Office Depot 2012 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

R

etail Strategy

As consumers have shifted their buying patterns, we have been developing new store formats to satisfy changing customer needs and

shopping behavior. We now have almost 80 stores in small- to mid-sized store formats. The inventory selections in these stores are

the higher-volume items that customers seek and the stores provide for an expanded services offering. At the stores, customers also

have the ability to order our inventory products from our web site. We continue to make modifications to these prototypes.

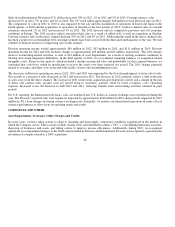

During 2012, the North American Retail Division conducted a review of each store location and developed a revised retail strategy

(the “NA Retail Strategy”). Approximately 40% of the stores in our portfolio have leases that will be at an optional renewal period

within the next three years and 65% within the next five years. Each location was reviewed for a decision to retain as currently

configured and located, downsize to either small or mid-size format, relocate, remodel, or close at the end of the base lease term.

The result of this analysis is a plan to downsize approximately 275 locations to small-format stores at the end of their current lease

term over the next three years and an additional 165 locations over the following two years. Approximately 60 locations will be

down-sized or relocated to the mid-sized format over three years and another 25 over the following two years. We anticipate closing

approximately 50 stores as their base lease period ends. The remaining stores in the portfolio are anticipated to remain as configured,

be remodeled or have base lease periods more than five years in the future. Future market conditions may impact any of the decisions

used in this analysis. Downsizing and closing stores likely will result in lower reported sales in future periods. Downsized locations

will be removed from the comparable store sales calculation until the one year comparable period is reached at the new store size. The

NA Retail Strategy includes anticipated capital expenditures of approximately $60 million per year for the next five years.

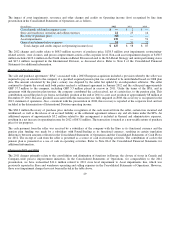

These decisions to modify the store portfolio have impacted our store impairment analysis which is prepared at an individual store

level. The cash flow time horizon for stores expected to be closed, relocated or downsized has been reduced to the base lease period,

eliminating renewal option periods from the calculation, where applicable. The current outlook on sales is a decline of 4% in the first

year. The projected sales continue to be negative for the second year, but are on an improving trend. This trend reflects our view that

a portion of the sales previously made in our retail locations may be migrating to our online and other channels, but because those

sales are not fulfilled out of the retail store, they are not considered cash flow sources in this impairment analysis. Gross margin

assumptions have been held constant at our current actual levels and we have assumed operating costs consistent with recent actual

results and planned activities.

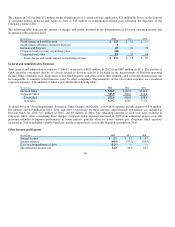

In addition to the impact of our real estate strategy on asset impairments, certain remaining assets will now be depreciated over

a

shorter period of time. We anticipate incremental accelerated depreciation of approximately $8 million and $4 million in 2013 and

2014, respectively. Because the NA Retail Strategy is based on taking actions at the end of the location’s lease term, we do not expect

significant closed store lease accruals. However, we do anticipate volatility in results in future periods as certain accounting criteri

a

are met. For example, certain locations with some level of impairment are facilities accounted for as capital leases. We no longe

r

expect to stay in the location beyond the base lease period but accounting rules limit the reconsideration of the capital lease term in

periods prior to a formal lease modification. This current period impairment charge related to these leased assets will be followed by

a

credit to income in a future period from release of the accrued capital lease obligations when the option periods are not exercised and

the leases are terminated. Additionally, operating leases with scheduled rent increases result in higher expense and establishment of

a

deferred rent credit in early years that is reversed in later years, resulting in a straight-line rent expense. If a location closes o

r

relocates at the end of the base lease term, this credit will be released to income at that time. Deferred rent credits for renegotiated

lease arrangements with the existing landlord will be amortized over the new lease period.

26