Oracle 2011 Annual Report Download - page 53

Download and view the complete annual report

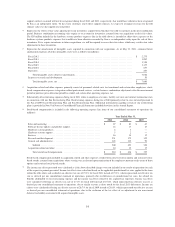

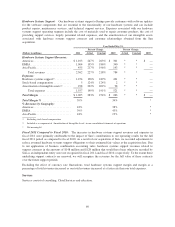

Please find page 53 of the 2011 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We caution readers that, while pre- and post-acquisition comparisons as well as the quantified amounts

themselves may provide indications of general trends, the acquisition information that we provide has inherent

limitations for the following reasons:

• the quantifications cannot address the substantial effects attributable to changes in business strategies,

including our sales force integration efforts. We believe that if our acquired companies had operated

independently and sales forces had not been integrated, the relative mix of products sold would have

been different; and

• although substantially all of our customers, including customers from acquired companies, renew their

software license updates and product support contracts when the contracts are eligible for renewal and

we strive to renew hardware systems support contracts, the amounts shown as software license updates

and product support deferred revenues and hardware systems support deferred revenues in our

supplemental disclosure related to certain charges (presented below) are not necessarily indicative of

revenue improvements we will achieve upon contract renewal to the extent customers do not renew.

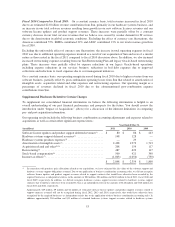

Constant Currency Presentation

Our international operations have provided and will continue to provide a significant portion of our total

revenues and expenses. As a result, total revenues and expenses will continue to be affected by changes in the

U.S. Dollar against major international currencies. In order to provide a framework for assessing how our

underlying businesses performed excluding the effect of foreign currency fluctuations, we compare the percent

change in the results from one period to another period in this Annual Report using constant currency disclosure.

To present this information, current and comparative prior period results for entities reporting in currencies other

than U.S. Dollars are converted into U.S. Dollars at constant exchange rates (i.e. the rates in effect on May 31,

2010, which was the last day of our prior fiscal year) rather than the actual exchange rates in effect during the

respective periods. For example, if an entity reporting in Euros had revenues of 1.0 million Euros from products

sold on May 31, 2011 and May 31, 2010, our financial statements would reflect reported revenues of $1.41

million in fiscal 2011 (using 1.41 as the month-end average exchange rate for the period) and $1.22 million in

fiscal 2010 (using 1.22 as the month-end average exchange rate for the period). The constant currency

presentation would translate the fiscal 2011 results using the fiscal 2010 exchange rate and indicate, in this

example, no change in revenues during the period. In each of the tables below, we present the percent change

based on actual, unrounded results in reported currency and in constant currency.

51