Pizza Hut 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

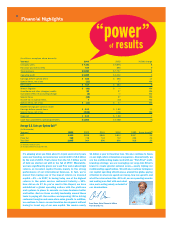

Financial Highlights

Year-end 2003

2003

2002

2002

% B(W) change

% B(W) change

Company sales

Company sales

$ 7,441

$ 7,441

$ 6,891

$ 6,891

8

8

Franchise and license fees

Franchise and license fees

939

939

866

866

9

9

Total revenues

Total revenues

$ 8,380 $ 7,757 8

$ 7,757 8

Operating profit

Operating profit

$ 1,059 $ 1,030 3

$ 1,030 3

Earnings before special items

Earnings before special items

$ 628

$ 628

$ 566 11

$ 566 11

Special items, net of tax

Special items, net of tax

(11) 17

17

NM

NM

Net income

Net income

$ 617

$ 617

$ 583 6

$ 583 6

Wrench litigation

Wrench litigation

$ (42)

$ (42)

$ — NM

$ — NM

AmeriServe and other (charges) credits

AmeriServe and other (charges) credits

26 27

27

NM

NM

Cumulative effect of accounting change

Cumulative effect of accounting change

(2) —

—

NM

NM

Special items

Special items

(18) 27

27

NM

NM

Income tax on special items

Income tax on special items

7 (10)

(10)

NM

NM

Special items, net of tax

Special items, net of tax

$ (11)

$ (11)

$ 17 NM

$ 17 NM

Diluted earnings per common share:

Diluted earnings per common share:

Earnings before special items

Earnings before special items

$ 2.06

$ 2.06

$ 1.82 13

$ 1.82 13

Special items, net of tax

Special items, net of tax

(0.04) 0.06

0.06

NM

NM

Reported

Reported

$ 2.02

$ 2.02

$ 1.88 7

$ 1.88 7

Cash flows provided by operating activities

Cash flows provided by operating activities

$ 1,053 $ 1,088 (3)

$ 1,088 (3)

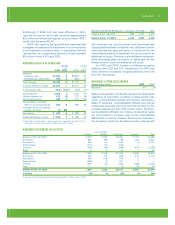

Average U.S. Sales per System Unit

Average U.S. Sales per System Unit

(a)

(In thousands)

(In thousands)

Year-end

Year-end

2003 2002 2001 2000

2002 2001 2000

1999 5-year growth

1999 5-year growth

(b)

KFC

KFC

$ 898

$ 898

$ 898 $ 865 $ 833

$ 898 $ 865 $ 833

$ 837 2%

$ 837 2%

Pizza Hut

Pizza Hut

748 748 724 712

748 724 712

696 3%

696 3%

Taco Bell

Taco Bell

1,005 964 890 896

964 890 896

918 2%

918 2%

(a) Excludes license units.

(a) Excludes license units.

(b) Compounded annual growth rate.

(b) Compounded annual growth rate.

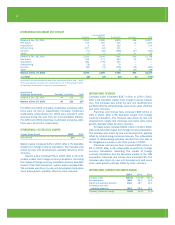

$1 billion a year in franchise fees. We also continue to focus

on our high-return international expansion. Domestically, we

are the multibranding leader and with our “Fish First” multi-

branding strategy, we are leveraging our Long John Silver’s

brand to create greater national scale — nearly tripling our

multibranding opportunities. We will also continue to improve

our capital spending effectiveness around the globe, paying

attention to where we spend our money, how we spend it, and

what the returns look like. All in all, we are spending smarter

and making sure that with each deci-

sion, we’re acting wisely on behalf of

our shareholders.

It’s amazing when you think about it. In just seven short years

since our founding, we lowered our overall debt to $2.1 billion

by the end of 2003. That’s down from the $4.7 billion worth

of debt we started out with in the fall of 1997. Meanwhile,

we have significantly grown our cash flow and realized high

returns on invested capital thanks mainly to the strong

performance of our international business. In fact, we’ve

moved from having one of the lowest returns on invested

capital — 8% — in 1997, to having today one of the highest

returns in the quick service restaurant industry — 18%.

How did we do it? As you’ve read in this Report, we have

established a global operating culture with the platforms

and systems in place to execute our base business better

and better. And our focus on daily leadership around these

tools is paying off. Our metrics are improving: We’re driving

restaurant margins and same-store sales growth. In addition,

we continue to focus on new franchise development without

having to invest any of our own capital. We receive nearly Dave Deno, Chief Financial Offi cer

Yum! Brands, Inc.

(In millions, except per share amounts)

(In millions, except per share amounts)

32.

““powerpower””

results

ofof