Pentax 2006 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2006 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

size of this business has decreased year by year. During the fiscal

year under review, we attended to streamlining the existing

business to lay the groundwork for our plans to revitalize it.

Future Prospects

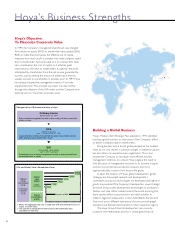

Hoya continues to strive to expand the scope of its two key

fields of business: Information Technology and Eye Care. The

Information Technology field currently enjoys the lion’s share of

growth in the Company’s profits and scale of business, but this is

also a field with plenty of risk, because any technological

revolution can suddenly change the competitive environment.

The Eye Care area, the other key field, is less affected by

technological innovation or shifts in economic conditions. The

two fields therefore strike a good balance with one another.

Our theme for the year ahead will be further sharpening

Hoya’s competitive edge. Since the Company’s mask blanks, LCD

photomasks, optical lenses and glass disks all enjoy a high share of

their markets, we spent the last two years prioritizing expansion

of productive capacity to fulfill supply responsibilities. We are

likely to meet our goals for increased production volumes in the

first half of fiscal 2007, so during the second half we plan to

devote more resources to further improving quality.

Management Systems

Within the Hoya Group, headquarters does not issue orders to

each business division relating to each action, and in fact each

division has the authority to conduct its own business.

Prescriptions for the improvements to quality that I referred to

above are prepared by each division. One division may

strengthen its cost-competitiveness, while another might consider

it vital to refine its leading-edge technologies. Also, because the

same division might need to proceed differently depending on

the region, there are circumstances when each region makes its

own independent decisions. For example, it is not unusual for the

Japanese, European and North American regions to undertake

completely different marketing activities for eyeglass lenses within

the Vision Care division.

I believe that the Hoya Group will be strongest if each business

division has its own decision-making authority, and if each division

works hard to create the ideal conditions for its own business. At

the same time, in return for this devolution of authority, each

division has the responsibility to explain its actions. The decision-

making process is unconstrained, but decision makers are held

commencement of full-scale production of lenses for camera-

equipped mobile phones, in addition to existing production of

lenses for digital cameras.

The Photonics division recorded a contraction in net sales of

6.1% in comparison with the previous year. This is a business

characterized by severe competition and challenges in product

differentiation. However, due to efforts to improve the earnings

structure in this business, we achieved a small increase of 4.6% in

operating income.

<Eye Care>

Net sales in the Vision Care division grew 10.0% compared to

the previous year, and operating income rose 19.3%. In Japan,

sales did not grow as quickly as we had hoped, as a result of the

slowdown in the eyeglass market. Demand recovered in Europe,

which is a large market for Hoya, and results for North America,

Asia-Pacific region also improved, yielding these strong

overall results.

In the Health Care division, net sales were 13.0% higher than

the previous year. This growth was driven by healthy sales in

Hoya’s directly managed contact lens specialty retail store chain,

Eye City, where we have been aggressively opening new stores. I

credit these good results to Eye City’s customer-specific consulting

approach to sales, and the excellent after-sales service offered. We

achieved growth despite the fact that price competition has

become entrenched in the Japanese domestic market. Elsewhere,

we are developing the global market especially in Europe for

intraocular lenses (IOLs), which are used in the treatment of

cataracts, and sales are growing steadily. During the fiscal year

under review, we made accounting changes in the treatment of the

bonus points given to Eye City customers when they make

purchases, and as a result a full year’s worth of the reserve fund

was appropriated in one lump sum as sales administrative

expenses for the fourth quarter. In addition to that, R&D costs

increased greatly due to investment in the development of new

products. As a result, the division recorded a decline in operating

income of 3.9% compared with a year earlier.

<Other Business Field>

The Crystal division, another business operated by Hoya, is

engaged in the production and sale of crystal tableware and

interior products. Faced with the contraction in the market for

gifts and increasing competition from overseas products, the