Pentax 2006 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2006 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

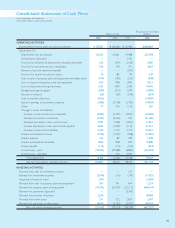

Thousands of U.S. Dollars

Millions of Yen (Note 1)

2006 2005 2004 2006

NET SALES ¥344,228 ¥308,172 ¥271,444 $2,930,348

COST OF SALES (Notes 11 and 12) 172,034 158,024 142,683 1,464,493

Gross profit 172,194 150,148 128,761 1,465,855

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

(Notes 7, 11 and 12) 71,098 65,228 60,594 605,244

Operating income 101,096 84,920 68,167 860,611

OTHER INCOME (EXPENSES):

Interest and dividend income 1,795 1,022 558 15,281

Interest expense (142) (87) (189) (1,209)

Foreign exchange gains (losses)—net 243 875 (2,900) 2,069

Equity in earnings of associated companies 1,285 3,708 1,700 10,939

Loss on clarification of soil pollution and others (3,726) (1,980) — (31,719)

Loss on closure of plant (523) (1,264) — (4,452)

Loss on disposal of property, plant and equipment (625) (948) (1,900) (5,321)

Loss on impairment of long-lived assets (Note 5) (1,233) (859) (2,040) (10,496)

Additional retirement benefits paid to employees (Note 7) (1,689) (843) (1,090) (14,378)

Gain on sales of property, plant and equipment and other assets 109 195 523 928

Gain on transfer of business 1,656 —— 14,097

Amortization of goodwill ——(3,300) —

Additional expense incurred to dissolve the contributory

funded pension plan (Note 7) ——(888) —

Other income (expenses)—net (879) (1,273) (3,145) (7,483)

Other expenses—net (3,729) (1,454) (12,671) (31,744)

INCOME BEFORE INCOME TAXES AND MINORITY INTERESTS 97,367 83,466 55,496 828,867

INCOME TAXES (Note 10):

Current 22,250 18,690 18,574 189,410

Deferred (512) 532 (2,775) (4,358)

Total income taxes 21,738 19,222 15,799 185,052

MINORITY INTERESTS IN NET INCOME (9) (109) (148) (76)

NET INCOME ¥ 75,620 ¥64,135 ¥ 39,549 $ 643,739

Yen U.S. Dollars

2006 2005 2004 2006

PER SHARE OF COMMON STOCK (Notes 2.o and 16):

Basic net income ¥171.71 ¥578.84 ¥350.96 $1.46

Diluted net income 171.08 577.52 350.56 1.46

Cash dividends applicable to the year 150.00 150.00 100.00 1.28

See notes to consolidated financial statements.

Consolidated Statements of Income

Hoya Corporation and Subsidiaries

Years Ended March 31, 2006, 2005 and 2004