Pentax 2006 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2006 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(%)

40

20

0

(Millions of yen)

200,000

150,000

100,000

50,000

0

Net sales (Millions of yen)

Operating income (Millions of yen)

Operating income ratio* (%)

Assets (Millions of yen)

Depreciation (Millions of yen)

Capital expenditures (Millions of yen)

135,071

45,170

33.4

132,240

13,205

22,247

165,664

63,290

38.1

162,638

14,730

31,962

190,552

74,862

39.1

204,192

18,716

37,244

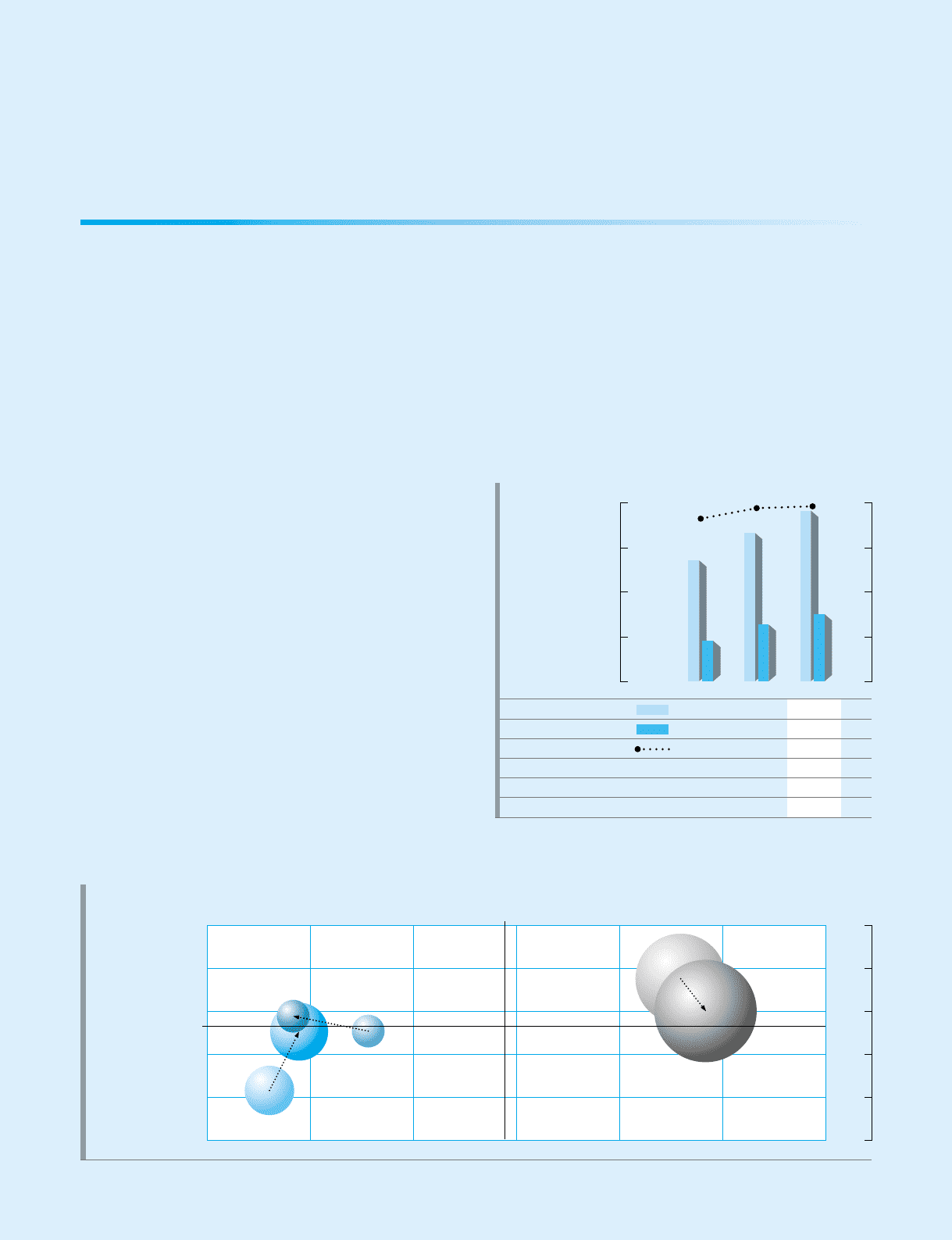

Sales Growth and Profitability of Main Business Segments

Fiscal year ended March 31, 2006 (Compared with the previous fiscal year) Sales Growth Ratio (%)

35

25

15

5

-5

-15

15202530354045

* The operating income ratio above is calculated using net sales plus intersegment

sales. Please refer to details on page 62 Segment Information.

Electro-Optics Division

Operating Income Ratio (%)

Consolidated Basis

Consolidated Basis

Size of circle shows the volume of operating income.

Net sales in the Electro-Optics division rose 15.0% year on year to

¥190,552 million. In mask blanks for semiconductor production, demand

was strong for high-precision products such as phase shift mask blanks in

response to greater functionality and higher capacity of LSIs. There was an

increase in orders for photomasks for semiconductor production, mainly

high-end products that comply with 65-nm line width design rules, though

sales remained flat overall as a result of a special order for ordinary class

products during the previous fiscal year. In photomasks for LCD panels, the

Group benefited from increased production capacity owing to the opening

of a new production facility, and demand was strong for leading-edge,

large-scale masks as a result of the establishment of highly active, new

production lines, and the development of new models by many

panel manufacturers.

In glass disks for HDDs, although demand for applications such as

portable music players slowed from the middle of the year, demand for

disks for laptop computers expanded strongly. Net sales also rose steadily

as a result of the start of production at a new plant, and investment aimed

at increasing production at existing plants. In optical glass products,

inventory adjustments in the digital camera market that began in the

