Oracle 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

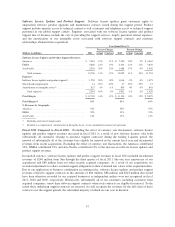

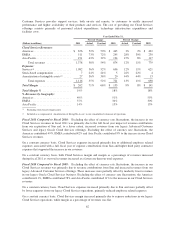

Fiscal 2010 Compared to Fiscal 2009: On a constant currency basis, total revenues increased in fiscal 2010

due to an estimated $2.8 billion revenue contribution from Sun, primarily in our hardware systems business, and

an increase in our total software revenues resulting from growth in our new software licenses revenues and our

software license updates and product support revenues. These increases were partially offset by a constant

currency decrease in our total services revenues that we believe was caused by weaker demand for IT services

due to the deterioration in global economic conditions. Excluding the effect of currency rate fluctuations, the

Americas contributed 55%, EMEA contributed 32% and APAC contributed 13% to our total revenues growth in

fiscal 2010.

Excluding the unfavorable effect of currency rate fluctuations, the increase in total operating expenses in fiscal

2010 was due to additional operating expenses incurred as a result of our acquisition of Sun and were of a similar

nature as those noted in the fiscal 2011 compared to fiscal 2010 discussion above. In addition, we also incurred

increased restructuring expenses resulting from our Sun Restructuring Plan and legacy Oracle-based restructuring

plans. These increases were partially offset by expense reductions in our legacy Oracle-based operations

including expense reductions in our services business, reductions in bad debt expenses due to improved

collections and reductions to travel expenses due to cost management initiatives.

On a constant currency basis, our operating margin increased during fiscal 2010 due to higher revenues from our

software business, partially offset by post-combination operating losses from Sun that related to amortization of

intangible assets, acquisition related and other expenses and restructuring expenses. Our operating margin as a

percentage of revenues declined in fiscal 2010 due to the aforementioned post-combination expense

contributions from Sun.

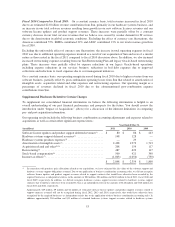

Supplemental Disclosure Related to Certain Charges

To supplement our consolidated financial information we believe the following information is helpful to an

overall understanding of our past financial performance and prospects for the future. You should review the

introduction under “Impact of Acquisitions” (above) for a discussion of the inherent limitations in comparing

pre- and post-acquisition information.

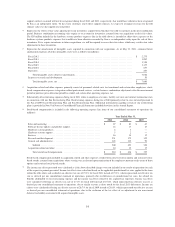

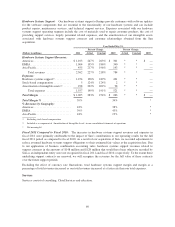

Our operating results include the following business combination accounting adjustments and expenses related to

acquisitions as well as certain other significant expense items:

Year Ended May 31,

(in millions) 2011 2010 2009

Software license updates and product support deferred revenues(1) . . . $ 80 $ 86 $ 243

Hardware systems support deferred revenues(1) .................. 148 128 —

Hardware systems products expenses(2) ......................... — 29 —

Amortization of intangible assets(3) ............................ 2,428 1,973 1,713

Acquisition related and other(4)(6) ............................. 208 154 117

Restructuring(5) ........................................... 487 622 117

Stock-based compensation(6) ................................. 500 421 340

Income tax effects(7) ........................................ (1,003) (1,054) (730)

$ 2,848 $ 2,359 $ 1,800

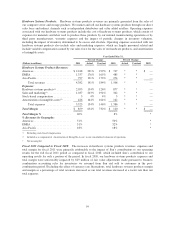

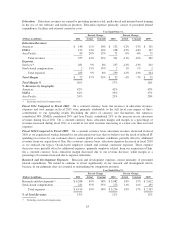

(1) In connection with purchase price allocations related to our acquisitions, we have estimated the fair values of the software support and

hardware systems support obligations assumed. Due to our application of business combination accounting rules, we did not recognize

software license updates and product support revenues related to support contracts that would have otherwise been recorded by the

acquired businesses as independent entities, in the amounts of $80 million, $86 million and $243 million in fiscal 2011, fiscal 2010 and

fiscal 2009, respectively. In addition, we did not recognize hardware systems support revenues related to hardware systems support

contracts that would have otherwise been recorded by Sun as an independent entity in the amounts of $148 million and $128 million for

fiscal 2011 and 2010, respectively.

Approximately $29 million, $9 million and $2 million of estimated software license updates and product support revenues related to

support contracts assumed will not be recognized during fiscal 2012, 2013 and 2014, respectively, that would have otherwise been

recognized by the acquired businesses as independent entities due to the application of these business combination accounting rules. In

addition, approximately $30 million and $11 million of estimated hardware systems support revenues related to hardware systems

53