Oracle 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.employee groups by seniority of job classification. Our expected dividend rate is based upon an annualized

dividend yield based on the per share dividend declared by our Board of Directors. The aforementioned inputs

entered into the option valuation model we use to fair value our stock awards are subjective estimates and

changes to these estimates will cause the fair values of our stock awards and related stock-based compensation

expense that we record to vary.

We record deferred tax assets for stock-based awards that result in deductions on our income tax returns, based

on the amount of stock-based compensation recognized and the fair values attributable to the vested portion of

stock awards assumed in connection with a business combination, at the statutory tax rate in the jurisdiction in

which we will receive a tax deduction. Because the deferred tax assets we record are based upon the stock-based

compensation expenses in a particular jurisdiction, the aforementioned inputs that affect the fair values of our

stock awards may also indirectly affect our income tax expense. In addition, differences between the deferred tax

assets recognized for financial reporting purposes and the actual tax deduction reported on our income tax returns

are recorded in additional paid-in capital. If the tax deduction is less than the deferred tax asset, the calculated

shortfall reduces our pool of excess tax benefits. If the pool of excess tax benefits is reduced to zero, then

subsequent shortfalls would increase our income tax expense. Our pool of excess tax benefits is computed in

accordance with the alternative transition method pursuant to ASC 718.

To the extent we change the terms of our employee stock-based compensation programs, experience market

volatility in the pricing of our common stock that increases the implied volatility calculation of our publicly

traded, longest-term options, refine different assumptions in future periods such as forfeiture rates that differ

from our current estimates, or assume stock awards from acquired companies that are different in nature than our

stock award arrangements, amongst other potential impacts, the stock-based compensation expense that we

record in future periods and the tax benefits that we realize may differ significantly from what we have recorded

in previous reporting periods.

Allowances for Doubtful Accounts

We make judgments as to our ability to collect outstanding receivables and provide allowances for the portion of

receivables when collection becomes doubtful. Provisions are made based upon a specific review of all

significant outstanding invoices. For those invoices not specifically reviewed, provisions are provided at

differing rates, based upon the age of the receivable, the collection history associated with the geographic region

that the receivable was recorded and current economic trends. If the historical data we use to calculate the

allowances for doubtful accounts does not reflect the future ability to collect outstanding receivables, additional

provisions for doubtful accounts may be needed and our future results of operations could be materially affected.

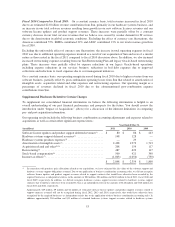

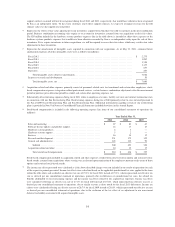

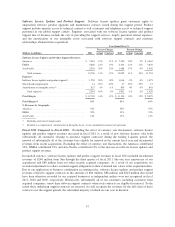

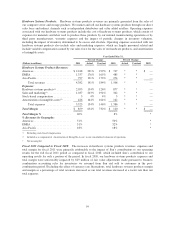

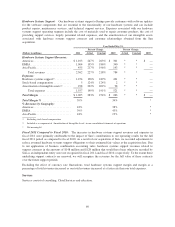

Results of Operations

Impact of Acquisitions

The comparability of our operating results in fiscal 2011 compared to fiscal 2010 is impacted by our acquisitions,

primarily the acquisition of Sun in our third quarter of fiscal 2010 and, to a lesser extent, our acquisitions of ATG

during the third quarter of fiscal 2011 and Phase Forward during the first quarter of fiscal 2011.

The comparability of our operating results in fiscal 2010 compared to fiscal 2009 is impacted by our acquisitions,

primarily the acquisition of Sun in our third quarter of fiscal 2010.

In our discussion of changes in our results of operations from fiscal 2011 compared to fiscal 2010, and fiscal

2010 compared to fiscal 2009, we quantify the contribution of our acquired products to the growth in new

software license revenues, software license updates and product support revenues, hardware systems products

revenues (as applicable) and hardware systems support revenues (as applicable) for the one year period

subsequent to the acquisition date. We also are able to quantify the total incremental expenses associated with

our hardware systems products and hardware systems support operating segments. The incremental contributions

of our other acquisitions to our other businesses and operating segments’ revenues and expenses are not provided

as they either were not separately identifiable due to the integration of these operating segments into our existing

operations and/or were insignificant to our results of operations during the periods presented.

50