Oracle 2011 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2011 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2011

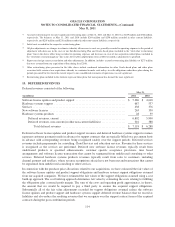

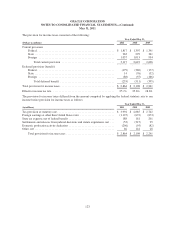

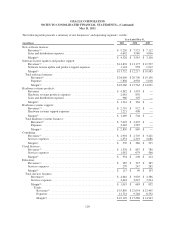

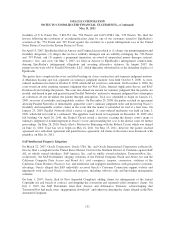

The components of our deferred tax liabilities and assets were as follows:

May 31,

(in millions) 2011 2010

Deferred tax liabilities:

Unrealized gain on stock ................................................. $ (130) $ (130)

Acquired intangible assets ................................................ (1,816) (2,128)

Other ................................................................ (44) (101)

Total deferred tax liabilities .......................................... $ (1,990) $ (2,359)

Deferred tax assets:

Accruals and allowances ................................................. $ 543 $ 629

Employee compensation and benefits ....................................... 742 649

Differences in timing of revenue recognition ................................. 305 67

Depreciation and amortization ............................................ 483 357

Tax credit and net operating loss carryforwards ............................... 2,675 2,916

Other ................................................................ 119 250

Total deferred tax assets ............................................. $ 4,867 $ 4,868

Valuation allowance .................................................... $ (772) $ (649)

Net deferred tax assets ............................................... $ 2,105 $ 1,860

Recorded as:

Current deferred tax assets ............................................... $ 1,189 $ 1,159

Non-current deferred tax assets ............................................ 1,076 1,267

Current deferred tax liabilities (in other current liabilities) ...................... (101) (142)

Non-current deferred tax liabilities ......................................... (59) (424)

Net deferred tax assets ............................................... $ 2,105 $ 1,860

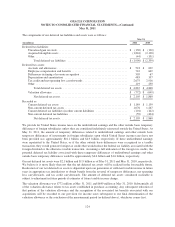

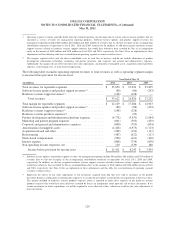

We provide for United States income taxes on the undistributed earnings and the other outside basis temporary

differences of foreign subsidiaries unless they are considered indefinitely reinvested outside the United States. At

May 31, 2011, the amount of temporary differences related to undistributed earnings and other outside basis

temporary differences of investments in foreign subsidiaries upon which United States income taxes have not

been provided was approximately $16.1 billion and $4.9 billion, respectively. If these undistributed earnings

were repatriated to the United States, or if the other outside basis differences were recognized in a taxable

transaction, they would generate foreign tax credits that would reduce the federal tax liability associated with the

foreign dividend or the otherwise taxable transaction. Assuming a full utilization of the foreign tax credits, the

potential deferred tax liability associated with these temporary differences of undistributed earnings and other

outside basis temporary differences would be approximately $4.6 billion and $1.6 billion, respectively.

Our net deferred tax assets were $2.1 billion and $1.9 billion as of May 31, 2011 and May 31, 2010, respectively.

We believe it is more likely than not that the net deferred tax assets will be realized in the foreseeable future.

Realization of our net deferred tax assets is dependent upon our generation of sufficient taxable income in future

years in appropriate tax jurisdictions to obtain benefit from the reversal of temporary differences, net operating

loss carryforwards, and tax credit carryforwards. The amount of deferred tax assets considered realizable is

subject to adjustment in future periods if estimates of future taxable income change.

The valuation allowance was $772 million at May 31, 2011 and $649 million at May 31, 2010. Substantially all

of the valuation allowance relates to tax assets established in purchase accounting. Any subsequent reduction of

that portion of the valuation allowance and the recognition of the associated tax benefits associated with our

acquisitions will be recorded to our provision for income taxes subsequent to our final determination of the

valuation allowance or the conclusion of the measurement period (as defined above), whichever comes first.

124