Pizza Hut 2003 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2003 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Yum! Brands Inc. 65.

if they meet age and service requirements and qualify for

retirement benefits.

On December 8, 2003, the Medicare Prescription Drug,

Improvement and Modernization Act of 2003 (the “Act”),

which introduces a Medicare prescription drug benefit as

well as a federal subsidy to sponsors of retiree health care

benefit plans that provide a benefit that is at least actuari-

ally equivalent to the Medicare benefit, was enacted. On

January 12, 2004 the FASB issued Financial Staff Position

No. 106a, “Accounting and Disclosure Requirements

Related to The Medicare Prescription Drug, Improvement

and Modernization Act of 2003” (“FSP 106a”) to discuss

certain accounting and disclosure issues raised by the Act.

We have elected to defer the measurement and disclosure

requirements under the provisions of FSP 106a until specific

authoritative guidance is issued by the FASB later in 2004.

The reported accumulated benefit obligation and net periodic

benefit costs of our postretirement plan do not reflect the

effects of the Act. The authoritative guidance, when issued,

could require revisions to previously reported information.

While we may be eligible for benefits under the Act based on

the prescription drug benefits provided in our postretirement

plan, we do not believe such benefits will have a material

impact on our Consolidated Financial Statements.

We use a measurement date of September 30 for

our pension and post-retirement medical plans described

above.

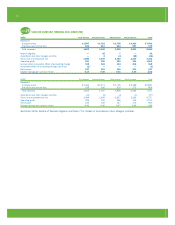

Obligation and Funded status at September 30:

Postretirement

Pension Benefits Medical Benefits

2003 2002 2003 2002

Change in benefit obligation

Benefit obligation at

beginning of year $ 501 $ 420 $ 68 $ 58

Service cost 26 22 2 2

Interest cost 34 31 5 4

Plan amendments — 14 — —

Curtailment gain (1) (3) — —

Benefits and expenses paid (21) (16) (4) (3)

Actuarial loss 90 33 10 7

Benefit obligation at end of year

$ 629 $ 501 $ 81 $ 68

Change in plan assets

Fair value of plan assets at

beginning of year $ 251 $ 291

Actual return on plan assets 52 (24)

Employer contributions 157 1

Benefits paid (21) (16)

Administrative expenses (1) (1)

Fair value of plan assets at

end of year $ 438 $ 251

Funded status $ (191) $ (250) $ (81) $ (68)

Employer contributions — 25.(a) — —

Unrecognized actuarial loss 230 169 28 18

Unrecognized prior service cost 12 16 — —

Net amount recognized at

year-end $ 51 $ (40) $ (53) $ (50)

(a) Reflects a contribution made between the September 30, 2002 measurement

date and December 28, 2002.

Amounts recognized in the

statement of financial position

consist of:

Accrued benefit liability $ (125) $ (172) $ (53) $ (50)

Intangible asset 14 18 — —

Accumulated other

comprehensive loss 162 114 — —

$ 51 $ (40) $ (53) $ (50)

Additional Information

Other comprehensive loss

attributable to change in

additional minimum liability

recognition $ 48 $ 76

Additional year-end information

for pension plans with

accumulated benefit obligations

in excess of plan assets

Projected benefit obligation $ 629 $ 501

Accumulated benefit obligation 563 448

Fair value of plan assets 438 251

While we are not required to make contributions to the Plan

in 2004, we may make discretionary contributions during

the year based on our estimate of the Plan’s expected

September 30, 2004 funded status.

Components of Net Periodic Benefit Cost

Pension Benefits

2003 2002 2001

Service cost $ 26 $ 22 $ 20

Interest cost 34 31 28

Amortization of prior service cost 4 1 1

Expected return on plan assets (30) (28) (29)

Recognized actuarial loss 6 1 1

Net periodic benefit cost $ 40 $ 27 $ 21

Additional loss recognized due to:

Curtailment $ — $ 1 $ —

Special termination benefits — — 2

Postretirement Medical Benefits

2003 2002 2001

Service cost $ 2 $ 2 $ 2

Interest cost 5 4 4

Amortization of prior service cost — — (1)

Recognized actuarial loss 1 1 —

Net periodic benefit cost $ 8 $ 7 $ 5

Prior service costs are amortized on a straight-line basis over

the average remaining service period of employees expected

to receive benefits. Curtailment gains and losses have gener-

ally been recognized in facility actions as they have resulted

primarily from refranchising and closure activities.

Weighted-average assumptions used to determine benefit

obligations at September 30:

Postretirement

Pension Benefits Medical Benefits

2003 2002 2003 2002

Discount rate 6.25% 6.85% 6.25% 6.85%

Rate of compensation increase 3.75% 3.85% 3.75% 3.85%