deferred tax liabilities $ 333 $ 305

Net operating loss and tax credit

carryforwards $ (231) $ (194)

Employee benefits (115) (100)

Self-insured casualty claims (52) (58)

Capital leases and future rent

obligations related to

sale-leaseback agreements (86) (114)

Various liabilities and other (362) (303)

Gross deferred tax assets (846) (769)

Deferred tax asset valuation

allowances 183 155

Net deferred tax assets (663) (614)

Net deferred tax (assets) liabilities $ (330) $ (309)

Reported in Consolidated Balance Sheets as:

Deferred income tax assets $ (165) $ (121)

Other assets (178) (222)

Accounts payable and other current liabilities

13 34

$ (330) $ (309)

A determination of the unrecognized deferred tax liability

for temporary differences related to our investments in

foreign subsidiaries and investments in foreign unconsoli-

dated affiliates that are essentially permanent in duration

is not practicable.

We have available net operating loss and tax credit

carryforwards totaling approximately $1.5 billion at

December 27, 2003 to reduce future tax of YUM and certain

subsidiaries. The carryforwards are related to a number

of foreign and state jurisdictions. Of these carryforwards,

$18 million expire in 2004 and $1.2 billion expire at various

times between 2005 and 2021. The remaining carryfor-

wards of approximately $313 million do not expire.

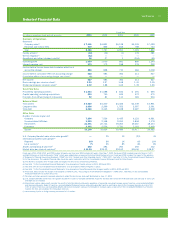

REPORTABLE OPERATING SEGMENTS

note

23

We are principally engaged in developing, operating,

franchising and licensing the worldwide KFC, Pizza Hut

and Taco Bell concepts, and since May 7, 2002, the LJS

and A&W concepts, which were added when we acquired

YGR. KFC, Pizza Hut, Taco Bell, LJS and A&W operate

throughout the U.S. and in 88, 86, 12, 3 and 13 coun-

tries and territories outside the U.S., respectively. Our five

largest international markets based on operating profit in

2003 are China, United Kingdom, Australia, Canada and

Korea. At December 27, 2003, we had investments in 9

unconsolidated affiliates outside the U.S. which operate

principally KFC and/or Pizza Hut restaurants. These uncon-

solidated affiliates operate in China, Japan, Poland and

the United Kingdom. Additionally, we had an investment in

an unconsolidated affiliate in the U.S. which operates Yan

Can restaurants.

We identify our operating segments based on manage-

ment responsibility within the U.S. and International. For

purposes of applying SFAS No. 131, “Disclosure About

Segments of An Enterprise and Related Information”

(“SFAS 131”), we consider LJS and A&W to be a single

segment. We consider our KFC, Pizza Hut, Taco Bell and

LJS/A&W operating segments to be similar and therefore

have aggregated them into a single reportable operating

segment. Within our International operating segment, no indi-

vidual country was considered material under the SFAS 131

requirements related to information about geographic areas

and therefore, none have been reported separately.

Revenues 2003 2002 2001

United States $ 5,655 $ 5,347 $ 4,827

International 2,725 2,410 2,126

$ 8,380 $ 7,757 $ 6,953