Office Depot 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

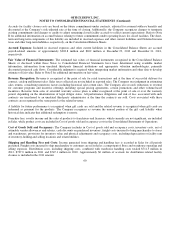

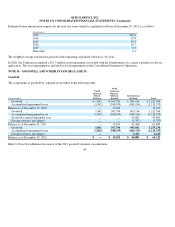

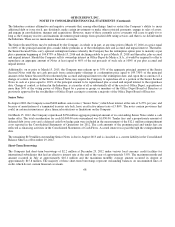

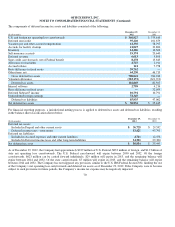

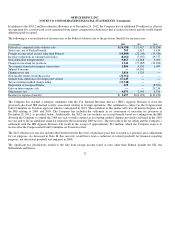

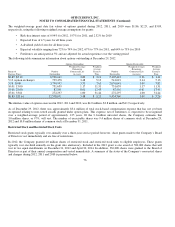

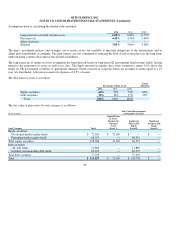

The components of deferred income tax assets and liabilities consisted of the following:

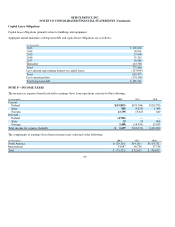

For financial reporting purposes, a jurisdictional netting process is applied to deferred tax assets and deferred tax liabilities, resulting

in the balance sheet classification shown below.

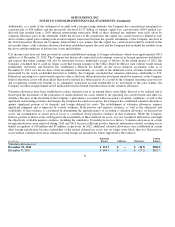

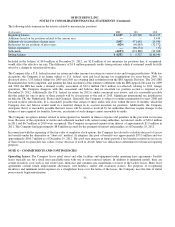

As of December 29, 2012, the Company had approximately $229 million of U.S. Federal, $833 million of foreign, and $1.2 billion o

f

state net operating loss carryforwards. The U.S. Federal carryforward will expire between 2030 and 2032. Of the foreign

carryforwards, $623 million can be carried forward indefinitely, $29 million will expire in 2013, and the remaining balance will

expire between 2014 and 2032. Of the state carryforwards, $7 million will expire in 2013, and the remaining balance will expire

between 2014 and 2032. The Company has not triggered any provision, similar to the U.S. IRS Federal Section 382, limiting the use

of the Company’s net operating loss carryforwards and deferred tax assets as of December 29, 2012. If the Company were to become

subject to such provisions in future periods, the Company’s income tax expense may be negatively impacted.

70

(In thousands)

December 29,

2012

December 31,

2011

U.S. and forei

g

n net o

p

eratin

g

loss carr

y

forwards

$366,927

$379,610

Deferred rent credit

95,220

101,679

Vacation

p

a

y

and other accrued com

p

ensation

61,356

78,797

Accruals for facilit

y

closin

g

s

21,027

32,800

Inventor

y

14,406

13,562

Self-insurance accruals

19,374

20,640

Deferred revenue

6,613

5,893

State credit carr

y

forwards, net of Federal benefit

8,278

13,643

Allowance for bad debts

2,727

2,911

Accrued rebates

121

7,978

Basis difference in fixed assets

39,762

—

Other items, net

64,230

46,713

Gross deferred tax assets

700,041

704,226

Valuation allowance

(583,172)

(621,719)

Deferred tax assets

116,869

82,507

Internal software

2,799

4,216

Basis difference in fixed assets

—

32,055

Deferred Sub

p

art F income

10,791

10,791

Undistributed forei

g

n earnin

g

s

72,345

—

Deferred tax liabilities

85,935

47,062

Net deferred tax assets

$30,934

$35,445

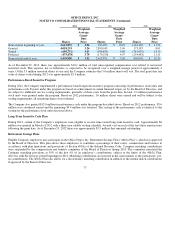

(In thousands)

December 29,

2012

December 31,

2011

Deferred tax assets:

Included in Pre

p

aid and other current assets

$ 36,725

$ 29,592

Deferred income taxes

–

noncurrent

33,421

47,791

Deferred tax liabilities:

Included in Accrued ex

p

enses and other current liabilities

4,711

12,558

Included in Deferred income taxes and other lon

g

-term liabilities

34,501

29,380

Net deferred tax asset

$30,934

$35,445