Oracle 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2011

Advertising

All advertising costs are expensed as incurred. Advertising expenses, which are included within sales and

marketing expenses, were $88 million, $75 million and $71 million in fiscal 2011, 2010 and 2009, respectively.

Research and Development

All research and development costs are expensed as incurred. Costs eligible for capitalization under ASC 985-20,

Software-Costs of Software to be Sold, Leased or Marketed, were not material to our consolidated financial

statements in fiscal 2011, 2010 or 2009.

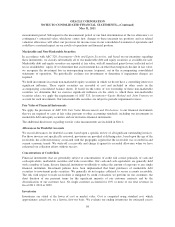

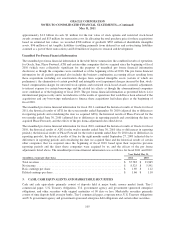

Acquisition Related and Other Expenses

Acquisition related and other expenses consist of personnel related costs for transitional and certain other

employees, stock-based compensation expenses, integration related professional services, certain business

combination adjustments after the measurement period or purchase price allocation period has ended, and certain

other operating expenses, net. Stock-based compensation included in acquisition related and other expenses

resulted from unvested options and restricted stock-based awards assumed from acquisitions whereby vesting

was accelerated upon termination of the employees pursuant to the original terms of those options and restricted

stock-based awards. As a result of our adoption of the FASB’s revised accounting guidance for business

combinations as of the beginning of fiscal 2010, certain acquisition related and other expenses are now recorded

as expenses in our statements of operations that would previously have been included as a part of the

consideration transferred and capitalized as a part of the accounting for our acquisitions pursuant to previous

accounting rules, primarily direct transaction costs such as professional services fees.

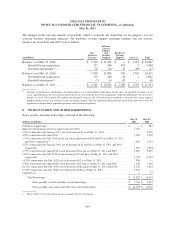

Year Ended May 31,

(in millions) 2011 2010 2009

Transitional and other employee related costs ..................... $ 129 $ 66 $ 45

Stock-based compensation .................................... 10 15 15

Professional fees and other, net ................................. 66 68 35

Business combination adjustments, net ........................... 3 5 22

Total acquisition related and other expenses .................. $ 208 $ 154 $ 117

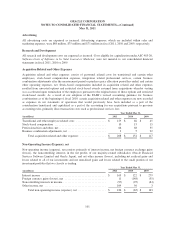

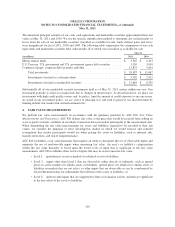

Non-Operating Income (Expense), net

Non-operating income (expense), net consists primarily of interest income, net foreign currency exchange gains

(losses), the noncontrolling interests in the net profits of our majority-owned subsidiaries (Oracle Financial

Services Software Limited and Oracle Japan), and net other income (losses), including net realized gains and

losses related to all of our investments and net unrealized gains and losses related to the small portion of our

investment portfolio that we classify as trading.

Year Ended May 31,

(in millions) 2011 2010 2009

Interest income ............................................. $ 163 $ 122 $ 279

Foreign currency gains (losses), net ............................. 11 (148) (55)

Noncontrolling interests in income .............................. (97) (95) (84)

Other income, net ........................................... 109 56 3

Total non-operating income (expense), net .................... $ 186 $ (65) $ 143

101