Oracle 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

increases were partially offset by a reduction in amortization associated with certain of our intangible assets that

became fully amortized in fiscal 2011. Amortization of intangible assets increased in fiscal 2010 in comparison

to fiscal 2009 due to additional amortization from acquired intangible assets that we acquired since the beginning

of fiscal 2009, including from our acquisition of Sun. See Note 7 of Notes to Consolidated Financial Statements

included elsewhere in this Annual Report for additional information regarding our intangible assets (including

weighted average useful lives) and related amortization.

Acquisition Related and Other Expenses: Acquisition related and other expenses consist of personnel related

costs for transitional and certain other employees, stock-based compensation expenses, integration related

professional services, certain business combination adjustments after the measurement periods or purchase price

allocation periods have ended, and certain other operating expenses, net. Stock-based compensation expenses

included in acquisition related and other expenses resulted from unvested stock options and restricted stock-

based awards assumed from acquisitions whereby vesting was accelerated upon termination of the employees

pursuant to the original terms of those stock options and restricted stock-based awards. As a result of our

adoption of the FASB’s revised accounting standard for business combinations as of the beginning of fiscal 2010,

certain acquisition related and other expenses were recorded as expenses in our fiscal 2011 and 2010 statements

of operations that had been historically included as a part of the consideration transferred and capitalized as a part

of our accounting for acquisitions pursuant to previous accounting rules, primarily direct transaction costs such

as professional services fees.

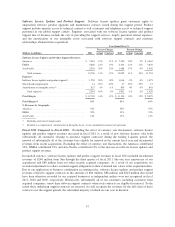

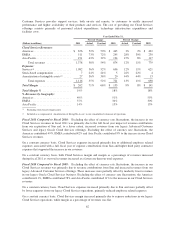

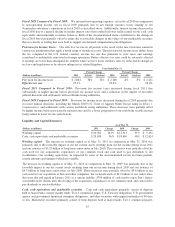

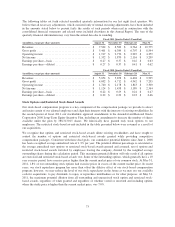

Year Ended May 31,

Percent Change Percent Change

(Dollars in millions) 2011 Actual Constant 2010 Actual Constant 2009

Transitional and other employee related costs ..... $ 129 94% 86% $ 66 46% 54% $ 45

Stock-based compensation .................... 10 -37% -37% 15 -1% -1% 15

Professional fees and other, net ................. 66 -2% -4% 68 99% 96% 35

Business combination adjustments, net ........... 3 -28% -78% 5 -79% -76% 22

Total acquisition related and other expenses . . . $ 208 35% 27% $ 154 32% 36% $ 117

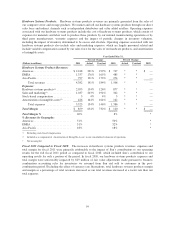

Fiscal 2011 Compared to Fiscal 2010: On a constant currency basis, acquisition related and other expenses

increased primarily due to the full fiscal year impact of Sun’s expense contributions, including higher transitional

employee related expenses.

Fiscal 2010 Compared to Fiscal 2009: On a constant currency basis, acquisition related and other expenses

increased in fiscal 2010 primarily due to higher employee related and professional services expenses resulting

from our acquisition of Sun.

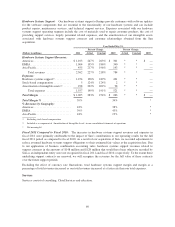

Restructuring expenses: Restructuring expenses consist of employee severance costs and may also include

charges for duplicate facilities and other contract termination costs to improve our cost structure prospectively.

Beginning in fiscal 2010, our adoption of the FASB’s revised accounting standard for business combinations

required that, in connection with any prospective acquisition, we record involuntary employee termination and

other exit costs associated with such acquisition to restructuring expenses in our consolidated financial

statements. For additional information regarding our Oracle-based and acquired company restructuring plans, see

Note 9 of Notes to Consolidated Financial Statements included elsewhere in this Annual Report.

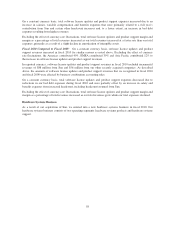

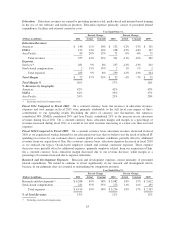

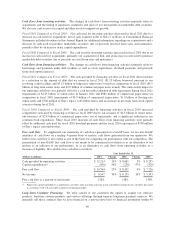

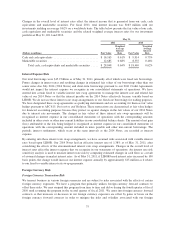

Year Ended May 31,

Percent Change Percent Change

(Dollars in millions) 2011 Actual Constant 2010 Actual Constant 2009

Restructuring expenses ................ $ 487 -22% -23% $ 622 432% 423% $ 117

Fiscal 2011 Compared to Fiscal 2010: Restructuring expenses in fiscal 2011 primarily related to our Sun

Restructuring Plan, which our management approved, committed to and initiated in order to better align our cost

structure as a result of our acquisition of Sun. To a lesser extent, we also incurred expenses associated with other

Oracle-based plans, which our management approved, committed to and initiated in order to restructure and

65