second half of the previous year were completed. Sales rose from the

previous fiscal year as a result of increased demand for lenses for digital

cameras (mainly products with high degrees of added value), and the full-

scale start of shipments of camera lenses for new applications such as

mobile phones.

Operating income in the Electro-Optics division rose 18.3% to

¥74,862 million. In the first half, demand exceeded supply capacity for many

products, boosting profit margins to high levels because plant capacity

utilization rates were high. In the second half, supply capacity was filled as a

result of the benefit of investment in increased production, although profit

margins eroded due to such factors as the surfacing of price competition

for certain products, and changes in the product mix. Demand for all

products remained strong, however, and the operating income ratio for the

full year rose by 1.0 percentage point to 39.1%. By quarter, the operating

income ratio was 42.0% in the first quarter, 38.3% in the second quarter,

39.8% in the third quarter and 36.8% in the fourth quarter.

As indicated in the graph for “Sales Growth and Profitability of Main

Business Segments” (“the segment graph”), the net sales growth rate in

the Electro-Optics division was higher than the consolidated average

growth rate for net sales of 11.7% (the circle is above the Consolidated

Basis line), and the operating income ratio rose from the previous

consolidated fiscal year (the circle shifted to the right).

Capital investment in the Electro-Optics division rose 16.5% to

¥37,244 million, due mainly to the establishment of a new large-scale LCD

photomask plant in South Korea, a new HDD glass disk plant in Vietnam,

and proactive investments to increase production capacity at existing

plants, such as those for optical lenses.

Net sales for the Photonics division fell 6.1% to ¥10,093 million from

the previous fiscal year. Operating income rose 4.6% to ¥934 million, and

the operating income ratio improved 0.9 percentage point to 9.0%.

Although net sales declined as a result of a reshuffling of the product mix

in favor of more profitable products, earnings rose due to the

strengthening of the marketing structure and greater efficiency in the

production structure.

Segment Overview

Information Technology (Electro-Optics and Photonics Division)

Health Care

Vision Care

2004 2005 2006

Electro-Optics