Pentax 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

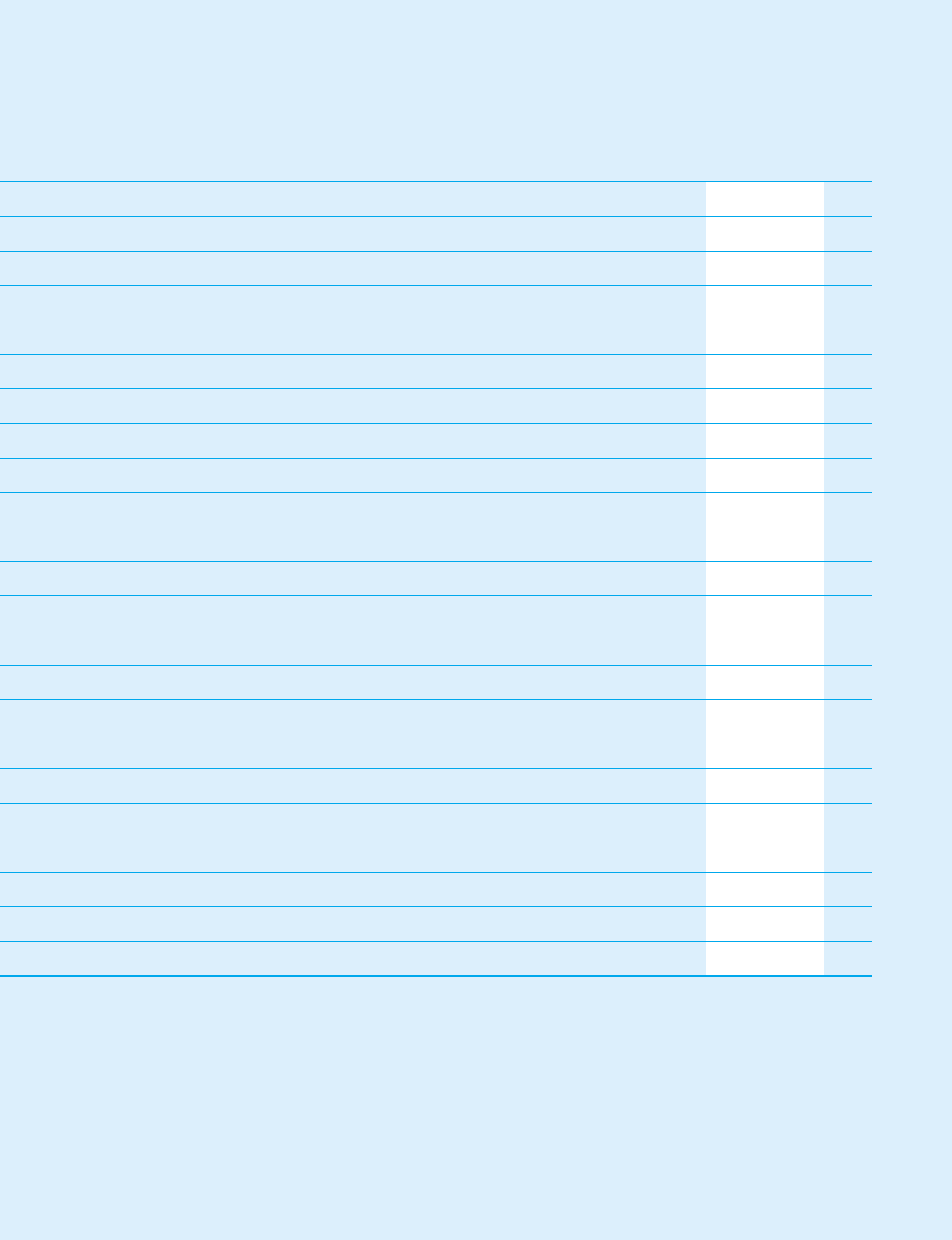

¥236,802

45,128

48,184

21,860

23.8

8.6

11.8

73.0

3.1

39,673

32,138

7.3

46.65

12.50

116.24

420.11

43.7

17.6

4.9

2,040

947.6

12,966

¥235,265

43,898

45,774

23,741

24.2

8.7

11.5

78.8

3.2

19,585

20,105

7.3

50.78

12.50

88.31

471.55

44.5

25.6

4.8

2,260

1,049.8

13,311

¥246,293

52,983

50,874

20,038

24.4

7.3

9.0

81.7

2.9

15,948

19,792

8.7

42.77

12.50

82.72

486.29

41.8

21.6

3.7

1,787

830.3

14,023

¥271,444

68,167

66,554

39,549

22.3

14.0

17.8

75.5

2.8

30,659

25,328

9.8

87.74

25.00

174.91

491.90

28.9

14.5

5.2

2,537

1,178.7

18,092

¥308,172

84,920

89,525

64,135

21.1

20.0

25.8

79.1

2.7

40,175

22,520

10.9

144.71

37.50

171.65

623.59

20.4

17.2

4.7

2,950

1,325.7

21,234

¥344,228

101,096

103,638

75,620

20.7

21.2

27.1

77.3

2.7

48,786

27,485

14.1

171.71

60.00

240.57

648.87

27.7

19.7

7.3

4,750

2,066.3

25,176

2001 2002 2003 2004 2005 2006

Cash flow per share: From fiscal 2002 and after, figures for cash flow per share are shown as cash flow from operating activities divided by the average number of issued shares for the

fiscal period. Figures prior to 2002 are calculated using simple cash flow calculated by adding depreciation and other factors to net income.

Price earnings ratio (stock price at year-end/net income per share): An index of valuation that compares the Company’s stock price with its earnings to judge whether the stock is

overvalued or undervalued.

Price cash flow ratio (stock price at year-end/cash flow per share): Cash flow is calculated by adding net income, depreciation, amortization and other. Depreciation indicates active

investment aiming for future growth, so the price cash flow ratio can be used to gauge the price level of a stock by

taking into consideration future growth potential. It can be used together with the price earnings ratio, the market

average and comparative ratios for other companies in the same industry to judge whether the Company’s stock price

is overvalued or undervalued.

Price book value ratio (stock price at year-end/shareholders’ equity per share): An index of valuation that compares the Company’s stock price to the value of its net assets. An index of

less than one suggests that dissolving the company and selling off its assets may be more profitable than

holding the company’s stock.