Pentax 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

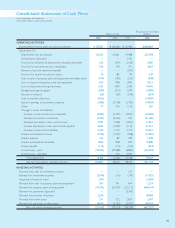

The accompanying consolidated financial statements have been

prepared in accordance with the provisions set forth in the

Japanese Securities and Exchange Law and its related accounting

regulations, and in conformity with accounting principles generally

accepted in Japan, which are different in certain respects as to

application and disclosure requirements of International Financial

Reporting Standards.

The accounts of overseas subsidiaries are based on their

accounting records maintained in conformity with generally

accepted accounting principles prevailing in the respective

countries of domicile. The accompanying consolidated financial

statements have been restructured and translated into English

(with some expanded descriptions and the inclusion of consoli-

dated statements of shareholders’ equity) from the consolidated

financial statements of the Company prepared in accordance

with Japanese GAAP and filed with the appropriate Local Finance

Bureau of the Ministry of Finance as required by the Securities

and Exchange Law. Some supplementary information included in

the statutory Japanese language consolidated financial statements,

but not required for fair presentation, is not presented in the

accompanying consolidated financial statements.

The translations of the Japanese yen amounts into U.S. dollars

are included solely for the convenience of readers outside Japan,

using the prevailing exchange rate at March 31, 2006, which was

¥117.47 to U.S. $1. The convenience translations should not be

construed as representations that the Japanese yen amounts have

been, could have been, or could in the future be, converted into

U.S. dollars at this or any other rate of exchange.

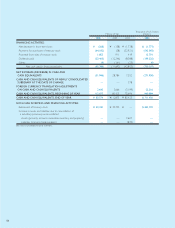

No. 1 BASIS OF PRESENTING CONSOLIDATED FINANCIAL STATEMENTS

a. Principles of Consolidation—The consolidated financial state-

ments as of March 31, 2006 include the accounts of the Company

and its 62 (58 in 2005 and 55 in 2004) subsidiaries (together, the

“Group”).

Under the control or influence concept, those companies in

which the Company, directly or indirectly, is able to exercise con-

trol over operations are fully consolidated, and those companies

over which the Group has the ability to exercise significant

influence are accounted for by the equity method.

Investment in an associated company through the years is

accounted for by the equity method and remaining associated

companies are stated at cost due to immateriality.

The differences between the cost and underlying net equity of

investment in consolidated subsidiaries and associated companies

accounted for by the equity method are charged to income

when incurred.

All significant intercompany balances and transactions have been

eliminated in consolidation. All material unrealized profits included in

assets resulting from transactions within the Group are eliminated.

b. Cash Equivalents—Cash equivalents are short-term invest-

ments that are readily convertible into cash, and are exposed to

insignificant risk of changes in value. Cash equivalents mature or

become due within three months of the date of acquisition.

c. Inventories—Inventories are stated principally at cost using the

average method.

d. Investment Securities—All investment securities are classified

as available-for-sale securities. Marketable available-for-sale securi-

ties are reported at fair value, with unrealized gains and losses,

net of applicable taxes, reported in a separate component of

shareholders’ equity. The cost of securities sold is determined

based on the moving-average method.

Non-marketable available-for-sale securities are stated at cost

determined by the moving-average method. For other than tem-

porary declines in fair value, investment securities are reduced to

net realizable value by a charge to income.

No. 2 SUMMARY OF SIGNIFICANT ACCOUNTING AND REPORTING POLICIES

Notes to Consolidated Financial Statements

Hoya Corporation and Subsidiaries