Pentax 2006 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2006 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

I am delighted to have the opportunity to report on

Hoya’s consolidated results for the fiscal year ended

March 31, 2006, and to give an overview of our

future business direction.

The Surprising Scope of Hoya’s Business

The number of Hoya shareholders jumped from just 7,000 a

year ago to more than 50,000 at the end of March 2006.

Institutional investors continue to hold the greater proportion of

shares, but I am also extremely pleased that a large number of

individuals became Hoya shareholders during the fiscal year

under review.

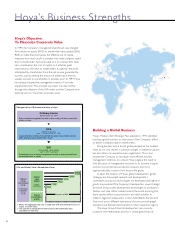

Many readers probably have an image of Hoya as a company

in the eyeglass lens and contact lens business. In fact, the

Company has core strengths in two business areas: Information

Technology and Eye Care. Eyeglass lenses and contact lenses are

the main products of the Eye Care side of our business, and I

believe that consumers in general are quite familiar with the

Hoya name when it comes to these. In the Information

Technology business, however, some might be surprised to hear

about our dominant share in the markets for the mask blanks

and photomasks that are so essential to the production of

semiconductor chips and LCD panels, the glass disks used in the

HDDs found in notebook computers, and the optical glass lenses

seen in digital cameras and camera-equipped mobile phones. All

of these are home electrical products influenced by advances in

digital technologies, and although Hoya’s brand name does not

appear on these consumer products, we contribute significantly

to the improved functionality of the products that people

everywhere use. Our products greatly enhance the convenience

to consumers. Hoya has been admired by institutional investors

for some time, but from here forward I hope that individual

shareholders will also feel an affinity for Hoya as an especially

approachable company.

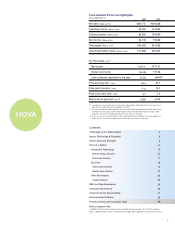

Review of Fiscal 2006 Results

Let me provide a brief review of Hoya’s consolidated results for

fiscal 2006. Net sales rose 11.7% on the previous year to reach

¥344,228 million. Operating income was up 19.0% year on year

to ¥101,096 million, and ordinary income grew 15.8% to

¥103,638 million. Net income increased 17.9% to ¥75,620

million. In the Information Technology field, both sales and income

saw double-digit growth as we stepped up production capacity in

response to strong demand. In fact, demand grew more quickly

than expected, so we lost some opportunities due to inadequate

supply. In the Eye Care field, both eyeglass lenses and contact

lenses achieved steady growth in sales and income. Clearly, the

industrial structures of the Information Technology and Eye Care

fields differ greatly. Yet I believe that this year’s results clearly

demonstrate the effectiveness of Hoya’s overall group strategy,

which is to maximize income by leveraging our intrinsic strengths

in both fields.

<Information Technology>

The Electro-Optics division saw net sales grow by 15.0% over

the previous year, and operating income rose 18.3%. Like last

year, both the growth in demand for digital consumer electronics

products and the increasing demand for highly functional

products contributed to these favorable results.

Hoya’s mask blanks, which are used in the production of

semiconductors, enjoy the major share of the market, and sales

to semiconductor manufacturers around the globe continued to

post steady results. Over the past several years, sales of high-end

products have been expanding. The trend toward more minutely

detailed integrated circuit (IC) chips continues, and the need for

high-resolution, high-precision mask blanks keeps on growing.

Demand for photomasks employed in semiconductor production

is following a similar trend.

In South Korea, we built a new plant for production of the

photomasks used in the manufacture of LCD panels. With this

step, we have completed our three-facility production system,

with the other bases being in Japan and Taiwan. Because each of

Hoya’s production facilities is located close to the panel makers’

own plants, we can ensure that our products accurately meet

our clients’ detailed requirements. We are positioned to develop

our business with great responsiveness to market needs. Another

positive for the Company is that the growing size of LCD panels

is driving increased demand for larger and more precise

photomasks—an area where we already have the edge.

Income from the sale of glass disks for HDDs saw a major

increase in the fiscal year under review, with demand driven by

the many consumers replacing their desktop computers with

notebooks as the latter have become widely used. During the

year, Hoya responded to this strong demand by opening a new

plant in Vietnam, in addition to expanding capacity at existing

plants. In the field of optical lenses, results were enhanced by the