Pentax 2006 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2006 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

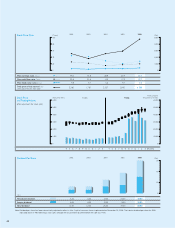

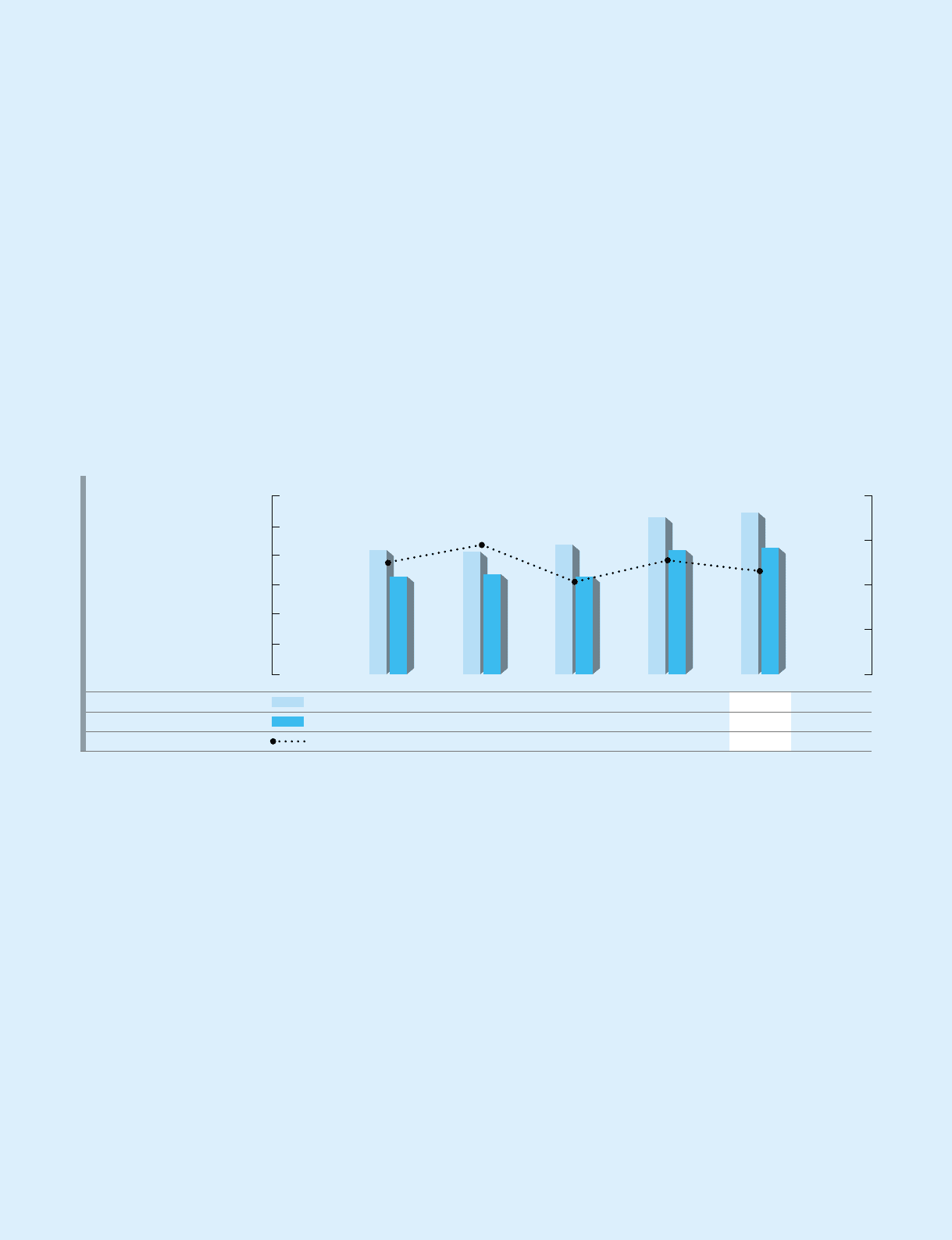

Total Assets,

Shareholders’ Equity and

Shareholders’ Equity Ratio

(Millions of yen)

400,000

300,000

200,000

100,000

0

(%)

90

85

80

75

70

65

60

2002 2003 2004 2005 2006

Total assets (Millions of yen)

Shareholders’ equity (Millions of yen)

Shareholders’ equity ratio (%)

278,068

219,180

78.8

274,289

224,219

81.7

289,887

218,979

75.5

351,482

277,889

79.1

361,538

279,481

77.3

Financial Position

In terms of assets at the end of the consolidated fiscal year under review,

current assets declined by 8.8% to ¥212,274 million. This was due mainly to

a 4.0% increase in notes and accounts receivable to ¥78,294 million, against

a 26.0% fall in cash and cash equivalents to ¥83,574 million stemming from

an increase in expenditures for acquisition of treasury stock (up ¥63,994

million year on year), and an increase in dividend payments (up ¥11,157

million). Because property, plant and equipment increased 26.7% to

¥120,604 million, and investments and other assets rose 22.2% to ¥28,660

million, noncurrent assets expanded 25.8% to ¥149,264 million. Total assets

increased 2.9% from the previous fiscal year to ¥361,538 million.

Current liabilities increased 12.0% to ¥79,305 million, reflecting

increases in notes and accounts payable of 3.2% to ¥41,020 million, and

income taxes payable of 43.1% to ¥14,342 million. Noncurrent liabilities fell

7.0% from the previous fiscal year to ¥1,832 million, while total liabilities

were up 11.5% to ¥81,137 million.

In shareholders’ equity, retained earnings decreased 0.7%, or ¥1,909

million, to ¥266,346 million, reflecting the increase in net income of

¥75,620 million, against a decrease of ¥77,529 million composed mainly of

dividends paid of ¥23,398 million, and retirement of treasury stock of

¥53,181 million. Shareholders’ equity rose 0.6% from the previous fiscal

year to ¥279,481 million as a result of a shift in the foreign currency

translation adjustments from a subtraction of ¥4,688 million the previous

fiscal year to an addition of ¥7,142 million resulting from a decline in the

value of the yen, and an increase in treasury stock of ¥8,401 million.

The shareholders’ equity ratio fell by 1.8 percentage points, to 77.3%

from 79.1%.