Pentax 2006 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2006 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

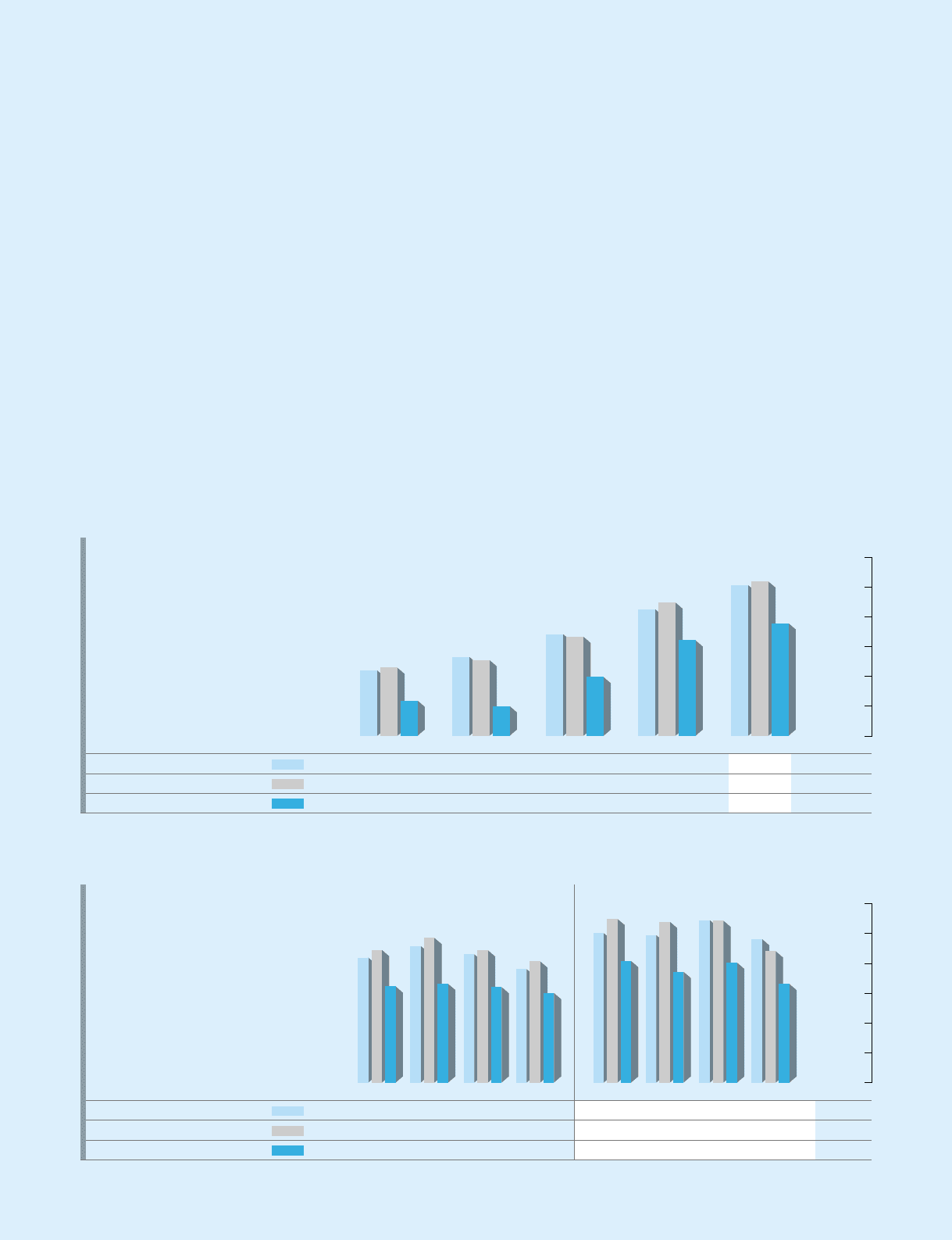

Operating Income,

Ordinary Income and Net Income

(Millions of yen)

120,000

100,000

80,000

60,000

40,000

20,000

0

2002 2003 2004 2005 2006

Operating income

Ordinary income

Net income

43,898

45,774

23,741

52,983

50,874

20,038

68,167

66,554

39,549

84,920

89,525

64,135

101,096

103,638

75,620

Quarterly Profits (Millions of yen)

30,000

25,000

20,000

15,000

10,000

5,000

0

1Q 2Q 3Q

2005

4Q 1Q 2Q 3Q

2006

4Q

Operating income

Ordinary income

Net income

21,082

22,366

16,223

23,047

24,405

16,671

21,652

22,314

16,123

19,139

20,440

15,118

25,056

27,466

20,389

24,740

26,974

18,596

27,257

27,161

20,120

24,043

22,037

16,515

Net Income

As net sales expanded, the cost of sales also rose, increasing 8.9% year

on year to ¥172,034 million. Because cost of sales grew less than net

sales, which increased 11.7%, the gross profit margin improved to 50.0%,

up 1.3 percentage points from 48.7% in the previous fiscal year. Selling,

general and administrative (SG&A) expenses also rose with the growth

in net sales, increasing 9.0% to ¥71,098 million. SG&A expenses as a

percentage of net sales, however, declined 0.4 percentage point, from

21.1% to 20.7%, because SG&A expenses rose at a lower pace than the

growth rate for net sales. As a result, operating income increased 19.0%

to ¥101,096 million, and the operating income ratio improved by 1.8

percentage points to 29.4%. By quarter, the operating income ratio was

30.6% in the first quarter, 29.1% in the second quarter, 31.2% in the

third quarter and 26.7% in the fourth quarter.

Net income for the consolidated fiscal year under review increased

17.9% to ¥75,620, despite contraction in other income such factors as a

fall in equity in earnings of associated companies of ¥2,423 million from

the previous fiscal year and a decline in foreign exchange gains (losses),

from ¥875 million in the previous year to ¥243 million. There were

otherwise increase of ¥1,746 million for loss on clarification of soil

pollution and ¥374 million for impairment losses, although declines of

¥323 million in loss on disposal of property, plant and equipment, and

¥741 million in loss on plant closure from the ¥1,264 million due to

significant restructuring generated in the previous year.

Return on assets (ROA) improved by 1.2 percentage points to

21.2%, and return on equity (ROE) improved by 1.3 percentage points

to 27.1%. Dividends for the consolidated fiscal year under review

consisted of an interim dividend of ¥120 per share and a year-end

dividend of ¥30 per share, for an aggregate ¥150 per share for the full

year. If the interim dividend is adjusted retroactively to reflect the 4-for-1

stock split implemented in November 2005, the dividend payment for

the full year amounts to ¥60 per share (¥120 ÷ 4 + ¥30 = ¥60), a 60%

increase from previous year’s dividend of ¥37.5 per share.

(Millions of yen)

(Millions of yen)