Pizza Hut 2003 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2003 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66.

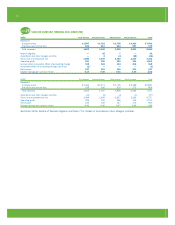

Weighted-average assumptions used to determine the net periodic benefit cost for fiscal years:

Pension Benefits Postretirement Medical Benefits

2003 2002 2001 2003 2002 2001

Discount rate 6.85% 7.60% 8.03% 6.85% 7.58% 8.27%

Long-term rate of return on plan assets 8.50% 10.00% 10.00% — — —

Rate of compensation increase 3.85% 4.60% 5.03% 3.85% 4.60% 5.03%

Our estimated long-term rate of return on plan assets

represents a weighted-average of expected future returns

on the asset categories included in our target investment

allocation based primarily on the historical returns for each

asset category, adjusted for an assessment of current

market conditions.

Assumed health care cost trend rates at September 30:

Postretirement

Medical Benefits

2003 2002

Health care cost trend rate assumed for next year 12% 12%

Rate to which the cost trend rate is assumed to

decline (the ultimate trend rate) 5.5% 5.5%

Year that the rate reaches the ultimate trend rate 2012 2011

There is a cap on our medical liability for certain retirees.

The cap for Medicare eligible retirees was reached in 2000

and the cap for non-Medicare eligible retirees is expected to

be reached between the years 2007–2008; once the cap is

reached, our annual cost per retiree will not increase.

Assumed health care cost trend rates have a signifi-

cant effect on the amounts reported for our postretirement

health care plans. A one-percentage-point change in

assumed health care cost trend rates would have the

following effects:

1-Percentage- 1-Percentage-

Point Point

Increase Decrease

Effect on total of service and interest cost $ — $ —

Effect on postretirement benefit obligation $ 4 $ (3)

Plan Assets

Our pension plan weighted-average asset allocations at

September 30, by asset category are set forth below:

Asset Category 2003 2002

Equity securities 65% 62%

Debt securities 30% 37%

Cash 5% 1%

Total 100% 100%

Our primary objectives regarding the pension assets are to

optimize return on assets subject to acceptable risk and

to maintain liquidity, meet minimum funding requirements

and minimize plan expenses. To achieve these objectives

we have adopted a passive investment strategy in which

the asset performance is driven primarily by the investment

allocation. Our target investment allocation is 70% equity

securities and 30% debt securities, consisting primarily

of low cost index mutual funds that track several sub-

categories of equity and debt security performance. The

investment strategy is primarily driven by lower participant

ages and reflects a long-term investment horizon favoring a

higher equity component in the investment allocation.

A mutual fund held as an investment by the pension

plan includes YUM stock in the amounts of $0.2 million and

$0.1 million at September 30, 2003 and 2002 (less than

1% of total plan assets in each instance).

STOCK-BASED EMPLOYEE COMPENSATION

note

18

At year-end 2003, we had four stock option plans in effect:

the YUM! Brands, Inc. Long-Term Incentive Plan (“1999

LTIP”), the 1997 Long-Term Incentive Plan (“1997 LTIP”), the

YUM! Brands, Inc. Restaurant General Manager Stock Option

Plan (“RGM Plan”) and the YUM! Brands, Inc. SharePower

Plan (“SharePower”). During 2003, the 1999 LTIP was

amended, subsequent to shareholder approval, to increase

the total number of shares available for issuance and to

make certain other technical and clarifying changes.

We may grant awards of up to 29.8 million shares

and 45.0 million shares of stock under the 1999 LTIP, as

amended, and 1997 LTIP, respectively. Potential awards to

employees and non-employee directors under the 1999 LTIP

include stock options, incentive stock options, stock appre-

ciation rights, restricted stock, stock units, restricted stock

units, performance shares and performance units. Potential

awards to employees and non-employee directors under the

1997 LTIP include stock appreciation rights, restricted stock

and performance restricted stock units. Prior to January 1,

2002, we also could grant stock options and incentive stock

options under the 1997 LTIP. We have issued only stock

options and performance restricted stock units under the

1997 LTIP and have issued only stock options under the

1999 LTIP.

We may grant stock options under the 1999 LTIP to

purchase shares at a price equal to or greater than the

average market price of the stock on the date of grant.

New option grants under the 1999 LTIP can have varying

vesting provisions and exercise periods. Previously granted

options under the 1997 LTIP and 1999 LTIP vest in periods

ranging from immediate to 2007 and expire ten to fifteen

years after grant.

We may grant options to purchase up to 15.0 million

shares of stock under the RGM Plan at a price equal to or

greater than the average market price of the stock on the