Pizza Hut 2003 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2003 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We are more confident than ever that multibranding

is potentially the biggest sales and profit driver in the

restaurant industry since the drive-thru window.

us more confident than ever that multibranding is potentially the biggest sales and profit driver

in the restaurant industry since the introduction of the drive-thru window.

We started with combinations of KFC/Taco Bell and Taco Bell/Pizza Hut Express. We learned that

we were able to add significant incremental average sales per unit, dramatically improving our

unit cash flows. Our franchisees then pioneered multibrand combinations of KFC and Taco Bell

with Long John Silver’s, the country’s leading seafood restaurant, and A&W All American Food,

which offers pure-beef hamburgers and hot dogs along with its signature Root Beer Float. Based

on outstanding customer feedback and results, we acquired Long John Silver’s and A&W in

2002. With this acquisition we tripled our multibranding potential in the U.S.

We can now open high return new restaurants in trade areas that used to be too expensive or

did not have enough population density to allow us to go to market with one brand. With multi-

branding, we believe we can take both KFC and Taco Bell to 8,000 units in the U.S. compared

to the over 5,000 each we have today. As we expand, we expect to take volumes to an average

of at least $1.1 million per restaurant.

One of the most exciting learnings we had in 2003, is that Long John Silver’s is performing

even better than expected …we call it our hidden jewel. That’s because there is no national

fish competitor in the QSR industry and consequently there is pent-up consumer demand for

seafood. In addition to outstanding sales results with KFC and Taco Bell, we have created a

Long John Silver’s/A&W combination that allows us to expand into “home-run” trade areas

where we know demand is high and KFC and Taco Bell are already there. The results have led

us to a “fish first” strategy with the goal of making Long John Silver’s a national brand.

I’m also pleased to report that we have created on our own a new multibrand concept called

WingStreet, which is a tasty line of flavored bone-in and bone-out chicken wings. We believe that

WingStreet can be an ideal multibrand partner for Pizza Hut’s delivery service. Initial customer

response is promising. We also acquired Pasta Bravo, a California fast casual chain with an

outstanding line of pastas at great value, to be a partner brand with Pizza Hut’s traditional

dine-in restaurants. Franchise testing is underway. We are confident multibranding will be every

bit as successful at Pizza Hut as it has been for our other brands.

In last year’s report, I stated that the biggest multibranding challenge is building the operating

capability to successfully run these restaurants. That’s still a fact. With branded variety comes

complexity. However, we have structured and invested to drive execution and it’s paying off.

We now have a fully dedicated team of operating experts who have improved back of house

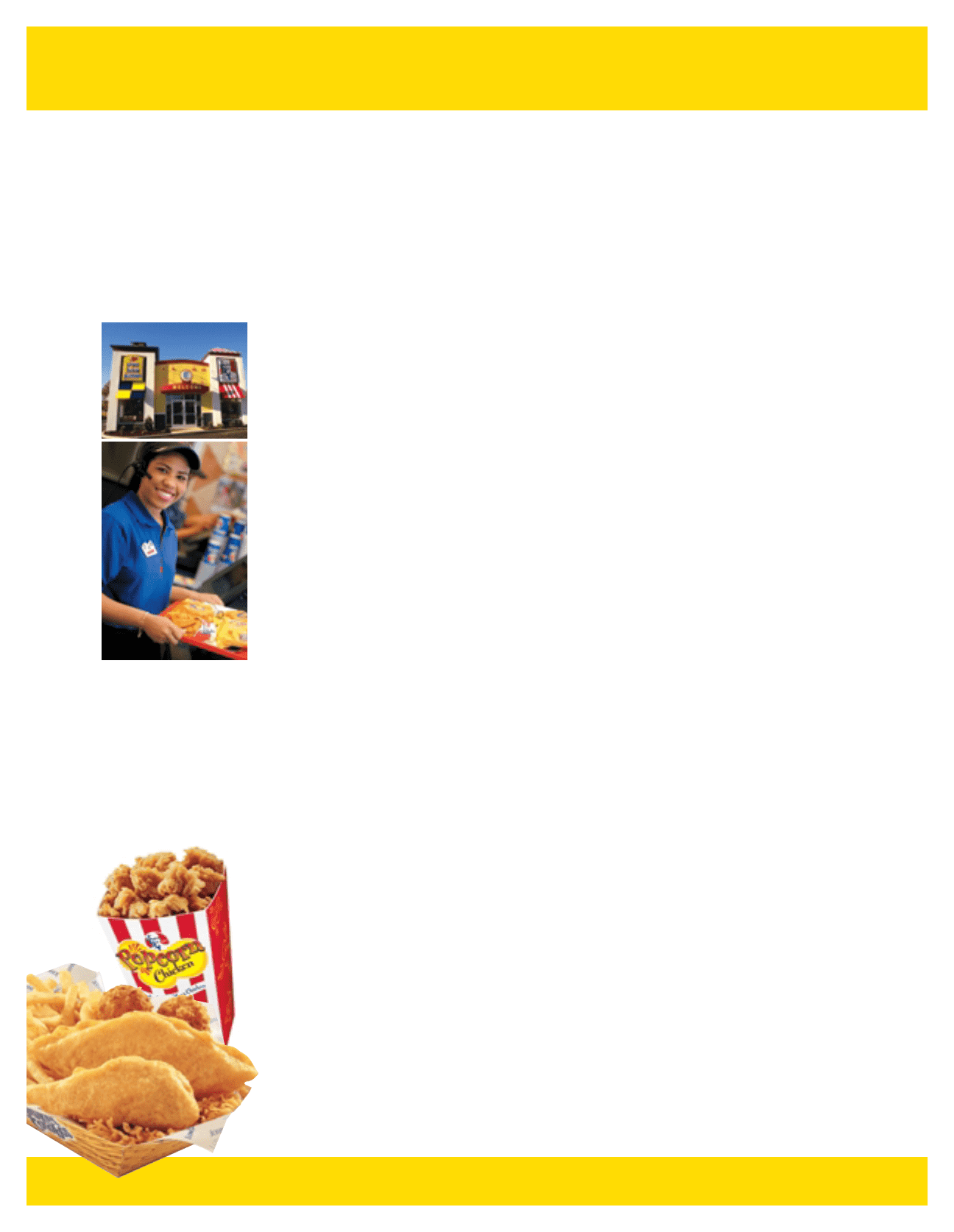

Top: The popularity o

f

the Lon

g

J

ohn

Si

lver’s brand

g

rew

i

n

2003

a

s it became the

p

artner-of-choice

in Y

u

m!’

s

n

e

w M

u

l

t

i

b

r

a

n

d

r

estau-

rants. This

y

ear, Yum! has adopted

a

“fi sh fi rst” strategy of using the

Multibrand development concept to

get Long John Silver’s distribution up

to at least

3,000

un

i

ts and make

i

t a

nat

i

onal brand

.

B

ottom: Multibrandin

g

o

ff

ers our

c

ustomers more cho

i

ce and conve

-

nience by brin

g

in

g

to

g

ether two o

f

our great brands under one roof

.

4.