Oracle 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

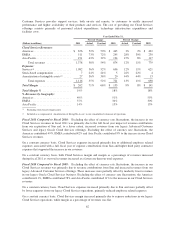

Software Business

Our software business consists of our new software licenses segment and software license updates and product

support segment.

New Software Licenses: New software license revenues represent fees earned from granting customers licenses

to use our database and middleware as well as our application software products. We continue to place

significant emphasis, both domestically and internationally, on direct sales through our own sales force. We also

continue to market our products through indirect channels. Sales and marketing expenses are largely personnel

related and include commissions earned by our sales force for the sale of our software products, and also include

marketing program costs and amortization of intangible assets.

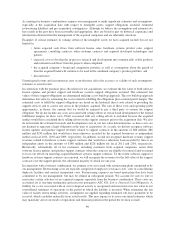

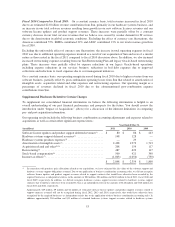

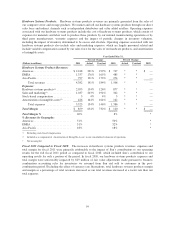

Year Ended May 31,

Percent Change Percent Change

(Dollars in millions) 2011 Actual Constant 2010 Actual Constant 2009

New Software License Revenues:

Americas .............................. $ 4,662 26% 24% $ 3,704 15% 14% $ 3,216

EMEA ................................ 2,861 16% 13% 2,463 -5% -4% 2,589

Asia Pacific ............................ 1,712 25% 16% 1,366 4% -3% 1,318

Total revenues ...................... 9,235 23% 19% 7,533 6% 4% 7,123

Expenses:

Sales and marketing(1) .................... 5,455 17% 16% 4,654 2% 1% 4,571

Stock-based compensation ................ 84 5% 5% 79 17% 17% 67

Amortization of intangible assets(2) ......... 811 0% 0% 816 0% 0% 819

Total expenses ...................... 6,350 14% 13% 5,549 2% 1% 5,457

Total Margin .......................... $ 2,885 45% 37% $ 1,984 19% 15% $ 1,666

Total Margin % ........................ 31% 26% 23%

% Revenues by Geography:

Americas .............................. 50% 49% 45%

EMEA ................................ 31% 33% 36%

Asia Pacific ............................ 19% 18% 19%

Revenues by Product:

Database and middleware ................. $ 6,626 23% 19% $ 5,406 6% 4% $ 5,123

Applications ........................... 2,609 23% 20% 2,127 6% 5% 2,000

Total new software license revenues .... $ 9,235 23% 19% $ 7,533 6% 4% $ 7,123

% Revenues by Product:

Database and middleware ................. 72% 72% 72%

Applications ........................... 28% 28% 28%

(1) Excluding stock-based compensation

(2) Included as a component of ‘Amortization of Intangible Assets’ in our consolidated statements of operations

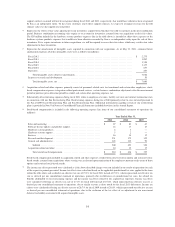

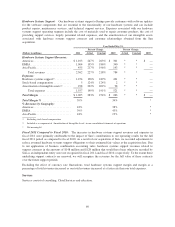

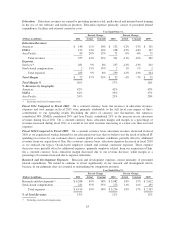

Fiscal 2011 Compared to Fiscal 2010: Excluding the effect of favorable foreign currency rate fluctuations of 4

percentage points, total new software license revenues increased by 19% in fiscal 2011 due to growth across all

major regions and product types and incremental revenues from our acquisitions. On a constant currency basis,

the Americas contributed 63%, EMEA contributed 21% and Asia Pacific contributed 16% to our new software

license revenues growth during fiscal 2011.

In constant currency, database and middleware revenues and applications revenues increased by 19% and 20%,

respectively, in fiscal 2011 primarily due to growth resulting from improved customer demand, our sales force’s

execution and incremental revenues from our acquisitions. In reported currency, Sun contributed $398 million in

growth to our database and middleware revenues through the third quarter of fiscal 2011 (the one year

anniversary of our acquisition) and our other recent acquisitions contributed $40 million during fiscal 2011. In

reported currency, our recent acquisitions contributed $191 million to the growth in our applications revenues

during fiscal 2011.

55