Pizza Hut 2003 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2003 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56.

deemed impaired and written off. The charge of $5 million

was recorded in facility actions.

For indefinite-lived intangible assets, our impairment

test consists of a comparison of the fair value of an intan-

gible asset with its carrying amount. Fair value is the price a

willing buyer would pay for the intangible asset and is gener-

ally estimated by discounting the expected future cash flows

associated with the intangible asset. We also perform our

annual test for impairment of our indefinite-lived intangible

assets at the beginning of our fourth quarter. Our indefinite-

lived intangible assets consist of values assigned to certain

trademarks/brands we have acquired. When determining

the fair value, we limit assumptions about important factors

such as sales growth to those that are supportable based

on our plans for the trademark/brand. As discussed in

Note 12, we recorded a $5 million charge in 2003 as a

result of the impairment of an indefinite-lived intangible

asset. This charge was recorded in facility actions.

See Note 12 for further discussion of SFAS 142.

Stock-Based Employee Compensation

At December 27, 2003, the Company had four stock-

based employee compensation plans in effect, which are

described more fully in Note 18. The Company accounts

for those plans under the recognition and measurement

principles of Accounting Principles Board Opinion No. 25,

“Accounting for Stock Issued to Employees,” and related

Interpretations. No stock-based employee compensation

cost is reflected in net income, as all options granted under

those plans had an exercise price equal to the market value

of the underlying common stock on the date of grant. The

following table illustrates the effect on net income and

earnings per share if the Company had applied the fair

value recognition provisions of SFAS No. 123 “Accounting

for Stock-Based Compensation,” to stock-based employee

compensation.

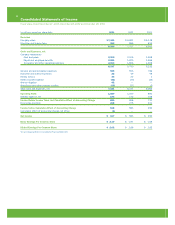

2003 2002 2001

Net Income, as reported $ 617 $ 583 $ 492

Deduct: Total stock-based employee

compensation expense determined

under fair value based method for

all awards, net of related tax effects (36) (39) (37)

Net income, pro forma 581 544 455

Basic Earnings per Common Share

As reported $ 2.10 $ 1.97 $ 1.68

Pro forma 1.98 1.84 1.55

Diluted Earnings per Common Share

As reported $ 2.02 $ 1.88 $ 1.62

Pro forma 1.91 1.76 1.50

Derivative Financial Instruments

Our policy prohibits the use of derivative instruments for

trading purposes, and we have procedures in place to

monitor and control their use. Our use of derivative instru-

ments has included interest rate swaps and collars, treasury

locks and foreign currency forward contracts. In addition, on

a limited basis we utilize commodity futures and options

contracts. Our interest rate and foreign currency derivative

contracts are entered into with financial institutions while

our commodity derivative contracts are exchange traded.

We account for derivative financial instruments in

accordance with SFAS No. 133, “Accounting for Derivative

Instruments and Hedging Activities” (“SFAS 133”) as

amended by SFAS No. 149, “Amendment of Statement 133

on Derivative Instruments and Hedging Activities

(“SFAS 149”). SFAS 133 requires that all derivative instru-

ments be recorded on the Consolidated Balance Sheet at

fair value. The accounting for changes in the fair value (i.e.,

gains or losses) of a derivative instrument is dependent upon

whether the derivative has been designated and qualifies

as part of a hedging relationship and further, on the type

of hedging relationship. For derivative instruments that are

designated and qualify as a fair value hedge, the gain or

loss on the derivative instrument as well as the offsetting

gain or loss on the hedged item attributable to the hedged

risk are recognized in the results of operations. For deriva-

tive instruments that are designated and qualify as a cash

flow hedge, the effective portion of the gain or loss on the

derivative instrument is reported as a component of other

comprehensive income (loss) and reclassified into earnings

in the same period or periods during which the hedged trans-

action affects earnings. Any ineffective portion of the gain or

loss on the derivative instrument is recorded in the results of

operations immediately. For derivative instruments not desig-

nated as hedging instruments, the gain or loss is recognized

in the results of operations immediately. See Note 16 for a

discussion of our use of derivative instruments, management

of credit risk inherent in derivative instruments and fair value

information related to debt and interest rate swaps.

New Accounting Pronouncements Not Yet Adopted

In January 2003, the FASB issued Interpretation No. 46,

“Consolidation of Variable Interest Entities, an interpretation

of ARB No. 51” (“FIN 46”). FIN 46 was subsequently revised

in December 2003. FIN 46 addresses the consolidation of

entities whose equity holders have either (a) not provided

sufficient equity at risk to allow the entity to finance its own

activities or (b) do not possess certain characteristics of a

controlling financial interest. FIN 46 requires the consolida-

tion of these entities, known as variable interest entities

(“VIEs”), by the primary beneficiary of the entity. The primary

beneficiary is the entity, if any, that is subject to a majority of

the risk of loss from the VIE’s activities, entitled to receive

a majority of the VIEs residual returns, or both. FIN 46 is

effective for all entities at the end of the first reporting period

ending after March 15, 2004 (the quarter ending March 20,

2004 for the Company). FIN 46 was effective for special-

purpose entities (as defined by FIN 46) at the end of the first

reporting period ending after December 15, 2003, which did

not impact the Consolidated Financial Statements. FIN 46

requires certain disclosures in financial statements issued

after December 31, 2003, if it is reasonably possible that

the Company will consolidate or disclose information about

VIEs when FIN 46 becomes effective.