Pizza Hut 2003 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2003 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64.

comparing the cumulative change in the forward contract

with the cumulative change in the hedged item. No signifi-

cant ineffectiveness was recognized in 2003 or 2002 for

those foreign currency forward contracts designated as

cash flow hedges.

Commodities

We also utilize on a limited basis commodity futures and

options contracts to mitigate our exposure to commodity

price fluctuations over the next twelve months. Those

contracts have not been designated as hedges under

SFAS 133. Commodity future and options contracts

entered into for the fiscal years ended December 27, 2003

and December 28, 2002 did not significantly impact the

Consolidated Financial Statements.

Deferred Amounts in Accumulated Other

Comprehensive Income (Loss)

As of December 27, 2003, we had a net deferred loss asso-

ciated with cash flow hedges of approximately $2 million,

net of tax. Of this amount, we estimate that a net after-

tax loss of less than $1 million will be reclassified into

earnings through December 25, 2004. The remaining net

after-tax loss of approximately $2 million, which arose from

the settlement of treasury locks entered into prior to the

issuance of certain amounts of our fixed-rate debt, will be

reclassified into earnings from December 26, 2004 through

2012 as an increase to interest expense on this debt.

Credit Risks

Credit risk from interest rate swap, treasury lock and

forward rate agreements and foreign exchange contracts is

dependent both on movement in interest and currency rates

and the possibility of non-payment by counterparties. We

mitigate credit risk by entering into these agreements with

high-quality counterparties, and netting swap and forward

rate payments within contracts.

Accounts receivable consists primarily of amounts due

from franchisees and licensees for initial and continuing

fees. In addition, we have notes and lease receivables

from certain of our franchisees. The financial condition

of these franchisees and licensees is largely dependent

upon the underlying business trends of our Concepts. This

concentration of credit risk is mitigated, in part, by the

large number of franchisees and licensees of each Concept

and the short-term nature of the franchise and license fee

receivables.

Fair Value

At December 27, 2003 and December 28, 2002, the

fair values of cash and cash equivalents, short-term

investments, accounts receivable, and accounts payable

approximated carrying value because of the short-term

nature of these instruments. The fair value of notes

receivable approximates carrying value after consideration

of recorded allowances.

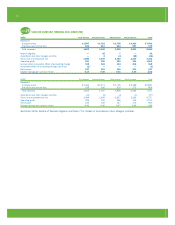

The carrying amounts and fair values of our other

financial instruments subject to fair value disclosures are

as follows:

2003 2002

Carrying Fair Carrying Fair

Amount Value Amount Value

Debt

Short-term borrowings

and long-term debt,

excluding capital leases

and the derivative

instrument adjustments

$ 1,925 $ 2,181 $ 2,302 $ 2,470

Debt-related derivative

instruments:

Open contracts in a net

asset position 31 31 48 48

Foreign currency-related

derivative instruments:

Open contracts in a net

asset (liability) position — — (1) (1)

Lease guarantees 8 37 4 42

Guarantees supporting

financial arrangements of

certain franchisees,

unconsolidated affiliates

and other third parties 8 10 16 17

Letters of credit — 3 — 3

We estimated the fair value of debt, debt-related derivative

instruments, foreign currency-related derivative instruments,

guarantees and letters of credit using market quotes and

calculations based on market rates.

PENSION AND POSTRETIREMENT MEDICAL BENEFITS

note

17

Pension Benefits

We sponsor noncontributory defined benefit pension

plans covering substantially all full-time U.S. salaried

employees, certain hourly employees and certain interna-

tional employees. The most significant of these plans, the

YUM Retirement Plan (the “Plan”), is funded while benefits

from the other plan are paid by the Company as incurred.

During 2001, the Plan was amended such that any sala-

ried employee hired or rehired by YUM after September 30,

2001 is not eligible to participate in the Plan. Benefits are

based on years of service and earnings or stated amounts

for each year of service.

Postretirement Medical Benefits

Our postretirement plan provides health care benefits,

principally to U.S. salaried retirees and their dependents.

This plan includes retiree cost sharing provisions. During

2001, the plan was amended such that any salaried

employee hired or rehired by YUM after September 30,

2001 is not eligible to participate in this plan. Employees

hired prior to September 30, 2001 are eligible for benefits