Oracle 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

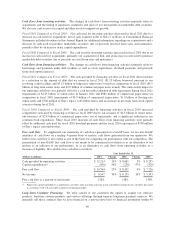

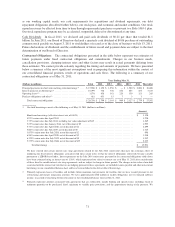

days of the contracts’ dates of execution. We record the transfers of amounts due from customers to financial

institutions as sales of financial assets because we are considered to have surrendered control of these financial

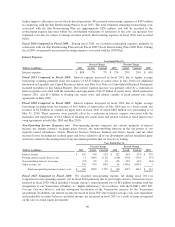

assets. We financed $1.5 billion, $1.2 billion and $1.4 billion or approximately 16%, 16% and 19%, respectively,

of our new software license revenues in fiscal 2011, 2010 and 2009, respectively, and $117 million, or

approximately 3%, of our hardware systems products revenues in fiscal 2011.

Recent Financing Activities

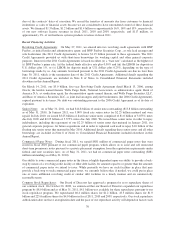

Revolving Credit Agreements: On May 27, 2011, we entered into two revolving credit agreements with BNP

Paribas, as initial lender and administrative agent; and BNP Paribas Securities Corp., as sole lead arranger and

sole bookrunner (the 2011 Credit Agreements) to borrow $1.15 billion pursuant to these agreements. The 2011

Credit Agreements provided us with short-term borrowings for working capital and other general corporate

purposes. Interest for the 2011 Credit Agreements is based on either (x) a “base rate” calculated as the highest of

(i) BNP Paribas’s prime rate, (ii) the federal funds effective rate plus 0.50% and (iii) the LIBOR for deposits in

U.S. dollars plus 1%, or (y) LIBOR for deposits made in U.S. dollars plus 0.25%, depending on the type of

borrowings made by us. Any amounts borrowed pursuant to the 2011 Credit Agreements are due no later than

June 30, 2011, which is the termination date of the 2011 Credit Agreements. Additional details regarding the

2011 Credit Agreements are included in Note 8 of Notes to Consolidated Financial Statements included

elsewhere in this Annual Report.

On March 14, 2011, our $3.0 billion, five-year Revolving Credit Agreement dated March 15, 2006, among

Oracle; the lenders named therein, Wells Fargo Bank, National Association, as administrative agent, Bank of

America N.A. as syndication agent; the documentation agents named therein, and Wells Fargo Securities, LLC,

and Banc of America Securities LLC, as joint lead arrangers and joint bookrunners (the 2006 Credit Agreement),

expired pursuant to its terms. No debt was outstanding pursuant to the 2006 Credit Agreement as of its date of

expiration.

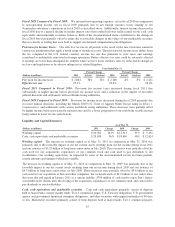

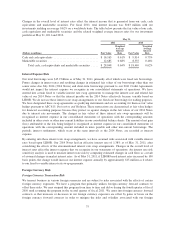

Senior Notes: As of May 31, 2011, we had $14.8 billion of senior notes outstanding ($13.8 billion outstanding

as of May 31, 2010). In January 2011, our 5.00% fixed rate senior notes for $2.25 billion matured and were

repaid. In July 2010, we issued $3.25 billion of fixed rate senior notes comprised of $1.0 billion of 3.875% notes

due July 2020 and $2.25 billion of 5.375% notes due July 2040. We issued these senior notes in order to repay

indebtedness, including the repayment of our $2.25 billion of senior notes that matured in January 2011, for

general corporate purposes, for future acquisitions and in order to replenish cash used to repay $1.0 billion of the

floating rate senior notes that matured in May 2010. Additional details regarding these senior notes and all other

borrowings are included in Note 8 of Notes to Consolidated Financial Statements included elsewhere in this

Annual Report.

Commercial Paper Notes: During fiscal 2011, we repaid $881 million of commercial paper notes that were

issued in fiscal 2010 pursuant to our commercial paper program, which allows us to issue and sell unsecured

short-term promissory notes pursuant to a private placement exemption from the registration requirements under

federal and state securities laws. As of May 31, 2011, we had no commercial paper notes outstanding ($881

million outstanding as of May 31, 2010).

Our ability to issue commercial paper notes in the future is highly dependent upon our ability to provide a back-

stop by means of a revolving credit facility or other debt facility for amounts equal to or greater than the amounts

of commercial paper notes we intend to issue. While presently we have no such facilities in place that may

provide a back-stop to such commercial paper notes, we currently believe that, if needed, we could put in place

one or more additional revolving credit or similar debt facilities in a timely manner and on commercially

reasonable terms.

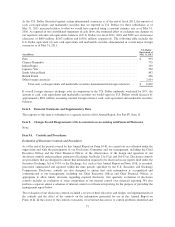

Common Stock Repurchases: Our Board of Directors has approved a program for us to repurchase shares of

our common stock. On October 20, 2008, we announced that our Board of Directors expanded our repurchase

program by $8.0 billion and as of May 31, 2011, $4.1 billion was available for share repurchases pursuant to our

stock repurchase program. We repurchased 40.4 million shares for $1.2 billion, 43.3 million shares for $1.0

billion and 225.6 million shares for $4.0 billion in fiscal 2011, 2010 and 2009, respectively. Our stock repurchase

authorization does not have an expiration date and the pace of our repurchase activity will depend on factors such

70