Oracle 2011 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2011 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2011

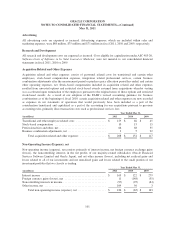

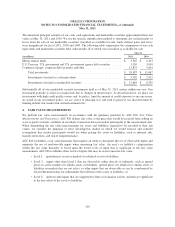

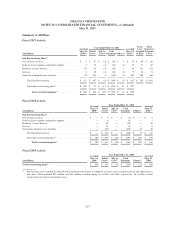

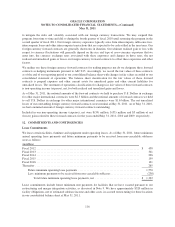

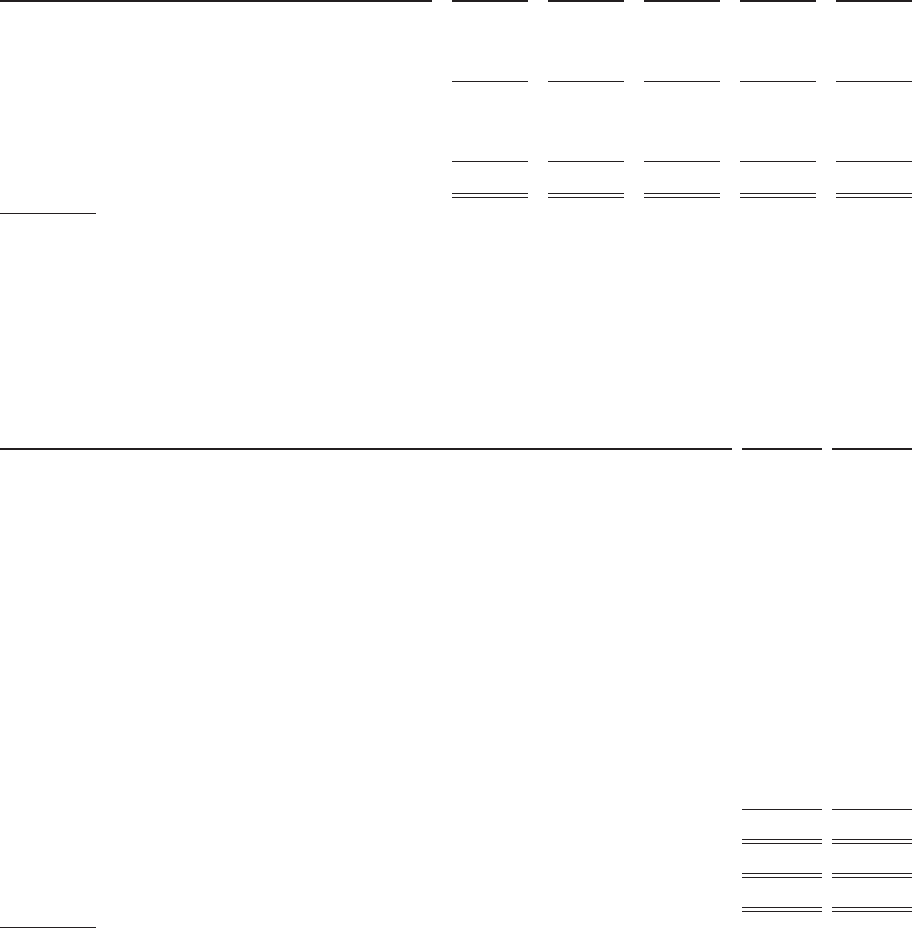

The changes in the carrying amounts of goodwill, which is generally not deductible for tax purposes, for our

software business operating segments, our hardware systems support operating segment and our services

business for fiscal 2011 and 2010 were as follows:

(in millions)

New

Software

Licenses

Software

License

Updates

and

Product

Support

Hardware

Systems

Support Services Total

Balances as of May 31, 2009 ................... $ 5,716 $ 11,334 $ — $ 1,792 $ 18,842

Goodwill from acquisitions ................. 217 490 891 2 1,600

Goodwill adjustments(1) .................... 62 (22) 32 (89) (17)

Balances as of May 31, 2010 ................... 5,995 11,802 923 1,705 20,425

Goodwill from acquisitions ................. 797 240 23 2 1,062

Goodwill adjustments(1) .................... (7) 10 63 — 66

Balances as of May 31, 2011 ................... $ 6,785 $ 12,052 $ 1,009 $ 1,707 $ 21,553

(1) Pursuant to our business combinations accounting policy, we record goodwill adjustments for the effect on goodwill of changes to net

assets acquired during the measurement period (up to one year from the date of an acquisition). Goodwill adjustments for our services

business in fiscal 2010 include $82 million that primarily relates to the reclassification of goodwill associated with certain acquired

product offerings to our new software licenses operating segment. The other goodwill adjustments presented in the table above were not

significant to our previously reported operating results or financial position.

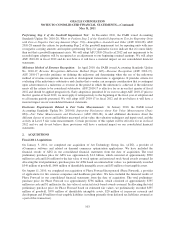

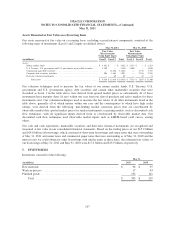

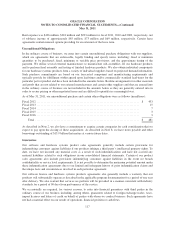

8. NOTES PAYABLE AND OTHER BORROWINGS

Notes payable and other borrowings consisted of the following:

May 31, May 31,

(Dollars in millions) 2011 2010

Commercial paper notes ............................................................. $ — $ 881

Short-term borrowings (effective interest rate of 0.44%) .................................... 1,150 —

5.00% senior notes due January 2011, net of discount of $1 as of May 31, 2010 ................. — 2,249

4.95% senior notes due April 2013 ..................................................... 1,250 1,250

3.75% senior notes due July 2014, net of fair value adjustment of $69 and $33 as of May 31, 2011

and 2010, respectively(1) ........................................................... 1,569 1,533

5.25% senior notes due January 2016, net of discount of $5 and $6 as of May 31, 2011 and 2010,

respectively ..................................................................... 1,995 1,994

5.75% senior notes due April 2018, net of discount of $1 each as of May 31, 2011 and 2010 ....... 2,499 2,499

5.00% senior notes due July 2019, net of discount of $5 and $6 as of May 31, 2011 and 2010,

respectively ..................................................................... 1,745 1,744

3.875% senior notes due July 2020, net of discount of $2 as of May 31, 2011 ................... 998 —

6.50% senior notes due April 2038, net of discount of $2 each as of May 31, 2011 and 2010 ....... 1,248 1,248

6.125% senior notes due July 2039, net of discount of $8 each as of May 31, 2011 and 2010 ....... 1,242 1,242

5.375% senior notes due July 2040, net of discount of $25 as of May 31, 2011 .................. 2,225 —

Capital leases ...................................................................... 1 15

Total borrowings ............................................................... $ 15,922 $ 14,655

Notes payable, current and other current borrowings ............................... $ 1,150 $ 3,145

Notes payable, non-current and other non-current borrowings ........................ $ 14,772 $ 11,510

(1) Refer to Note 11 for a description of our accounting for fair value hedges

109