Pentax 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

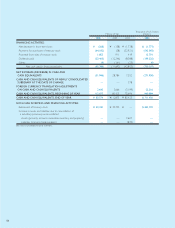

Obligations under finance leases:

Millions of Yen Thousands of U.S. Dollars

2006 2005 2006

Due within one year ¥833 ¥786 $7,091

Due after one year 1,200 1,358 10,216

Total ¥2,033 ¥2,144 $17,307

Allowance for impairment loss on leased property of ¥170 million as of March 31, 2005 is not included in obligations under finance leases.

Depreciation expense and other information under finance leases:

Millions of Yen Thousands of U.S. Dollars

2006 2005 2004 2006

Depreciation expense ¥726 ¥959 ¥1,297 $6,180

Lease payments 896 959 1,297 7,627

Reversal of allowance for impairment loss on leased property 170 105 — 1,447

Impairment loss ——276 —

The imputed interest expense portion as lessee is included in the above obligations under finance leases.

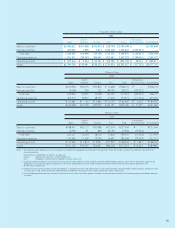

No. 13 CONTINGENT LIABILITIES

At March 31, 2006, the Group had the following contingent liabilities:

Millions of Yen Thousands of U.S. Dollars

2006 2005 2006

Guarantees of borrowings and lease obligations for customers ¥2,206 ¥1,364 $18,779

Guarantees of borrowings for the Group’s employees 4534

Total ¥2,210 ¥1,369 $18,813

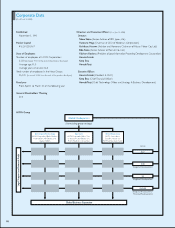

On June 17, 2005, June 18, 2004, June 20, 2003 and June 21,

2002, the Company’s shareholders approved a stock option plan

for the Group’s directors and key employees. Under the plan,

4,401 thousand options were granted to them to purchase shares

of the Company’s common stock during the exercise period from

October 1, 2006 to September 30, 2015, October 1, 2005 to

September 30, 2009, October 1, 2004 to September 30, 2008 or

from October 1, 2003 to September 30, 2007. The options were

granted at an exercise price of ¥4,150, ¥2,713, ¥2,438, ¥1,673

or ¥1,918.

At the Company’s shareholders’ meeting held on June 16, 2006,

the following stock option plan for the Group’s directors and key

employees was approved. The plan provides for granting options

to the Group’s directors and key employees to purchase up to

1,200 thousand shares of the Company’s common stock in

the period from October 1, 2007 to September 30, 2016. The

options are granted at an exercise price at the fair value at the

previous date of the option grant. The Company plans to issue

acquired treasury stock upon exercise of the stock options.

No. 14 STOCK-BASED COMPENSATION PLANS (UNAUDITED)