Pentax 2006 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2006 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Eye Care

Compared by Hoya

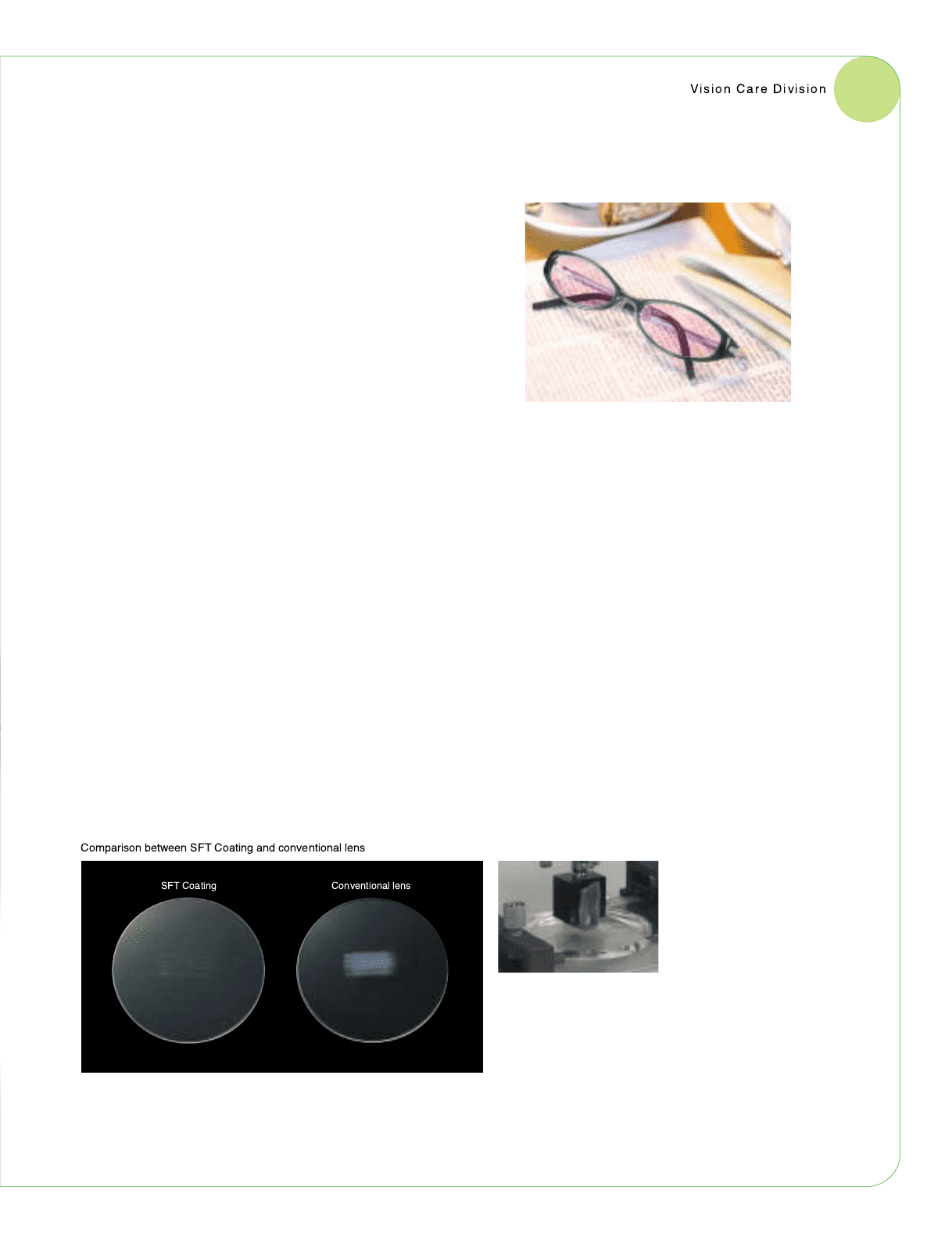

The steel wool wear endurance

test, which moves the lens from

side to side 50 times with a

load of four kg applied to the

steel wool

Eyeglass Lenses

While the global eyeglass lens market is showing moderate growth overall,

there is a trend toward polarization in the market, with sales of high-end

lenses rising in specific regions and countries, and low-priced products

becoming more prominent elsewhere. Faced with such a market

environment, the Company has continued to focus on the upper end of this

market, relying on cutting-edge technology to provide high-value-added

products that support the vision needs of society. This strategy has provided

solid growth.

Underpinning growth during the fiscal year ended March 31, 2006, was

an emphasis on localization, and the success of continuous new product

development. The eyeglass lens market varies widely by country and region

in terms of distribution structures, customer preferences and governmental

regulation, and Hoya has restructured its business to divest decision-making authority to country and regional managers, allowing

them to pursue the best strategies for their markets. This region-based marketing strategy has opened up new channels for the

cutting-edge products that are the basis for the Company’s success. These include the thin, high-index material lens EYNOA and

EYRY, “Hoyalux iD,” the world’s first integrated double-surface progressive lens design. By utilizing both surfaces of the lens in

conjunction, these lenses expand the clear view at both near and far distances, and vastly improve on the curvature and

distortions common in previous lenses. Other products include the new SunTech series of light-sensitive lenses, and a scratch-

resistant SFT Coating.

The two most important markets for Hoya are Japan and Europe, both of which have high demand for premium products

and similar replacement cycles. The Vision Care headquarters was relocated from Japan to the Netherlands during 2005,

reflecting the growth potential in Europe and a commitment to greater global business development from a European base.

Hoya Continues to Hold the Top Market Share in Japan

Despite a mature market that has been stagnant overall for the last few years, reflecting sluggish personal consumption and

deflationary trends, Hoya continues to hold the leading position in its home market, where the quality and reliability of its

products are particularly valued, and sales inched up from a year earlier. Low-priced glasses from discount retailers, the so-called

“three-price shops,” remain popular, but growth has shown signs of leveling off, and recovery in the economy is helping to turn

attention toward the premium products in which Hoya has an advantage. The aging of the population should also give a boost to

the multifocal lenses and special coatings that are the Company’s strength, and provide steady sales if not rapid growth.