Oracle 2011 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2011 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2011

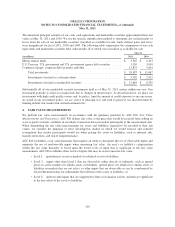

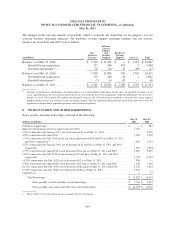

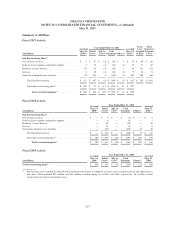

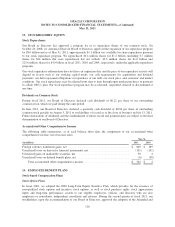

(2) Accrued restructuring for our most significant restructuring plans at May 31, 2011 and May 31, 2010 was $449 million and $546 million,

respectively. The balances at May 31, 2011 and 2010 include $244 million and $290 million recorded in other current liabilities,

respectively, and $205 million and $256 million recorded in other non-current liabilities, respectively.

(3) Initial costs recorded for the respective restructuring plans.

(4) All plan adjustments are changes in estimates whereby all increases in costs are generally recorded to operating expenses in the period of

adjustment with decreases in the costs of our Sun Restructuring Plan and Oracle-based plans (included in the “total other restructuring

plans” line in the above table) being recorded to operating expenses and decreases in costs of our acquisition related plans (included in

the “total other restructuring plans” line in the above table) adopted prior to fiscal 2010 recorded as adjustments to goodwill.

(5) Represents foreign currency translation and other adjustments. In addition, includes accrued restructuring plan liabilities of $275 million

that were assumed from our acquisition of Sun during fiscal 2010.

(6) Other restructuring plans presented in the table above include condensed information for other Oracle-based plans and other plans

associated with certain of our acquisitions whereby we continued to make cash outlays to settle obligations under these plans during the

periods presented but for which the current impact to our consolidated statements of operations was not significant.

(7) Restructuring plans included in this footnote represent those plans that management has deemed the most significant.

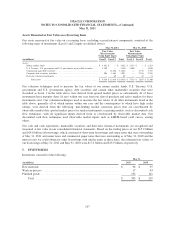

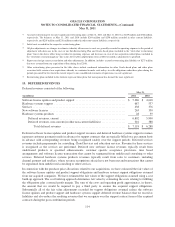

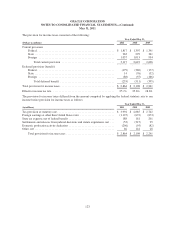

10. DEFERRED REVENUES

Deferred revenues consisted of the following:

May 31,

(in millions) 2011 2010

Software license updates and product support ................................... $ 5,386 $ 4,618

Hardware systems support .................................................. 687 537

Services ................................................................. 438 376

New software licenses ..................................................... 263 330

Hardware systems products ................................................. 28 39

Deferred revenues, current .............................................. 6,802 5,900

Deferred revenues, non-current (in other non-current liabilities) ................. 316 388

Total deferred revenues ............................................ $ 7,118 $ 6,288

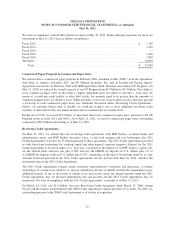

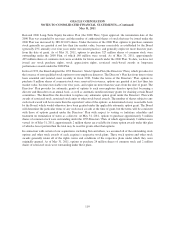

Deferred software license updates and product support revenues and deferred hardware systems support revenues

represent customer payments made in advance for support contracts that are typically billed on a per annum basis

in advance with corresponding revenues being recognized ratably over the support periods. Deferred services

revenues include prepayments for consulting, Cloud Services and education services. Revenue for these services

is recognized as the services are performed. Deferred new software license revenues typically result from

undelivered products or specified enhancements, customer specific acceptance provisions, time based

arrangements and software license transactions that cannot be segmented from undelivered consulting or other

services. Deferred hardware systems products revenues typically result from sales to customers, including

channel partners and resellers, where revenue recognition criteria have not been met and transactions that cannot

be segmented from undelivered consulting or other services.

In connection with the purchase price allocations related to our acquisitions, we have estimated the fair values of

the software license updates and product support obligations and hardware systems support obligations assumed

from our acquired companies. We have estimated the fair values of the support obligations assumed using a cost

build-up approach. The cost build-up approach determines fair value by estimating the costs relating to fulfilling

the obligations plus a normal profit margin. The sum of the costs and operating profit approximates, in theory,

the amount that we would be required to pay a third party to assume the acquired support obligations.

Substantially all of the fair value adjustments recorded for support obligations assumed reduce the software

license updates and product support and hardware systems support deferred revenue balances that we record as

liabilities and also reduce the resulting revenues that we recognize over the support contract term of the acquired

contracts during the post-combination periods.

114