Oracle 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

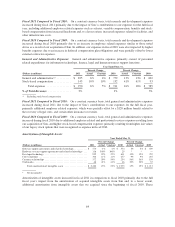

support contracts assumed will not be recognized during fiscal 2012 and 2013, respectively, that would have otherwise been recognized

by Sun as an independent entity. To the extent customers renew these support contracts, we expect to recognize revenues for the full

contract value over the support renewal period.

(2) Represents the effects of fair value adjustments to our inventories acquired from Sun that were sold to customers in the post-combination

period. Business combination accounting rules require us to account for inventories assumed from our acquisitions at their fair values.

The $29 million included in the hardware systems products expenses line in the table above is intended to adjust these expenses to the

hardware systems products expenses that would have been otherwise recorded by Sun as an independent entity upon the sale of these

inventories. If we acquire inventories in future acquisitions, we will be required to assess their fair values, which may result in fair value

adjustments to those inventories.

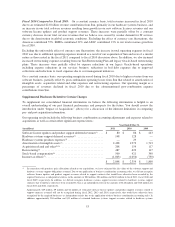

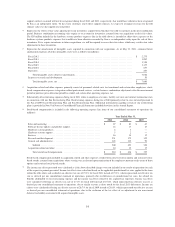

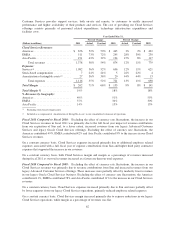

(3) Represents the amortization of intangible assets acquired in connection with our acquisitions. As of May 31, 2011, estimated future

amortization expenses related to intangible assets were as follows (in millions):

Fiscal 2012 ................................................................................. $ 2,275

Fiscal 2013 ................................................................................. 1,902

Fiscal 2014 ................................................................................. 1,554

Fiscal 2015 ................................................................................. 1,155

Fiscal 2016 ................................................................................. 657

Thereafter .................................................................................. 267

Total intangible assets subject to amortization .................................................. 7,810

In-process research and development ............................................................. 50

Total intangible assets, net ................................................................. $ 7,860

(4) Acquisition related and other expenses primarily consist of personnel related costs for transitional and certain other employees, stock-

based compensation expenses, integration related professional services, certain business combination adjustments after the measurement

period or purchase price allocation period has ended, and certain other operating expenses, net.

(5) Substantially all restructuring expenses during fiscal 2011 relate to employee severance, facility exit costs and contract termination costs

in connection with our Sun Restructuring Plan. Restructuring expenses during fiscal 2010 primarily relate to costs incurred pursuant to

our Fiscal 2009 Oracle Restructuring Plan and Sun Restructuring Plan. Additional information regarding certain of our restructuring

plans is provided in Note 9 of Notes to Consolidated Financial Statements included elsewhere in this Annual Report.

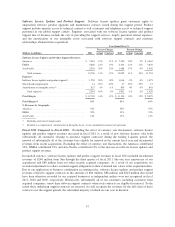

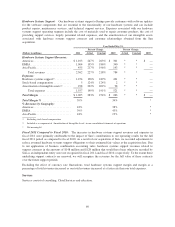

(6) Stock-based compensation is included in the following operating expense line items of our consolidated statements of operations (in

millions):

Year Ended May 31,

2011 2010 2009

Sales and marketing .............................................. $ 87 $ 81 $ 67

Software license updates and product support .......................... 14 17 13

Hardware systems products ........................................ 2 3 —

Hardware systems support ......................................... 5 2 —

Services ....................................................... 16 14 12

Research and development ......................................... 231 172 155

General and administrative ......................................... 145 132 93

Subtotal .................................................... 500 421 340

Acquisition related and other ....................................... 10 15 15

Total stock-based compensation ................................. $ 510 $ 436 $ 355

Stock-based compensation included in acquisition related and other expenses resulted from unvested stock options and restricted stock-

based awards assumed from acquisitions whose vesting was accelerated upon termination of the employees pursuant to the terms of those

options and restricted stock-based awards.

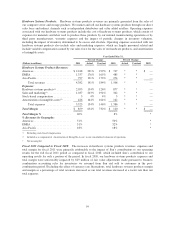

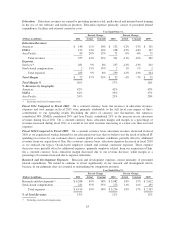

(7) The income tax effects presented were calculated as if the above described charges were not included in our results of operations for each

of the respective periods presented. Income tax effects were calculated based on the applicable jurisdictional tax rates applied to the items

within the table above and resulted in an effective tax rate of 25.3% for fiscal 2011 instead of 25.1%, which represented our effective tax

rate as derived per our consolidated statement of operations, primarily due to differences in jurisdictional tax rates, the related tax

benefits attributable to our restructuring expenses and the income tax effects related to our acquired tax exposures. Income tax effects

were calculated reflecting an effective tax rate of 27.1% for fiscal 2010 instead of 25.6%, which represented our effective tax rate as

derived per our consolidated statement of operations, due to similar reasons as those noted for the fiscal 2011 differences. Income tax

effects were calculated reflecting an effective tax rate of 28.7% for fiscal 2009 instead of 28.6%, which represented our effective tax rate

as derived per our consolidated statement of operations, due to the exclusion of the tax effect of an adjustment to our non-current

deferred tax liability associated with acquired intangible assets.

54