Pizza Hut 2003 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2003 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Yum! Brands Inc. 69.

person or group has acquired, or has commenced or intends

to commence a tender offer for, 15% or more, or 20% or

more if such person or group owned 10% or more on the

adoption date of this plan, of our Common Stock. In the

event the rights become exercisable for Common Stock,

each right will entitle its holder (other than the Acquiring

Person as defined in the Agreement) to purchase, at the

right’s then-current exercise price, YUM Common Stock

having a value of twice the exercise price of the right. In the

event the rights become exercisable for Common Stock and

thereafter we are acquired in a merger or other business

combination, each right will entitle its holder to purchase,

at the right’s then-current exercise price, common stock of

the acquiring company having a value of twice the exercise

price of the right.

We can redeem the rights in their entirety, prior to

becoming exercisable, at $0.01 per right under certain

specified conditions. The rights expire on July 21, 2008,

unless we extend that date or we have earlier redeemed or

exchanged the rights as provided in the Agreement.

This description of the rights is qualified in its

entirety by reference to the original Rights Agreement,

dated July 21, 1998, and the Agreement of Substitution

and Amendment of Common Share Rights Agreement,

dated August 28, 2003, between YUM and American

Stock Transfer and Trust Company, the Rights Agent (both

including the exhibits thereto).

SHARE REPURCHASE PROGRAM

note

21

In November 2003, our Board of Directors authorized a new

share repurchase program. This program authorizes us to

repurchase, through May 21, 2005, up to $300 million of

our outstanding Common Stock (excluding applicable trans-

action fees). During 2003, we repurchased approximately

169,000 shares for approximately $5.7 million under this

program at an average price per share of approximately

$34. Based on market conditions and other factors, addi-

tional repurchases may be made from time to time in the

open market or through privately negotiated transactions

at the discretion of the Company.

In November 2002, our Board of Directors authorized

a share repurchase program. This program authorized us

to repurchase up to $300 million (excluding applicable

transaction fees) of our outstanding Common Stock. This

share repurchase program was completed in 2003. During

2003, we repurchased approximately 9.2 million shares

for approximately $272 million at an average price per

share of approximately $30 under this program. During

2002, we repurchased approximately 1.2 million shares for

approximately $28 million at an average price per share of

approximately $24 under this program.

In February 2001, our Board of Directors authorized

a share repurchase program. This program authorized us

to repurchase up to $300 million (excluding applicable

transaction fees) of our outstanding Common Stock. This

share repurchase program was completed in 2002. During

2002, we repurchased approximately 7.0 million shares

for approximately $200 million at an average price per

share of approximately $29 under this program. During

2001, we repurchased approximately 4.8 million shares for

approximately $100 million at an average price per share

of approximately $21 under this program.

INCOME TAXES

note

22

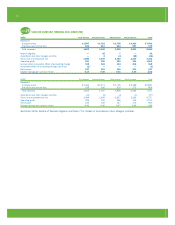

The details of our income tax provision (benefit) are set

forth below. Amounts do not include the income tax benefit

of approximately $1 million on the $2 million cumulative

effect adjustment recorded on December 29, 2002 due to

the adoption of SFAS 143.

2003 2002 2001

Current:

Federal $ 181 $ 137 $ 200

Foreign 114 93 75

State (4) 24 38

291 254 313

Deferred:

Federal (23) 29 (29)

Foreign (16) (6) (33)

State 16 (2) (10)

(23) 21 (72)

$ 268 $ 275 $ 241

Taxes payable were reduced by $26 million, $49 million

and $13 million in 2003, 2002 and 2001, respectively, as

a result of stock option exercises. In addition, goodwill and

other intangibles were reduced by $8 million in 2001 as a

result of the settlement of a disputed claim with the Internal

Revenue Service relating to the deductibility of reacquired

franchise rights and other intangibles offset by an $8 million

reduction in deferred and accrued taxes payable.

Valuation allowances related to deferred tax assets

in certain states increased by $6 million ($4 million, net

of federal tax) and $1 million ($1 million, net of federal

tax) and in foreign countries increased by $19 million and

$6 million in 2003 and 2002, respectively, as a result of

determining that it is more likely than not that certain loss

carryforwards will not be utilized prior to expiration. In

2001, valuation allowances related to deferred tax assets

in certain states and foreign countries were reduced by

$9 million ($6 million, net of federal tax) and $6 million,

respectively, as a result of determining that these assets

will be utilized prior to expiration.

The deferred foreign tax provision for both 2002 and

2001 included a $2 million credit to reflect the impact of

changes in statutory tax rates in various countries.