Oracle 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiscal 2010 Compared to Fiscal 2009: We incurred non-operating expenses, net in fiscal 2010 in comparison

to non-operating income, net in fiscal 2009 primarily due to net foreign currency losses relating to our

Venezuelan subsidiary’s operations in fiscal 2010 as described above. Additionally, interest income decreased in

fiscal 2010 due to a general decline in market interest rates that resulted in lower yields earned on our cash, cash

equivalents and marketable securities balances. Both of the aforementioned items contributed to the change in

fiscal 2010 but were partially offset by gains due to favorable changes in the values of our marketable securities

that we classify as trading that were held to support our deferred compensation plan obligations.

Provision for Income Taxes: Our effective tax rate in all periods is the result of the mix of income earned in

various tax jurisdictions that apply a broad range of income tax rates. The provision for income taxes differs from

the tax computed at the U.S. federal statutory income tax rate due primarily to state taxes and earnings

considered as indefinitely reinvested in foreign operations. Future effective tax rates could be adversely affected

if earnings are lower than anticipated in countries where we have lower statutory rates, by unfavorable changes in

tax laws and regulations or by adverse rulings in tax related litigation.

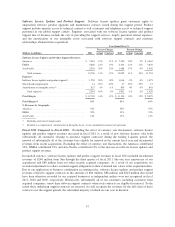

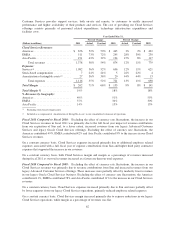

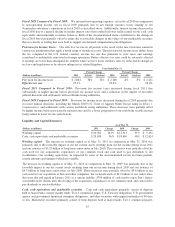

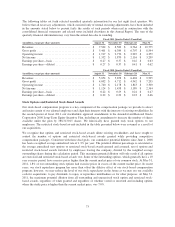

Year Ended May 31,

Percent Change Percent Change

(Dollars in millions) 2011 Actual Constant 2010 Actual Constant 2009

Provision for income taxes .......... $ 2,864 36% 32% $ 2,108 -6% -9% $ 2,241

Effective tax rate .................. 25.1% 25.6% 28.6%

Fiscal 2011 Compared to Fiscal 2010: Provision for income taxes increased during fiscal 2011 due

substantially to higher income before provision for income taxes and a reduction in the impact of favorable

judicial decisions and settlements with worldwide taxing authorities.

Fiscal 2010 Compared to Fiscal 2009: Provision for income taxes decreased during fiscal 2010 primarily due

to recent judicial decisions, including the March 2010 U.S. Court of Appeals Ninth Circuit ruling in Xilinx v.

Commissioner, and settlements with various worldwide taxing authorities. These decreases were partially offset

by higher income before provision for income taxes and by a lower proportion of our worldwide taxable income

being earned in lower tax rate jurisdictions.

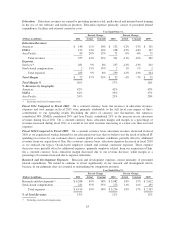

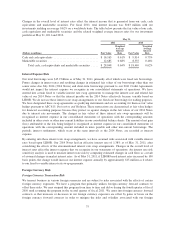

Liquidity and Capital Resources

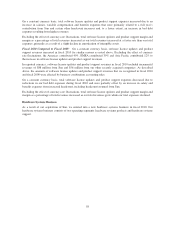

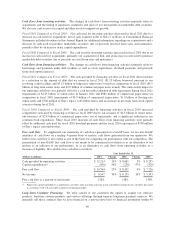

As of May 31,

(Dollars in millions) 2011 Change 2010 Change 2009

Working capital ................................. $24,982 103% $ 12,313 31% $ 9,432

Cash, cash equivalents and marketable securities ....... $ 28,848 56% $ 18,469 46% $ 12,624

Working capital: The increase in working capital as of May 31, 2011 in comparison to May 31, 2010 was

primarily due to the favorable impact to our net current assets resulting from our net income during fiscal 2011

and our issuance of $3.25 billion of long-term senior notes in July 2010. These increases were partially offset by

cash used for our acquisitions, repurchases of our common stock and cash used to pay dividends to our

stockholders. Our working capital may be impacted by some of the aforementioned factors in future periods,

certain amounts and timing of which are variable.

The increase in working capital as of May 31, 2010 in comparison to May 31, 2009 was primarily due to the

favorable impact to our net current assets resulting from our net income during fiscal 2010 and our issuance of

$4.5 billion of long-term senior notes in July 2009. These increases were partially offset by $5.6 billion of net

cash used for our acquisition of Sun and other companies, the reclassification of $2.2 billion of our senior notes

that were due and repaid in January 2011 as a current liability, $700 million of cash used to repay Sun’s legacy

convertible notes shortly after the closing of the acquisition, repurchases of our common stock and cash used to

pay dividends to our stockholders.

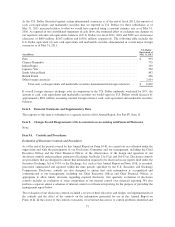

Cash, cash equivalents and marketable securities: Cash and cash equivalents primarily consist of deposits

held at major banks, money market funds, Tier-1 commercial paper, U.S. Treasury obligations, U.S. government

agency and government sponsored enterprise obligations, and other securities with original maturities of 90 days

or less. Marketable securities primarily consist of time deposits held at major banks, Tier-1 commercial paper,

67