Pizza Hut 2003 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2003 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

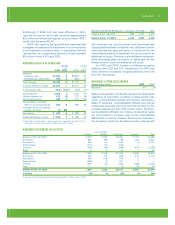

Yum! Brands Inc. 41.

Restaurant margin as a percentage of sales decreased

approximately 50 basis points in 2003, including a 20 basis

points unfavorable impact from foreign currency translation.

The remaining decrease was driven by the impact on margin

of same store sales declines. These decreases were partially

offset by the impact of supply chain savings initiatives on the

cost of food and paper (principally in China), and the cessa-

tion of depreciation expense of approximately $9 million for

the Puerto Rico business which is held for sale.

Restaurant margin as a percentage of sales increased

approximately 210 basis points in 2002, including the

favorable impact of approximately 60 basis points from

the adoption of SFAS 142. The increase was primarily driven

by the favorable impact of lower restaurant operating costs

and the elimination of lower average margin units through

store closures. Lower restaurant operating costs primarily

resulted from lower food and paper costs, partially offset

by higher labor costs.

INTERNATIONAL OPERATING PROFIT

Operating profit increased $80 million or 22% in 2003,

including a 7% favorable impact from foreign currency

translation. The remaining increase was driven by new unit

development and the impact of supply chain savings initia-

tives on the cost of food and paper, partially offset by the

impact of same store sales declines on margins and higher

general and administrative expenses.

Operating profit increased $56 million or 19% in 2002.

Excluding the impact of foreign currency translation and the

favorable impact from the adoption of SFAS 142, operating

profit increased 13%. The increase was driven by new unit

development and the favorable impact of lower restaurant

operating costs, primarily lower cost of food and paper. The

increase was partially offset by higher general and adminis-

trative expenses, primarily compensation-related costs.

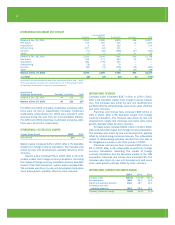

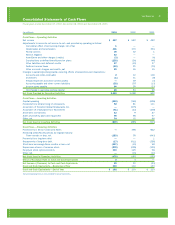

CONSOLIDATED CASH FLOWS

Net cash provided by operating activities was

$1,053 million

compared to $1,088 million in 2002. The

decrease was primarily driven by $130 million in voluntary

contributions to our funded pension plan in 2003, partially

offset by higher net income.

In 2002, net cash provided by operating activities

was $1,088 million compared to $832 million in 2001.

Excluding the impact of the AmeriServe bankruptcy reorga-

nization process, cash provided by operating activities was

$1,043 million versus $704 million in 2001. The increase

was driven by higher net income and timing of tax receipts

and payments.

Net cash used in investing activities was $519 million

versus $885 million in 2002. The decrease in cash used

was driven by the $275 million acquisition of YGR in 2002

and lower capital spending in 2003.

In 2002, net cash used in investing activities was

$885 million versus $503 million in 2001. The increase in

cash used was primarily due to the acquisition of YGR and

higher capital spending in 2002, partially offset by the acqui-

sition of fewer restaurants from franchisees in 2002.

Net cash used in financing activities was $475 million

versus $187 million in 2002. The increase was driven by

higher net debt repayments and higher shares repurchased

in 2003.

In 2002, net cash used in financing activities was

$187 million versus $352 million in 2001. The decrease is

primarily due to lower debt repayments and higher proceeds

from stock option exercises versus 2001, partially offset

by higher shares repurchased in 2002.

CONSOLIDATED FINANCIAL CONDITION

Assets increased $220 million or 4% to $5.6 billion

primarily due to a net increase in property, plant and

equipment, driven by capital expenditures in excess of

depreciation and asset dispositions. The decrease in

the allowance for doubtful accounts from $42 million to

$28 million was primarily the result of the write-off of receiv-

ables previously fully reserved.

Liabilities decreased $306 million or 6% to $4.5 billion

primarily due to the repayment of amounts under our Credit

Facility, decreased short-term borrowings and the reduc-

tion in long-term debt as a result of the amendment of

certain sale-leaseback agreements (see Note 14). These

decreases were partially offset by an increase in accounts

payable and other current liabilities primarily due to the

accrual of $42 million related to the Wrench litigation.

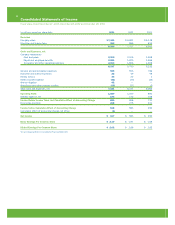

LIQUIDITY AND CAPITAL RESOURCES

Operating in the QSR industry allows us to generate

substantial cash flows from the operations of our company

stores and from our franchise operations, which require a

limited YUM investment. In each of the last two fiscal years,

net cash provided by operating activities has exceeded $1

billion. These cash flows have allowed us to fund our

discretionary spending, while at the same time reducing

our long-term debt balances. We expect these levels of net

cash provided by operating activities to continue in the fore-

seeable future. Our discretionary spending includes capital

spending for new restaurants, acquisitions of restaurants

from franchisees and repurchases of shares of our common

stock. Though a decline in revenues could adversely impact

our cash flows from operations, we believe our operating

cash flows, our ability to reduce discretionary spending,

and our borrowing capacity will allow us to meet our cash

requirements in 2004 and beyond.

Our primary bank credit agreement comprises a senior

unsecured Revolving Credit Facility (the “Credit Facility”)

which matures on June 25, 2005. On December 26,

2003, we voluntarily reduced our maximum borrowings