Pizza Hut 2003 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2003 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Yum! Brands Inc. 37.

The increase in other (income) expense in 2003 was

primarily driven by the improved operating performance of

our unconsolidated affiliates, particularly in China.

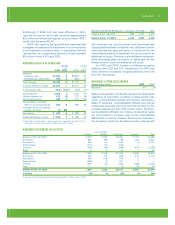

WORLDWIDE FACILITY ACTIONS

We recorded a net loss from facility actions of $36 million,

$32 million and $1 million in 2003, 2002 and 2001,

respectively. See the Store Portfolio Strategy section for

more detail of our refranchising and closure activities and

Note 7 for a summary of the components of facility actions

by reportable operating segment.

WORLDWIDE OPERATING PROFIT

% B/(W) % B/(W)

vs. vs.

2003 2002 2002 2001

United States $ 812 1 $ 802 15

International 441 22 361 19

Unallocated and corporate

expenses (179) — (178) (20)

Unallocated other income

(expense) (3) NM (1) NM

Unallocated facility actions gain 4 NM 19 NM

Wrench litigation (42) NM — —

AmeriServe and other (charges)

credits 26 NM 27 NM

Operating profit $ 1,059 3 $ 1,030 16

The changes in U.S. and International operating profit for

2003 and 2002 are discussed in the respective sections.

Unallocated and corporate expenses increased

$1 million in 2003 and $30 million or 20% in 2002. The

2002 increase was primarily driven by higher compensation-

related costs and higher corporate and project spending.

Unallocated facility actions comprises refranchising

gains (losses) which are not allocated to the U.S. or

International segments for performance reporting purposes.

See Note 7 for further discussion.

WORLDWIDE INTEREST EXPENSE, NET

2003 2002 2001

Interest expense $ 185 $ 180 $ 172

Interest income (12) (8) (14)

Interest expense, net $ 173 $ 172 $ 158

Interest expense increased $5 million or 3% in 2003.

Excluding the impact of the YGR acquisition, interest

expense decreased 6%. The decrease was primarily due

to a decrease in our average debt outstanding.

Interest expense increased $8 million or 5% in 2002.

Excluding the impact of the YGR acquisition, interest

expense decreased 12%. The decrease was driven by

a reduction in our average debt balance partially offset

by an increase in our average interest rate. Our average

interest rate increased due to a reduction in our variable-

rate borrowings using proceeds from the issuance of longer

term, fixed-rate notes.

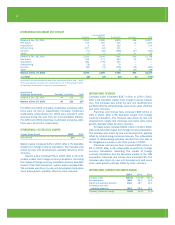

WORLDWIDE INCOME TAXES

2003 2002 2001

Reported

Income taxes $ 268 $ 275 $ 241

Effective tax rate 30.2% 32.1% 32.8%

The reconciliation of income taxes calculated at the U.S.

federal tax statutory rate to our effective tax rate is set

forth below:

2003 2002 2001

U.S. federal statutory tax rate 35.0% 35.0% 35.0%

State income tax, net of federal

tax benefit 1.8 2.0 2.1

Foreign and U.S. tax effects

attributable to foreign operations (3.6) (2.8) (0.7)

Adjustments to reserves and prior years (1.7) (1.8) (1.8)

Foreign tax credit amended

return benefit (4.1) — —

Valuation allowance additions

(reversals) 2.8 — (1.7)

Other, net — (0.3) (0.1)

Effective tax rate 30.2% 32.1% 32.8%

Income taxes and the effective tax rate as shown above

reflect tax on all amounts included in our results of opera-

tions except for the income tax benefit of approximately

$1 million on the $2 million cumulative effect adjustment

recorded in the year ended December 27, 2003 due to the

adoption of SFAS 143.

The 2003 effective tax rate decreased 1.9 percentage

points to 30.2%. The decrease in the effective tax rate was

primarily due to a 4.1 percentage point benefit of amending

certain prior U.S. income tax returns to claim credit for

foreign taxes paid in prior years. The returns were amended

upon our determination that it was more beneficial to claim

credit for such taxes than to deduct such taxes, as had

been done when the returns were originally filed. In future

years, we anticipate continuing to claim credit for foreign

taxes paid in the then current year, as we have done in 2003

and 2002. However, the amended return benefit recognized

in 2003 is non-recurring.

The decrease in the 2003 effective tax rate was

partially offset by the recognition of valuation allowances for

certain deferred tax assets whose realization is no longer

considered more likely than not. The valuation allowances

recognized primarily related to deferred tax assets in Mexico

and Thailand. See Note 22 for a discussion of valuation

allowances.

The 2002 effective tax rate decreased 0.7 percentage

points to 32.1%. The decrease in the effective tax rate

was primarily due to our claiming credit against our current

and future U.S. income tax liability for foreign taxes paid

in 2002, as opposed to deducting such taxes on our U.S.

income tax returns as was done in 2001. This decrease was

partially offset by the impact of lapping valuation allowance

reversals recorded in 2001.

In 2003 and 2002, the effective tax rate attributable to

foreign operations was lower than the U.S. federal statutory