Office Depot 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

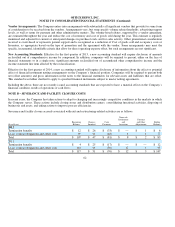

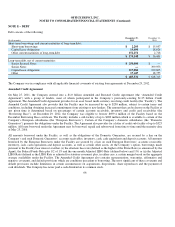

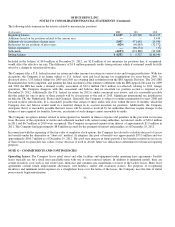

The Indenture contains affirmative and negative covenants that, among other things, limit or restrict the Company’s ability to: incu

r

additional debt or issue stock, pay dividends, make certain investments or make other restricted payments; engage in sales of assets;

and engage in consolidations, mergers and acquisitions. However, many of these currently active covenants will cease to apply for so

long as the Company receives and maintains investment grade ratings from specified debt rating services and there is no default unde

r

the Indenture. There are no maintenance financial covenants.

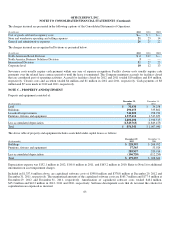

The Senior Secured Notes may be redeemed by the Company, in whole or in part, at any time prior to March 15, 2016 at a price equal

to 100% of the principal amount plus a make-whole premium as of the redemption date and accrued and unpaid interest. Thereafter,

the Senior Secured Notes carry optional redemption features whereby the Company has the redemption option prior to maturity at pa

r

plus a premium beginning at 104.875% at March 15, 2016 and declining ratably to par at March 15, 2018 and thereafter, plus accrued

and unpaid interest. Should the Company sell its ownership interest in Office Depot de Mexico, S.A., it would be required to offer to

repurchase an aggregate amount of Notes at least equal to 60% of the net proceeds of such sale at 100% of par plus accrued and

unpaid interest.

Additionally, on or prior to March 15, 2015, the Company may redeem up to 35% of the aggregate principal amount of the Senio

r

Secured Notes with the net cash proceeds from certain equity offerings at a redemption price equal to 109.750% of the principal

amount of the Senior Secured Notes redeemed plus accrued and unpaid interest to the redemption date; and, upon the occurrence of

a

change of control, holders of the Senior Secured Notes may require the Company to repurchase all or a portion of the Senior Secured

Notes in cash at a price equal to 101% of the principal amount to be repurchased plus accrued and unpaid interest to the repurchase

date. Change of control, as defined in the Indenture, is a transfer of all or substantially all of the assets of Office Depot, acquisition o

f

more than 50% of the voting power of Office Depot by a person or group, or members of the Office Depot Board of Directors as

previously approved by the stockholders of Office Depot ceasing to constitute a majority of the Office Depot Board of Directors.

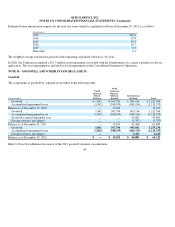

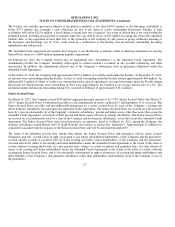

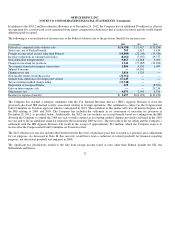

Senior Notes

In August 2003, the Company issued $400 million senior notes (“Senior Notes”) which bear interest at the rate of 6.25% per year, and

because of amortization of a terminated treasury rate lock, have an effective interest rate of 5.86%. The notes contain provisions that

could, in certain circumstances, place financial restrictions or limitations on the Company.

On March 15, 2012, the Company repurchased $250 million aggregate principal amount of its outstanding Senior Notes under a cash

tender offer. The total consideration for each $1,000.00 note surrendered was $1,050.00. Tender fees and a proportionate amount o

f

deferred debt issue costs and a deferred cash flow hedge gain were included in the measurement of the $12.1 million extinguishment

costs reported in the Consolidated Statements of Operations for 2012. The cash amounts of the premium paid and tender fees are

reflected as financing activities in the Consolidated Statements of Cash Flows. Accrued interest was paid through the extinguishment

date.

The remaining $150 million outstanding Senior Notes is due in August 2013 and is classified as a current liability in the Consolidated

Balance Sheet as of December 29, 2012.

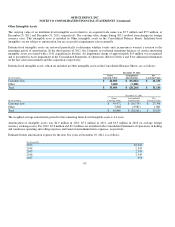

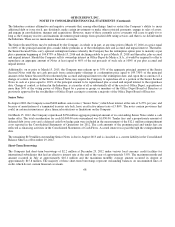

Short-Term Borrowing

The Company had short-term borrowings of $2.2 million at December 29, 2012 under various local currency credit facilities fo

r

international subsidiaries that had an effective interest rate at the end of the year of approximately 5.8%. The maximum month end

amount occurred in July at approximately $16.1 million and the maximum monthly average amount occurred in August at

approximately $15.8 million. The majority of these short-term borrowings represent outstanding balances on uncommitted lines o

f

credit, which do not contain financial covenants.

68