Pentax 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

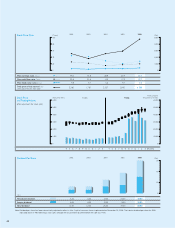

Net sales of the Vision Care division rose 10.0% to ¥104,457 million. In the

domestic eyeglass lens market, despite signs of deflationary trends and a

sense of shrinkage of the market, there was an increase in high-value-added

products such as progressive lenses, and sales rose slightly, 0.4% from the

previous fiscal year. In overseas markets, on the other hand, strong growth in

net sales was recorded in all regions, including Europe, North America and

the Asia-Pacific region.

In Europe, the Company’s principal market of Germany had remained

sluggish since the abolishment in December 2003 of a provision of the

health insurance system supporting the purchase of eyeglasses, but the

deep-rooted popularity of high-value-added lenses and recovery since the

abandonment of the health insurance provision resulted in a 15.9% rise in

sales. The global headquarters for the Vision Care division has been moved

to the Netherlands as part of an ongoing policy of focusing on the European

market. In North America, awareness of the Hoya brand is steadily rising, and

revenue rose 20.0% from the previous fiscal year as a result of the success of

product strategies. In the Asia-Pacific region, the focus on marketing activity

tailored to each region led to an 18.0% rise in net sales.

Operating income for the Vision Care division increased 19.3% to

¥20,370 million, while the operating income ratio was 19.5%, 1.5

percentage points higher than in the previous fiscal year. Profitability rose as

a result of a decline in the sales to cost ratio following the rise in revenue,

along with healthy sales of high-value-added products. By quarter, the

operating income ratio was 17.9% in the first quarter, 19.6% in the second

quarter, 21.9% in the third quarter and 18.7% in the fourth quarter. Circles

in the segment graph have shifted up and to the right, reflecting the

recovery in the net sales growth rate and increase in the profit margin.

Capital investment in the Vision Care division increased by 17.3% to

¥7,958 million. During the consolidated fiscal year under review, the

Company continued to build a global production organization with a focus

on optimal production locations.

