Office Depot 2012 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

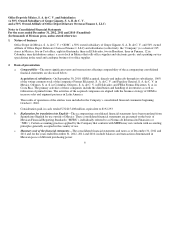

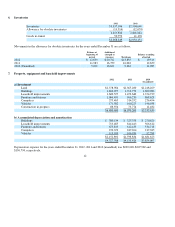

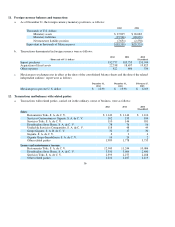

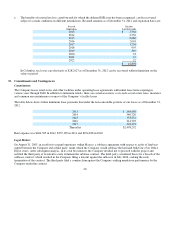

The Company amortizes the cost of its intangible assets with definite useful lives over such estimated useful lives. These

lives are reviewed at least annually to determine whether events and circumstances warrant a revision. Useful lives are as

follows:

10

g.

I

mpairment of long-lived assets in use

—

The Company reviews the carrying amounts of long-lived asset in use, other than

goodwill and intangible assets with indefinite useful lives, when an impairment indicator suggests that such amounts might

not be recoverable, considering the greater of the present value of future net cash flows or the net sales price upon disposal.

Impairment is recorded when the carrying amounts exceed the greater of the aforementioned amounts. Impairment

indicators considered for these purposes are, among others, operating losses or negative cash flows in the period if they are

combined with a history or projection of losses, depreciation and amortization charged to results, which in percentage

terms in relation to revenues are substantially higher than that of previous years, obsolescence, competition and other legal

and economic factors.

h. Goodwill and intangible assets

—

Goodwill represents the excess of consideration paid over the fair value of the net assets

acquired in subsidiary shares, as of the date of acquisition. Through December 31, 2007, goodwill was restated for the

effects of inflation using the NCPI. Intangible assets with indefinite useful lives are carried at cost. Goodwill and intangible

assets with indefinite useful lives are not amortized and are subject to impairment tests at least once a year, regardless of

the existence of im

p

airment indicators.

Years

Customer list

5

Non-com

p

ete a

g

reement

10

i.

P

rovisions

—

Provisions are recognized for current obligations that arise from a past event, that are probable to result in the

use of economic resources, and that can be reasonabl

y

estimated.

j

.

D

irect employee benefits

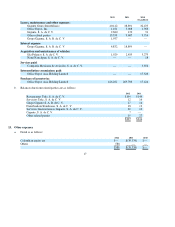

—

Direct employee benefits are calculated based on the services rendered by employees,

considering their most recent salaries. The liability is recognized as it accrues. These benefits include mainly statutory

em

p

lo

y

ee

p

rofit sharin

g

(“PTU”)

p

a

y

able, com

p

ensated absences, such as vacation and vacation

p

remiums, and incentives.

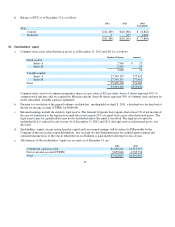

k.

E

mployee benefits for termination, retirement and other

—

Liabilities related to seniority premiums and, severance

payments are recognized as they accrue and are calculated by independent actuaries based on the projected unit credit

method usin

g

nominal interest rates.

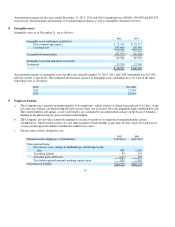

l. Statutory employee profit sharing (PTU)

—

PTU is recorded in the results of the year in which it is incurred and presented

under selling, administrative and general expenses in the accompanying consolidated statements of income. Deferred PTU

is derived from temporary differences that result from comparing the accounting and PTU bases of assets and liabilities

and is recognized only when it can be reasonably assumed that such difference will generate a liability or benefit, and there

is no indication that circumstances will change in such a way that the liabilities will not be paid or benefits will not be

realized.

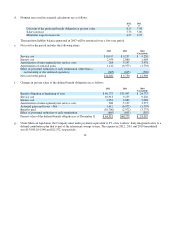

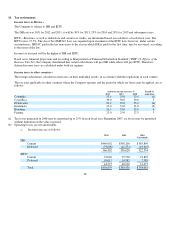

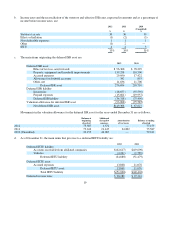

m.

I

ncome taxes—Income tax (“ISR”) and the Business Flat Tax (“IETU”) are recorded in the results of the year they are

incurred. To recognize deferred income taxes, based on its financial projections, the Company determines whether it

expects to incur ISR or IETU and, accordingly, recognizes deferred taxes based on that expectation. Deferred taxes are

calculated by applying the corresponding tax rate to temporary differences resulting from comparing the accounting and

tax bases of assets and liabilities and including, if any, future benefits from tax loss carryforwards and certain tax credits.

Deferred tax assets are recorded onl

y

when there is a hi

g

h

p

robabilit

y

of recover

y

.