Pentax 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

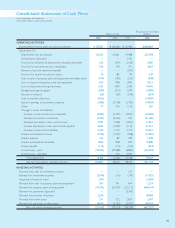

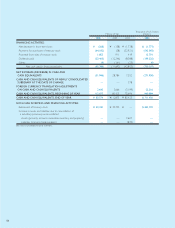

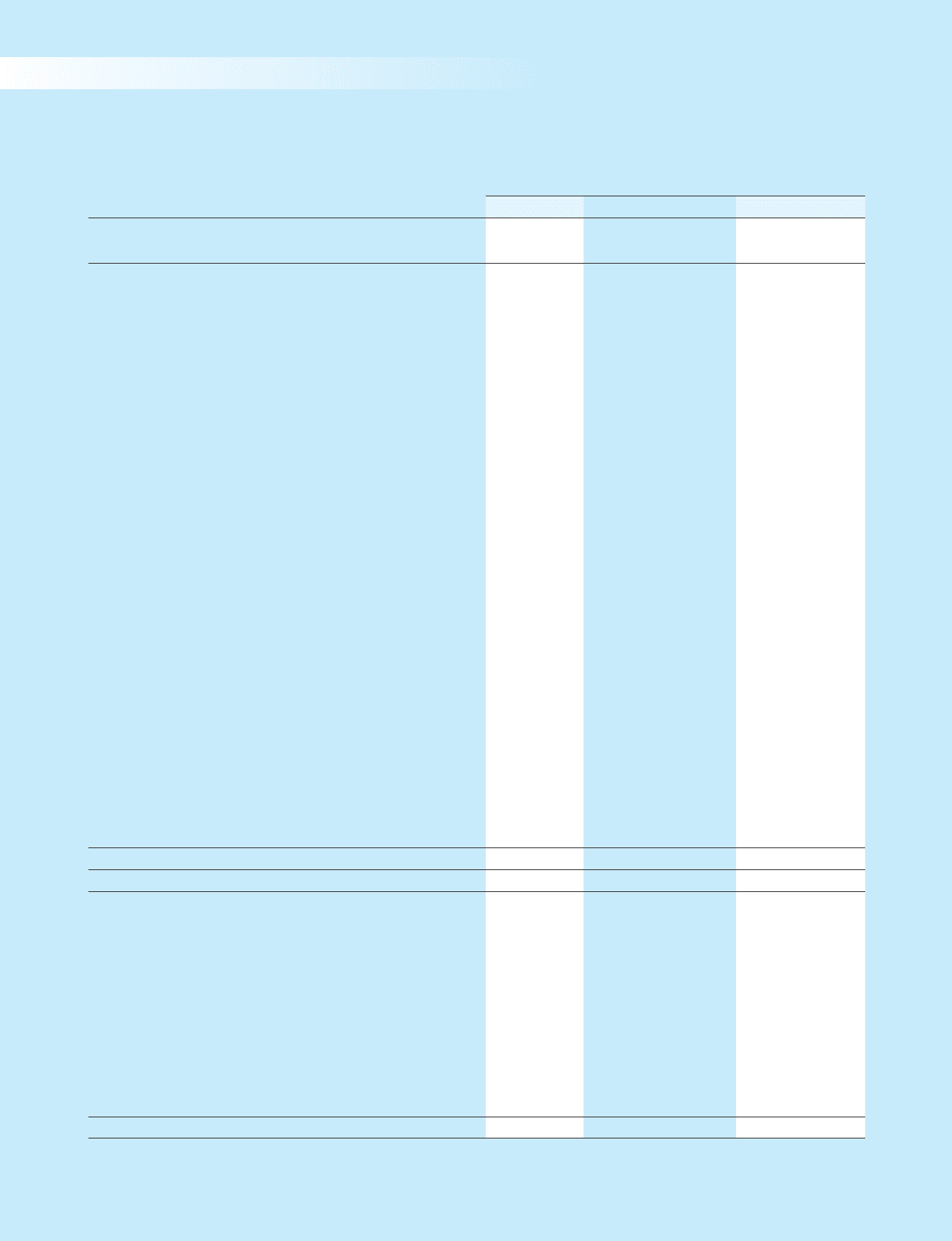

Thousands of U.S. Dollars

Millions of Yen (Note 1)

2006 2005 2004 2006

OPERATING ACTIVITIES:

Income before income taxes and minority interests ¥ 97,367 ¥83,466 ¥ 55,496 $ 828,867

Adjustments for:

Depreciation and amortization 26,252 21,661 19,988 223,478

Amortization of goodwill ——3,300 —

Provision for (reversal of) allowance for doubtful receivables 235 (345) (1,169) 2,000

Provision for accrued bonuses to employees 278 194 191 2,367

Reversal of accrued retirement benefits ——(293) —

Provision for reserve for periodic repairs 76 185 94 647

Gain on sales of property, plant and equipment and other assets (109) (195) (523) (928)

Loss on disposal of property, plant and equipment 625 948 1,900 5,321

Loss on impairment of long-lived assets 1,233 859 2,040 10,496

Foreign exchange loss (gain) (599) (233) 1,209 (5,099)

Bonuses to directors (65) (63) (169) (553)

Gain on transfer of business (1,656) —— (14,097)

Equity in earnings of associated companies (1,285) (3,708) (1,700) (10,939)

Other 77 554 1,126 655

Changes in assets and liabilities:

Increase in notes and accounts receivable (4,042) (5,393) (4,997) (34,409)

Decrease (increase) in inventories (2,547) (2,526) 222 (21,682)

Decrease (increase) in other current assets 2,097 2,428 (1,961) 17,851

Increase (decrease) in notes and accounts payable 3,644 (1,629) 5,116 31,021

Increase in other current liabilities 2,420 3,142 1,719 20,601

Interest and dividends income (1,795) (1,022) (558) (15,281)

Interest expense 142 87 189 1,209

Interest and dividends receivable 1,866 958 659 15,885

Interest payable (112) (110) (155) (953)

Income taxes—paid (18,247) (23,588) (6,880) (155,333)

Income taxes—refunded —330 3,900 —

Total adjustments 8,488 (7,466) 23,248 72,257

Net cash provided by operating activities 105,855 76,000 78,744 901,124

INVESTING ACTIVITIES:

Proceeds from sales of investment securities ——102 —

Payments for investment securities (2,070) (10) (379) (17,622)

Acquisition of majority shares (337) —— (2,869)

Proceeds from sales of property, plant and equipment 267 541 814 2,273

Payments for property, plant and equipment (47,742) (33,394) (23,212) (406,419)

Payments for purchases of goodwill ——(3,300) —

Proceeds from transfer of business 2,230 —— 18,984

Proceeds from other assets 271 532 2,829 2,307

Payments for purchases of other assets (4,632) (3,193) (5,193) (39,431)

Net cash used in investing activities (52,013) (35,524) (28,339) (442,777)

Consolidated Statements of Cash Flows

Hoya Corporation and Subsidiaries

Years Ended March 31, 2006, 2005 and 2004