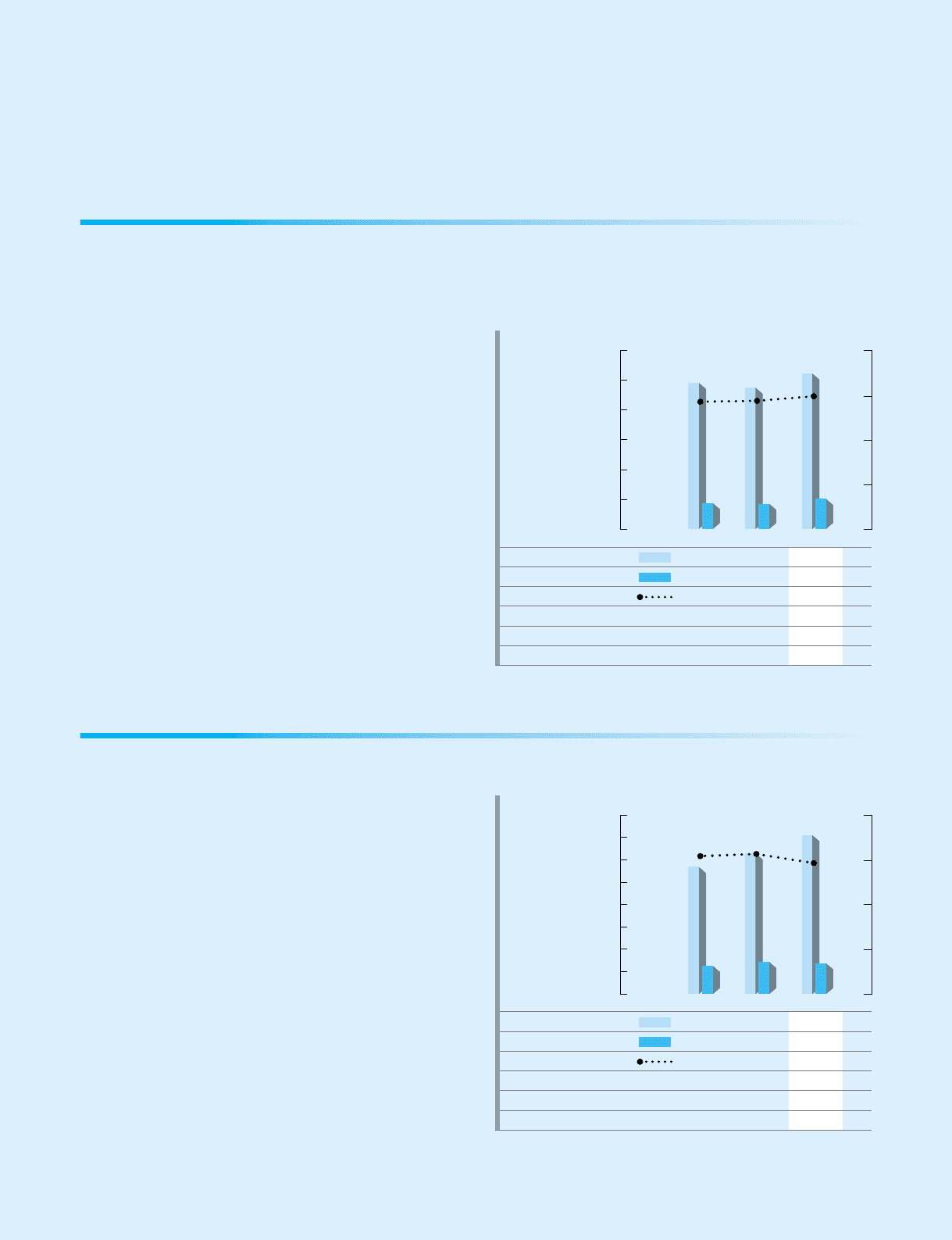

Net sales for the Health Care division grew 13.0% to ¥35,484 million. In contact

lenses, net sales expanded strongly due to efforts by directly managed Eye City

stores to open new locations and increase the ability to attract customers, along

with promotion of consulting sales requiring a high level of expertise. In IOLs,

sales rose both in Japan and overseas as a result of sales of high-value-added

products such as soft and yellow lenses, and due to aggressive efforts to

develop the business globally.

Operating income for the Health Care division decreased 3.9% to ¥6,859

million. In the fourth quarter of the consolidated fiscal year under review,

accounting for expenses related to the point system for product sales at Eye

City was changed from time of use to time of conferment, resulting in a full

year’s worth of point system expenses for the consolidated fiscal year under

review being recorded as a lump sum in SGA expenses during the fourth

quarter. As a result of this change in the accounting treatment for the point

system, and aggressive investment of R&D expenses in the IOL field, the

operating income ratio fell in the short term during the fourth quarter, and the

operating income ratio for the year was down 3.4 percentage points to 19.3%.

By quarter, the operating margin was 24.1% in the first quarter, 24.8% in the

second quarter, 21.0% in the third quarter and 7.6% in the fourth quarter.

On the segment graph, as a result of the increase in the net sales growth

rate combined with the fall in profit margin, the circle has shifted upward and to

the left. It also represents the effect of forward-looking investments made with

an eye to future growth.

Capital investment in the Health Care division increased approximately 3.2

times to ¥2,391 million. This was mainly for capital expenditures related to R&D

in the field of IOLs, and shifting of production plants overseas.

(%)

40

20

0

(Millions of yen)

120,000

100,000

80,000

60,000

40,000

20,000

0

Net sales (Millions of yen)

Operating income (Millions of yen)

Operating income ratio* (%)

Assets (Millions of yen)

Depreciation (Millions of yen)

Capital expenditures (Millions of yen)

98,203

17,496

17.8

92,082

5,735

6,916

94,971

17,079

18.0

90,765

5,900

6,787

104,457

20,370

19.5

98,243

6,444

7,958

(%)

40

20

0

(Millions of yen)

40,000

35,000

30,000

25,000

20,000

15,000

10,000

5,000

0

Net sales (Millions of yen)

Operating income (Millions of yen)

Operating income ratio* (%)

Assets (Millions of yen)

Depreciation (Millions of yen)

Capital expenditures (Millions of yen)

28,381

6,273

22.1

18,873

532

1,201

31,409

7,141

22.7

18,330

669

738

35,484

6,859

19.3

19,927

855

2,391

* The operating income ratio above is calculated using net sales plus intersegment

sales. Please refer to details on page 62 Segment Information.

* The operating income ratio above is calculated using net sales plus intersegment

sales. Please refer to details on page 62 Segment Information.

Eye Care (Vision Care Division)

Eye Care (Health Care Division)

2004 2005 2006

2004 2005 2006