Oracle 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2011

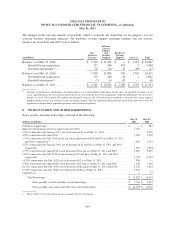

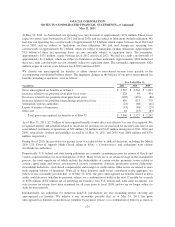

to mitigate the risks and volatility associated with our foreign currency transactions. We may suspend this

program from time to time and did so during the fourth quarter of fiscal 2010 until resuming the program in the

second quarter of fiscal 2011. Our foreign currency exposures typically arise from intercompany sublicense fees,

intercompany loans and other intercompany transactions that are expected to be cash settled in the near term. Our

foreign currency forward contracts are generally short-term in duration. Our ultimate realized gain or loss with

respect to currency fluctuations will generally depend on the size and type of cross-currency exposures that we

enter into, the currency exchange rates associated with these exposures and changes in those rates, the net

realized and unrealized gains or losses on foreign currency forward contracts to offset these exposures and other

factors.

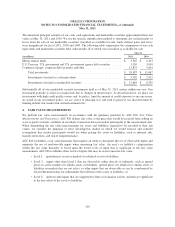

We neither use these foreign currency forward contracts for trading purposes nor do we designate these forward

contracts as hedging instruments pursuant to ASC 815. Accordingly, we record the fair values of these contracts

as of the end of our reporting period to our consolidated balance sheet with changes in fair values recorded to our

consolidated statement of operations. The balance sheet classification for the fair values of these forward

contracts is prepaid expenses and other current assets for unrealized gains and other current liabilities for

unrealized losses. The statement of operations classification for changes in fair values of these forward contracts

is non-operating income (expense), net, for both realized and unrealized gains and losses.

As of May 31, 2011, the notional amounts of the forward contracts we held to purchase U.S. Dollars in exchange

for other major international currencies were $2.5 billion and the notional amounts of forward contracts we held

to sell U.S. Dollars in exchange for other major international currencies were $1.6 billion. The net unrealized

losses of our outstanding foreign currency forward contracts were nominal at May 31, 2011. As of May 31, 2010,

we had a nominal amount of foreign currency forward contracts outstanding.

Included in our non-operating income (expense), net were $(39) million, $(35) million and $3 million of net

(losses) gains related to these forward contracts for the years ended May 31, 2011, 2010 and 2009, respectively.

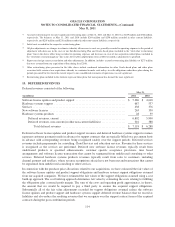

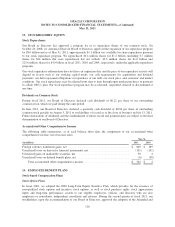

12. COMMITMENTS AND CONTINGENCIES

Lease Commitments

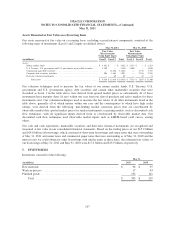

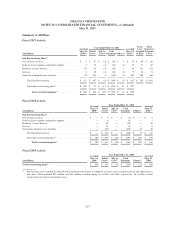

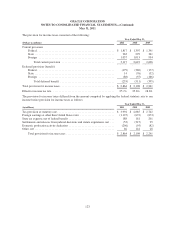

We lease certain facilities, furniture and equipment under operating leases. As of May 31, 2011, future minimum

annual operating lease payments and future minimum payments to be received from non-cancelable subleases

were as follows:

(in millions)

Fiscal 2012 ........................................................................ $ 458

Fiscal 2013 ........................................................................ 341

Fiscal 2014 ........................................................................ 226

Fiscal 2015 ........................................................................ 159

Fiscal 2016 ........................................................................ 121

Thereafter ......................................................................... 265

Future minimum operating lease payments ........................................... 1,570

Less: minimum payments to be received from non-cancelable subleases .................... (238)

Total future minimum operating lease payments, net ............................... $ 1,332

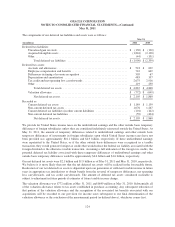

Lease commitments include future minimum rent payments for facilities that we have vacated pursuant to our

restructuring and merger integration activities, as discussed in Note 9. We have approximately $320 million in

facility obligations, net of estimated sublease income and other costs, in accrued restructuring for these locations

in our consolidated balance sheet at May 31, 2011.

116