Oracle 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

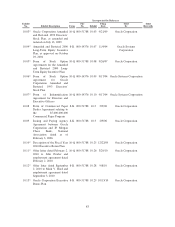

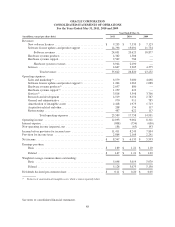

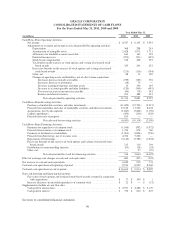

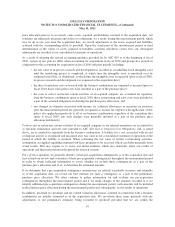

ORACLE CORPORATION

CONSOLIDATED STATEMENTS OF EQUITY

For the Years Ended May 31, 2011, 2010 and 2009

Comprehensive

(in millions) Income

Balances as of May 31, 2008 ...................

Common stock issued under stock-based

compensation plans ........................ $ —

Common stock issued under stock purchase plans . . —

Assumption of stock-based compensation plan

awards in connection with acquisitions ......... —

Stock-based compensation ..................... —

Repurchase of common stock .................. —

Cash dividends declared ($0.05 per share) ........ —

Tax benefit from stock plans ................... —

Other, net .................................. —

Distributions to noncontrolling interests .......... —

Net unrealized loss on defined benefit plans, net of

tax...................................... (14)

Foreign currency translation, net of tax ........... (350)

Net unrealized losses on derivative financial

instruments, net of tax ...................... (39)

Net unrealized gain on marketable securities, net of

tax...................................... 1

Net income ................................. 5,593

Comprehensive income ....................... $ 5,191

Balances as of May 31, 2009 ...................

Common stock issued under stock-based

compensation plans ........................ $ —

Common stock issued under stock purchase plans . . —

Assumption of stock-based compensation plan

awards in connection with acquisitions ......... —

Stock-based compensation ..................... —

Repurchase of common stock .................. —

Cash dividends declared ($0.20 per share) ........ —

Tax benefit from stock plans ................... —

Other, net .................................. —

Distributions to noncontrolling interests .......... —

Net unrealized loss on defined benefit plans, net of

tax...................................... (35)

Foreign currency translation, net of tax ........... (171)

Net unrealized losses on derivative financial

instruments, net of tax ...................... (6)

Net income ................................. 6,135

Comprehensive income ....................... $ 5,923

Balances as of May 31, 2010 ...................

Common stock issued under stock-based

compensation plans ........................ $ —

Common stock issued under stock purchase plans . . —

Assumption of stock-based compensation plan

awards in connection with acquisitions ......... —

Stock-based compensation ..................... —

Repurchase of common stock .................. —

Cash dividends declared ($0.21 per share) ........ —

Tax benefit from stock plans ................... —

Other, net .................................. —

Distributions to noncontrolling interests .......... —

Net unrealized gain on defined benefit plans, net of

tax...................................... 32

Foreign currency translation, net of tax ........... 480

Net unrealized gain on marketable securities, net of

tax...................................... 26

Net income ................................. 8,547

Comprehensive income ....................... $ 9,085

Common Stock and Total

Additional Paid in Accumulated Oracle

Capital Other Corporation

Number of Retained Comprehensive Stockholders’ Noncontrolling

Shares Amount Earnings Income Equity Interests Total Equity

5,150 $ 12,446 $ 9,961 $ 618 $ 23,025 $ 369 $ 23,394

76

3 696

64 —

— —

— 696

64 —

— 696

64

—

—

(226)

—

—

2

—

1

348

(550)

—

56

(81)

—

—

—

(3,410)

(250)

—

—

—

—

—

—

—

—

—

—

1

348

(3,960)

(250)

56

(81)

—

—

—

—

—

—

(37)

(53)

1

348

(3,960)

(250)

56

(118)

(53)

—

— —

— —

— (14)

(350) (14)

(350) —

(8) (14)

(358)

— — — (39) (39) — (39)

—

— —

— —

5,593 1

— 1

5,593 —

84 1

5,677

5,005 12,980 11,894 216 25,090 355 25,445

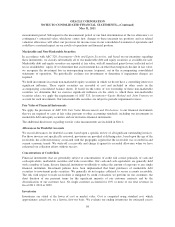

60

3 812

62 —

— —

— 812

62 —

— 812

62

—

—

(43)

—

—

1

—

100

440

(112)

—

268

98

—

—

—

(880)

(1,004)

—

1

—

—

—

—

—

—

—

—

100

440

(992)

(1,004)

268

99

—

—

—

—

—

—

1

(59)

100

440

(992)

(1,004)

268

100

(59)

—

— —

— —

— (35)

(171) (35)

(171) —

9 (35)

(162)

—

— —

— —

6,135 (6)

— (6)

6,135 —

95 (6)

6,230

5,026 14,648 16,146 4 30,798 401 31,199

78

4 1,281

95 —

— —

— 1,281

95 —

— 1,281

95

—

—

(40)

—

—

—

—

17

510

(121)

—

222

1

—

—

—

(1,051)

(1,061)

—

—

—

—

—

—

—

—

—

—

17

510

(1,172)

(1,061)

222

1

—

—

—

—

—

—

1

(65)

17

510

(1,172)

(1,061)

222

2

(65)

—

— —

— —

— 32

480 32

480 —

35 32

515

—

— —

— —

8,547 26

— 26

8,547 —

97 26

8,644

Balances as of May 31, 2011 ................... 5,068 $ 16,653 $ 22,581 $ 542 $ 39,776 $ 469 $ 40,245

See notes to consolidated financial statements.

89