Pizza Hut 2003 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2003 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42.

under the Credit Facility from $1.2 billion to $1.0 billion.

At December 27, 2003, our unused Credit Facility totaled

$737 million, net of outstanding letters of credit of

$263 million. There were no borrowings outstanding under

the Credit Facility at December 27, 2003. Our Credit Facility

contains financial covenants relating to maintenance of

leverage and fixed charge coverage ratios. The Credit

Facility also contains affirmative and negative covenants

including, among other things, limitations on certain addi-

tional indebtedness, guarantees of indebtedness, level of

cash dividends, aggregate non-U.S. investment and certain

other transactions as defined in the agreement. We were in

compliance with all covenants at December 27, 2003, and

do not anticipate that the covenants will impact our ability

to borrow under our Credit Facility for its remaining term.

The remainder of our long-term debt primarily comprises

senior unsecured notes. Amounts outstanding under senior

unsecured notes were $1.85 billion at December 27, 2003.

The first of these notes, in the amount of $350 million,

matures in 2005. We currently anticipate that our net cash

provided by operating activities will permit us to make a

significant portion of this $350 million payment without

borrowing additional amounts.

We estimate that capital spending will be approximately

$770 million and refranchising proceeds will be approxi-

mately $100 million in 2004. In November 2003, our Board

of Directors authorized a new $300 million share repur-

chase program. At December 27, 2003, we had remaining

capacity to repurchase, through May 21, 2005, up to

$294 million of our outstanding Common Stock (excluding

applicable transaction fees) under this program.

In addition to any discretionary spending we may

choose to make, significant contractual obligations and

payments as of December 27, 2003 included:

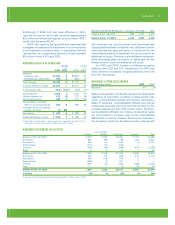

Less than More than

Total 1 Year 1–3 Years 3–5 Years 5 Years

Long-term debt(a) $ 1,930 $ 1 $ 553 $ 254 $ 1,122

Capital leases(b) 192 15 29 26 122

Operating leases(b) 2,484 320 540 431 1,193

Purchase obligations(c) 162 124 26 7 5

Other long-term liabilities reflected on our

Consolidated Balance Sheet under GAAP 31 — 17 5 9

Total contractual obligations $ 4,799 $ 460 $ 1,165 $ 723 $ 2,451

(a) Excludes a fair value adjustment of $29 million included in debt related to interest rate swaps that hedge the fair value of a portion of our debt. See Note 14.

(b) These obligations, which are shown on a nominal basis, relate to approximately 5,900 restaurants. See Note 15.

(c) Purchase obligations include agreements to purchase goods or services that are enforceable and legally binding on us and that specify all significant terms, including: fixed

or minimum quantities to be purchased; fixed, minimum or variable price provisions; and the approximate timing of the transaction. We have excluded agreements that are

cancelable without penalty. Purchase obligations relate primarily to purchases of property, plant and equipment as well as marketing, information technology, maintenance,

consulting and other agreements.

We have not included obligations under our pension and

postretirement benefit plans in the contractual obligations

table. Our funding policy regarding our funded pension plan

is to contribute amounts necessary to satisfy minimum

pension funding requirements plus such additional amounts

from time to time as are determined to be appropriate to

improve the plan’s funded status. The pension plan’s funded

status is affected by many factors including discount rates

and the performance of plan assets. We are not required to

make minimum pension funding payments in 2004, but we

may make discretionary contributions during the year based

on our estimate of the plan’s expected September 30, 2004

funded status. During 2003, we made voluntary pension

contributions of $130 million to our funded plan, none

of which represented minimum funding requirements.

Our postretirement plan is not required to be funded in

advance, but is pay as you go. We made postretirement

benefit payments of $4 million in 2003.

Also excluded from the contractual obligations table

are payments we may make for employee health and prop-

erty and casualty losses for which we are self-insured. The

majority of our recorded liability for self-insured employee

health and property and casualty losses represents

estimated reserves for incurred claims that have yet to be

filed or settled.

OFF-BALANCE SHEET ARRANGEMENTS

At December 27, 2003, we had provided approximately

$32 million of partial guarantees of two franchisee loan

pools, both of which were implemented prior to spin-off,

related primarily to the Company’s historical refranchising

programs and, to a lesser extent, franchisee development

of new restaurants. The total loans outstanding under

these loan pools were approximately $123 million at

December 27, 2003. In support of these guarantees, we

have posted $32 million of letters of credit. We also provide

a standby letter of credit of $23 million under which we

could potentially be required to fund a portion of one of the

franchisee loan pools. Any funding under the guarantees or

letters of credit would be secured by the franchisee loans

and any related collateral. We believe that we have appropri-

ately provided for our estimated probable exposures under

these contingent liabilities. These provisions were primarily

charged to facility actions. New loans are not currently being

added to either loan pool.