Pizza Hut 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Yum! Brands Inc. 39.

as a decrease primarily driven by store closures was largely

offset by new unit development.

Company sales increased $491 million or 11% in

2002. Excluding the favorable impact of the YGR acquisi-

tion, company sales increased 3%. The increase was driven

by new unit development and same store sales growth.

The increase was partially offset by store closures and

refranchising.

Franchise and license fees increased $29 million or

5% in 2002. Excluding the favorable impact of the YGR

acquisition, franchise and license fees increased 3%. The

increase was driven by same store sales growth and new

unit development, partially offset by store closures.

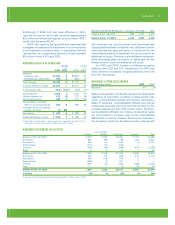

U.S. SAME STORE SALES

U.S. same store sales includes only company restaurants

that have been open one year or more. U.S. blended same

store sales include KFC, Pizza Hut, and Taco Bell company

owned restaurants only. U.S. same store sales for Long John

Silver’s and A&W restaurants are not included. Following are

the same store sales growth results by brand:

2003

Same Average

Store Trans- Guest

Sales actions Check

KFC (2)% (4)% 2%

Pizza Hut (1)% (4)% 3%

Taco Bell 2% 1% 1%

2002

Same Average

Store Trans- Guest

Sales actions Check

KFC — (2)% 2%

Pizza Hut — (2)% 2%

Taco Bell 7% 4% 3%

For 2003, blended Company same store sales were flat

due to a decrease in transactions offset by an increase in

average guest check. For 2002, blended Company same

store sales were up 2% due to increases in both transac-

tions and average guest check.

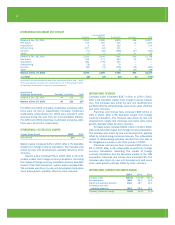

U.S. COMPANY RESTAURANT MARGIN

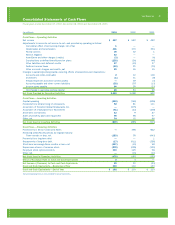

2003 2002 2001

Company sales 100.0% 100.0% 100.0%

Food and paper 28.8 28.2 28.6

Payroll and employee benefits 31.0 30.9 30.6

Occupancy and other operating

expenses 25.6 24.9 25.6

Company restaurant margin 14.6% 16.0% 15.2%

Restaurant margin as a percentage of sales decreased

approximately 140 basis points in 2003. The decrease

was primarily driven by increased occupancy expenses

due to higher rent, primarily due to additional rent expense

associated with the amended YGR sale-leaseback agree-

ments, and utilities. The higher food and paper costs were

primarily due to the impact of unfavorable discounting and

product mix. Also contributing to the decrease was higher

labor costs, primarily driven by low single-digit increases

in wage rates.

Restaurant margin as a percentage of sales increased

approximately 80 basis points in 2002. The increase

includes the favorable impact of approximately 50 basis

points from the adoption of SFAS 142, which was partially

offset by the unfavorable impact of approximately 20 basis

points from the YGR acquisition. The increase was primarily

driven by the favorable impact of same store sales growth

on margin and lower food and paper costs, partially offset by

an increase in labor costs. The decrease in food and paper

costs was primarily driven by cheese costs. The increase in

labor costs was primarily driven by wage rates.

U.S. OPERATING PROFIT

Operating profit increased $10 million or 1% in 2003.

Excluding the favorable impact of the YGR acquisition,

operating profit was flat compared to 2002. Decreases

driven by lower margins as a result of increased occupancy

expenses and the impact of unfavorable discounting and

product mix shift on food and paper costs were offset by

lower franchise and license and general and administrative

expenses.

Operating profit increased $107 million or 15% in

2002, including a 3% favorable impact from the adoption

of SFAS 142. Excluding the favorable impact of both SFAS

142 and the YGR acquisition, operating profit increased

9%. The increase was driven by same store sales growth

and the favorable impact of lapping franchise support costs

related to the restructuring of certain Taco Bell franchisees

in 2001. The increase was partially offset by higher restau-

rant operating costs, primarily due to higher labor costs, and

the unfavorable impact of refranchising and store closures.

The higher labor costs were driven by wage rates.

INTERNATIONAL RESULTS OF OPERATIONS

% B/(W) % B/(W)

vs. vs.

2003 2002 2002 2001

Revenue

Company sales $ 2,360 12 $ 2,113 14

Franchise and license fees 365 23 297 8

Total revenues $ 2,725 13 $ 2,410 13

Company restaurant margin $ 365 8 $ 337 31

% of Company sales 15.5% (0.5)ppts. 16.0% 2.1)ppts.

Operating profit $ 441 22 $ 361 19