Office Depot 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

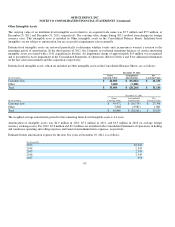

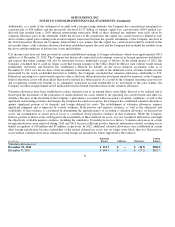

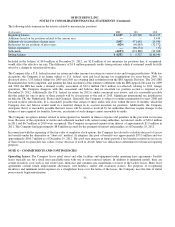

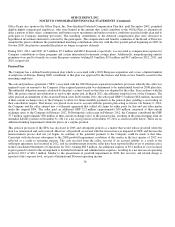

In addition to the $583.2 million valuation allowance as of December 29, 2012, the Company has an additional $5 million tax effected

net operating loss carryforward assets generated from equity compensation deductions that if realized in future periods would benefit

additional paid-in capital.

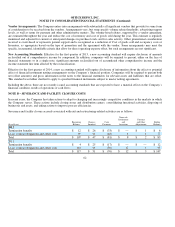

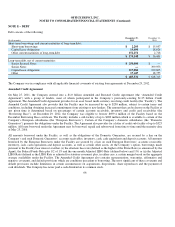

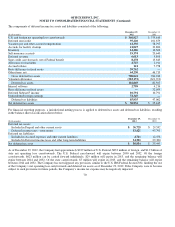

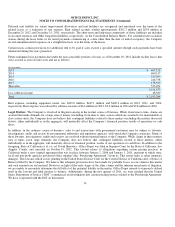

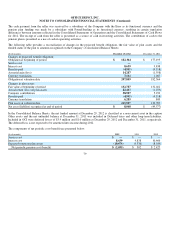

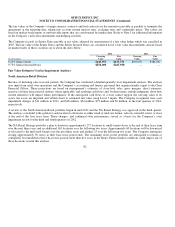

The following is a reconciliation of income taxes at the Federal statutory rate to the provision (benefit) for income taxes:

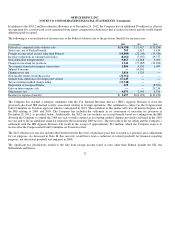

The Company has reached a tentative settlement with the U.S. Internal Revenue Service (“IRS”) Appeals Division to close the

previously-disclosed IRS deemed royalty assessment relating to foreign operations. The settlement is subject to the Congressional

Joint Committee on Taxation approval which is anticipated in 2013. The resolution of this matter will close all known disputes with

the IRS relating to 2009 and 2010. The Company has included the settlement in its assessment of uncertain tax positions at

December 29, 2012, as provided below. Additionally, the 2012 tax rate includes an accrued benefit based on a ruling from the IRS

allowing the Company to amend the 2009 tax year to make certain tax accounting method changes previously reflected in the 2010

tax year and to file an additional claim for refund for the incremental 2009 tax loss. The net result of the tax ruling and the Company’s

settlement with the IRS Appeals Division will result in the receipt of approximately $14 million, which the Company expects to

receive after the Congressional Joint Committee on Taxation review.

The 2012 effective tax rate also includes the benefit from the Recovery of purchase price that is treated as a purchase price adjustment

for tax purposes. As discussed in Note H, this recovery would have been a reduction of related goodwill for financial reporting

purposes, but the related goodwill was impaired in 2008.

The significant tax jurisdictions related to the line item foreign income taxed at rates other than Federal include the UK, the

Netherlands and France.

72

(In thousands) 2012 2011 2010

Federal tax com

p

uted at the statutor

y

rate

$(26,398)

$11,417

$(19,836)

State taxes, net of Federal benefit

709

1,417

1,434

Forei

g

n income taxed at rates other than Federal

(14,889)

(22,29

0

)

(15,926)

Increase (reduction) in valuation allowance

(8,66

2

)

(7,927)

29,777

Non-deductible forei

g

n interest

9,863

11,818

5,094

Chan

g

e in uncertain tax

p

ositions

1,34

2

(77,085)

(32,283)

Tax ex

p

ense from intercom

p

an

y

transactions

1,886

4,955

1,09

0

Sub

p

art F income

—

10,101

—

Chan

g

e in tax rate

1,816

1,529

—

Non-taxable return of

p

urchase

p

rice

(22,361)

—

—

Outside basis difference of forei

g

n

j

oint venture

67,645

—

—

Tax accountin

g

method chan

g

e rulin

g

(15,548)

—

—

Dis

p

osition of forei

g

n affiliates

223

—

(8,562)

Gain on intercom

p

an

y

sale

—

—

20,216

Other items, net

6,071

2,993

8,526

Income tax ex

p

ense (benefit)

$1,69

7

$(63,072)

$(10,47

0

)