Office Depot 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

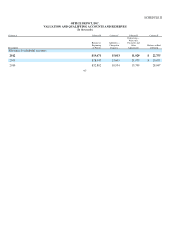

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

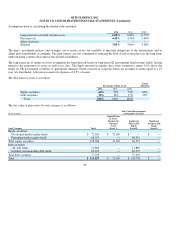

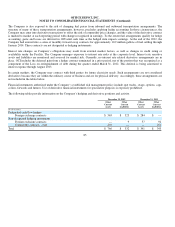

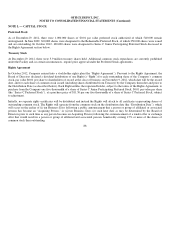

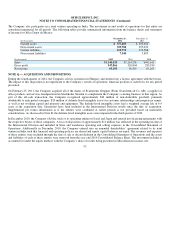

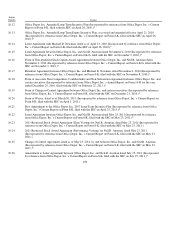

NOTE N — SUPPLEMENTAL INFORMATION ON OPERATING, INVESTING AND FINANCING ACTIVITIES

Additional supplemental information related to the Consolidated Statements of Cash Flows is as follows:

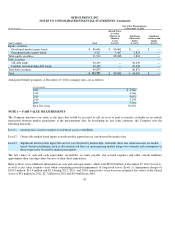

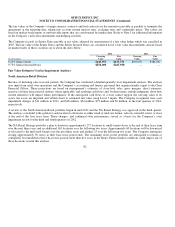

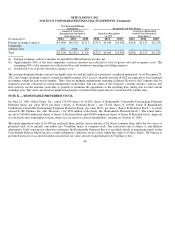

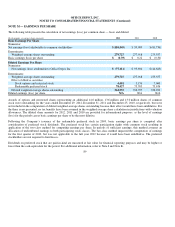

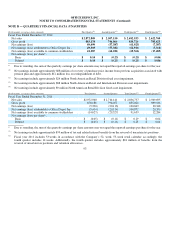

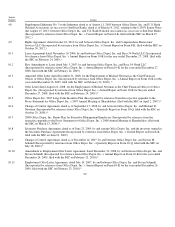

NOTE O — SEGMENT INFORMATION

Office Depot operates in three segments: North American Retail Division, North American Business Solutions Division, and

International Division. Each of these segments is managed separately primarily because it serves a different customer group. The

accounting policies for each segment are the same as those described in Note A. Division operating income is determined based on

the measure of performance reported internally to manage the business and for resource allocation. This measure allocates to the

respective Divisions those general and administrative expenses (“G&A”) considered directly or closely related to their operations.

Remaining G&A expenses and charges that are managed at the Corporate level are not allocated to the Divisions for measurement o

f

Division operating income. Refer to Note B for discussion of charges. Other companies may charge more or less of these items to

their segments and results may not be comparable to similarly titled measures used by other entities.

A summary of significant accounts and balances by segment, reconciled to consolidated totals follows.

90

(In thousands) 2012 2011 2010

Cash interest

p

aid (net of amounts ca

p

italized)

$56,808

$54,833

$62,352

Cash taxes

p

aid (refunded)

10,297

(3,317)

(54,459)

Non-cash asset additions under ca

p

ital leases

9,029

10,025

13,251

Non-cash

p

aid-in-kind dividends (refer to Note K)

22,765

7,656

—

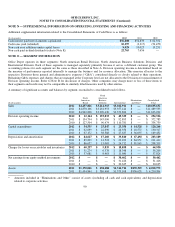

(In thousands)

North

American

Retail

North

American

Business

Solutions International

Eliminations

and Other*

Consolidated

Total

Sales

201

2

$4,457,826

$3,214,915

$3,022,911

$

—

$10,695,65

2

2011

$4,870,166

$3,261,953

$3,357,414

$

—

$11,489,533

201

0

$4,962,838

$3,290,430

$3,379,826

$

—

$11,633,094

Division o

p

eratin

g

income

201

2

$ 12,164

$ 193,033

$ 49,329

$

—

$ 254,526

2011

$ 134,794

$ 145,096

$ 92,895

$

—

$ 372,785

201

0

$ 127,504

$ 96,474

$ 110,781

$

—

$ 334,759

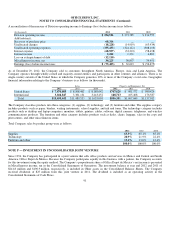

Ca

p

ital ex

p

enditures

201

2

$54,535

$25,847

$25,350

$14,528

$120,26

0

2011

$62,699

$22,690

$26,356

$18,572

$130,317

201

0

$67,172

$38,588

$27,637

$36,055

$169,452

Depreciation and amortization

201

2

$ 84,627

$ 17,260

$ 33,810

$ 67,492

$ 203,189

2011

$89,839

$14,518

$22,102

$84,951

$211,41

0

201

0

$86,657

$15,005

$24,712

$81,945

$208,319

Charges for losses on receivables and inventories

201

2

$ 40,237

$ 5,835

$ 18,858

$

—

$ 64,93

0

2011

$31,274

$6,578

$18,348

$

—

$56,20

0

201

0

$37,681

$8,463

$11,680

$

—

$57,824

Net earnings from equity method investments

201

2

$

—

$

—

$ 30,462

$

—

$ 30,46

2

2011

$

—

$

—

$ 31,426

$

—

$ 31,426

201

0

$

—

$

—

$ 30,635

$

—

$ 30,635

Assets

201

2

$1,170,046

$658,688

$1,311,716

$870,329

$4,010,779

2011

$1,434,844

$586,404

$1,373,108

$856,628

$4,250,984

* Amounts included in “Eliminations and Other” consist of assets (including all cash and cash equivalents) and depreciatio

n

related to cor

p

orate activities.