Oracle 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2011

11. DERIVATIVE FINANCIAL INSTRUMENTS

Interest Rate Swap Agreements

Fair Value Hedges

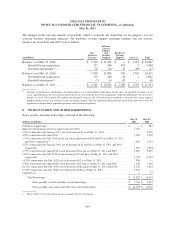

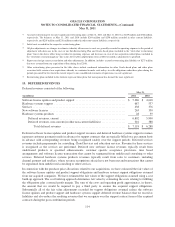

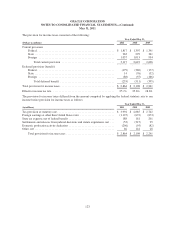

In September 2009, we entered into interest rate swap agreements that have the economic effect of modifying the

fixed interest obligations associated with our 3.75% senior notes due July 2014 (2014 Notes) so that the interest

payable on these notes effectively became variable based on LIBOR. The critical terms of the interest rate swap

agreements and the 2014 Notes match, including the notional amounts and maturity dates. Accordingly, we have

designated these swap agreements as qualifying hedging instruments and are accounting for them as fair value

hedges pursuant to ASC 815, Derivatives and Hedging. These transactions are characterized as fair value hedges

for financial accounting purposes because they protect us against changes in the fair value of our fixed rate

borrowings due to benchmark interest rate movements. The changes in fair values of these interest rate swap

agreements are recognized as interest expense in our consolidated statements of operations with the

corresponding amounts included in other assets or other non-current liabilities in our consolidated balance sheets.

The amount of net gain (loss) attributable to the risk being hedged is recognized as interest expense in our

consolidated statement of operations with the corresponding amount included in notes payable and other

non-current borrowings. The periodic interest settlements, which occur at the same interval as the 2014 Notes,

are recorded as interest expense. As of May 31, 2011 and 2010, the fair values of these interest rate swap

agreements recorded as other assets in our consolidated balance sheets were $69 million and $33 million,

respectively.

We do not use any interest rate swap agreements for trading purposes.

Cash Flow Hedges

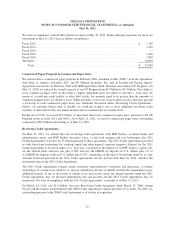

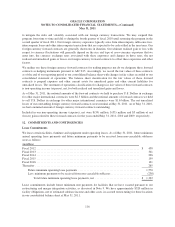

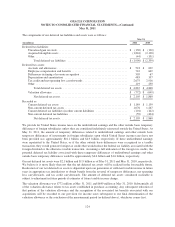

In relation to the variable interest obligations associated with our floating rate senior notes that were due and

repaid in May 2010 (Floating Rate Notes), we had entered into certain variable to fixed interest rate swap

agreements to manage the economic effects of the variable interest obligations and designated these agreements

as qualifying cash flow hedges. Upon repayment of the Floating Rate Notes in May 2010, we settled the interest

rate swap agreements associated with the Floating Rate Notes and no other arrangements were outstanding as of

May 31, 2011.

Net Investment Hedges

Periodically, we hedge net assets of certain of our international subsidiaries using foreign currency forward

contracts to offset the translation and economic exposures related to our foreign currency-based investments in

these subsidiaries. These contracts have been designated as net investment hedges pursuant to ASC 815. We

entered into these net investment hedges for the majority of fiscal 2010. We suspended this program during our

fourth quarter of fiscal 2010 and, as of May 31, 2011, we have no contracts of this nature outstanding. For fiscal

2010 and 2009, (losses) gains related to these contracts were recognized to accumulated other comprehensive

income (effective portion) for $(37) million and $(63) million, respectively and to non-operating income

(expense), net (ineffective portion and amount excluded from effectiveness testing) for $1 million and $10

million, respectively.

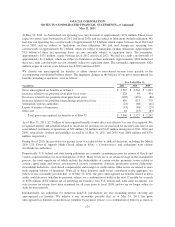

Foreign Currency Forward Contracts Not Designated as Hedges

We transact business in various foreign currencies and have established a program that primarily utilizes foreign

currency forward contracts to offset the risks associated with the effects of certain foreign currency exposures.

Under this program, our strategy is to enter into foreign currency forward contracts so that increases or decreases

in our foreign currency exposures are offset by gains or losses on the foreign currency forward contracts in order

115